The True All-In Cost To Mine Gold - Complete 2013 First Quarter Figures

Jul 11 2013, 08:05 | includes: ABX, GG, GLD, PHYS, SGOL

Over the last month we have been analyzing and posting the gold industry's true costs to mine each ounce of gold. We have analyzed all the major publicly traded primary gold producers, which includes close to 6 million ounces of mined production for Q1FY13. This represents 25% of total estimated world production for the first quarter, which is a very large portion of the total worldwide production of gold. We believe our numbers represent a large enough portion of mined production to extrapolate as a general figure across the industry.

Why These Costs Are Important

For gold ETF investors (GLD, SGOL, CEF, and PHYS) this metric is very important because it allows an inside understanding of the true costs associated with producing each new ounce of gold. This is arguably the most important metric in analyzing any commodity because it shows the price where production of that commodity becomes uneconomic. If it costs more to mine a commodity than the market is willing to pay for it, eventually producers will stop producing the commodity and close up shop. These are the type of environments that savvy commodity investors dream of because it allows them to purchase assets that cost more to produce than to buy, which is an environment that cannot last for very long because eventually supply will be lowered, cause scarcity, and then the price will increase.

Calculating the True Mining Cost of Gold - Our Methodology

In our previous analysis of 2012 true all-in gold costs for gold miners, we gave a thorough overview of the current way mining companies report their costs of production and why it is inaccurate and significantly underestimates total costs. Then we presented a more accurate methodology for investors to use to calculate the true costs of mining gold or gold. Please refer to that article for the details explaining this methodology, which is an important concept for all precious metals investors to understand.

Explanation of Our Metrics

Cost Per Gold-Equivalent Ounce - is the costs incurred for every payable gold-equivalent ounce. It is Revenues minus Net Income, which will give an investor total costs. We use payable gold and not produced gold, because payable gold is the gold that the miner actually keeps and is more reflective of their production. Miners also use payable gold and not produced gold when calculating their cash costs, so this is pretty standard.

We then add Derivative Gains (or minus Derivative Losses), which will give investors total costs without the effects of derivatives. Finally, we add Foreign Exchange Gains (or minus Foreign Exchange Losses) to remove the effects of foreign exchange on the company's costs.

Cost Per Gold-Equivalent Ounce Excluding Write-downs - is the above-mentioned "Cost per gold-equivalent ounce" minus Property/Investment Write-downs and Asset Sales. This provides investors with a metric that removes exceptional gains or losses due to write-downs and asset sales.

Cost Per Gold-Equivalent Ounce Excluding Write-downs and Adding Smelting and Refining Costs - is the above-mentioned "Cost per gold-equivalent ounce excluding write-downs" adding in smelting, refining and all other necessary pre-revenue costs. This is a new metric that we are now introducing to our true all-in cost series because it will more accurately measure all-in costs and allow comparisons between miners.

Most investors are unaware that many miners will remove smelting, refining, and other costs before reporting their total revenues figures and these pre-revenue costs are not reported in the income statement. The result of this is that it skews all-in costs higher for miners that refine themselves or include the costs in their income statement, while inaccurately showing lower costs for miners that remove it before reporting revenues.

A simple test can be done on any miner to see if there are any pre-revenue costs that are not reported in the income statement. Simply take payable production and multiply it by average realized sales price and this should come relatively close to the total revenues figure. If it gives you a number much higher than reported revenues then there are pre-revenue costs that are not being reported.

This line should alleviate these issues and allow comparisons on a fair basis.

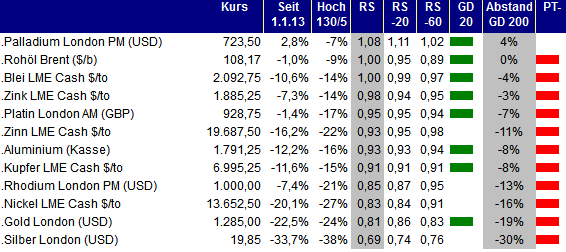

What are the Industry's Gold Costs?

We have compiled all the numbers for gold companies we analyzed for 2011, 2012, and Q1FY13 in the table below. The companies included (with links to their associated detailed calculation pages) are: Barrick Gold (ABX), Goldcorp (GG), Yamana Gold (AUY), Newmont Mining (NEM), Agnico-Eagle (AEM), Eldorado Gold (EGO), Goldfields (GFI), Allied Nevada Gold (ANV), Randgold (GOLD), Alamos Gold (AGI), Kinross Gold (KGC), Silvercrest Mines (SVLC), and Iamgold (IAG).

Important Note: For our gold equivalent calculations, we have adjusted the numbers to reflect the Q1FY13 average LBMA price for all the metals. This results in a gold-to-silver ratio of 1:54, copper ratio of 482:1 (pounds to gold ounces), lead ratio of 1568:1 (pounds to gold ounces), and a zinc ratio of 1832:1 (pounds to gold ounces).

This will also lead to minor differences in our previously published true all-in gold costs for the industry since in our 2012 analysis we used Q4FY12 LBMA average prices, while for this quarter we used Q1FY13 LBMA average prices.

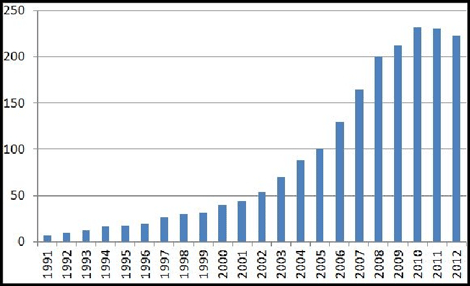

(Click to enlarge)

Note about write-downs: A positive write-down value signifies a loss, while a negative write-down signifies a profit. Additionally, the gold production numbers for FY2011 and FY2012 include around 1 million ounces attributable to Goldfields that has been spun-off into Sibanye Gold. After their business split, these ounces will no longer be included in 2013 so production gold comparisons need to take this into account.

Observations for Gold Investors

True Cost Figures - Investors can see that true all-in costs continued to rise on a year-over-year basis, averaging $1308 for Q1FY13 versus $1298 for Q1FY12. Though we are starting to see costs level off on a sequential basis as costs dropped from $1401 in Q4FY13, and are only slightly up by 1% from the FY2012 average of $1296. This is showing us that the industry is beginning to get costs under control.

Production of gold was down on a year-over-year basis from 5.97 million ounces in Q1FY12 to 5.85 million ounces in Q1FY13, which is a decline of about 120,000 ounces or about 2%. On a sequential basis the decline was much greater as gold production dropped from 6.48 million ounces, or about 10%.

In terms of annual output, companies are on pace to produce only 23.4 million ounces in FY2013 - which would be a significant drop from FY2012 and FY2011 (even when including he GFI spinoff). Though we would caution it is a little too early to extrapolate these numbers because first quarter production tends to be a bit lower than other quarters. But the drop in production should not be surprising because it looks like part of the formula to cutting costs is to avoid processing low-grade ore - which should improve costs on a per ounce basis, but may reduce production significantly.

Based on Q1FY13 results, miners will have to still cut costs to remain profitable at current gold levels. In general, management in the mining industry has switched from a production-based approach to a cost-based approach - no longer are we going to see producers focusing on mining as many ounces as possible. We expect more of the same in Q2FY13 and investors should be tracking costs as miners begin to report second quarter results. Additionally, we will be following closely gold production to see if it continues to fall.

Conclusion and Investor Takeaways

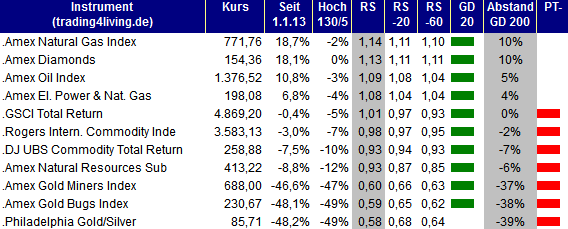

Using this information offers investors a number of valuable takeaways. For investors in the gold ETF's (GLD, SGOL, PHYS, and CEF), the true cost of gold production is a very important metric to understand because it significantly affects gold supply.

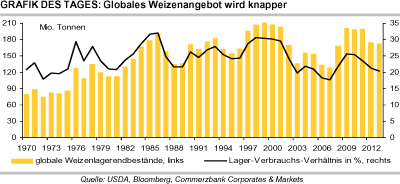

There is a misconception about gold market economics and many erroneously believe that newly mined gold supply is irrelevant to the gold price. Unfortunately, this causes investors to completely ignore the fundamentals of global gold mine supply and leaves a large hole in their understanding of the gold market. We go into detail about this in another article but mine supply does make up a great deal of the for-sale physical supply. That means if gold producers cut back on production then there will be less for sale, which would add support to the gold price.

Though in terms of production costs gold miners are doing much better than silver miners, many still produce gold with all-in costs above current gold spot prices. That means we believe cost cuts will continue for the rest of the year and investors should make sure the gold companies they own are producing gold at reasonable costs and have sufficient liquidity. We will shortly be issuing a list of gold companies and their true all-in costs for Q1FY13, so investors interested should follow our future articles

The high costs to produce physical gold and the drops in gold production are very bullish for investors. The reports analyzed in this article were also issued before the April gold drop, so we believe that many miners will be aggressively cutting costs and production so we may see production costs drop - but we believe this will also drop production totals.

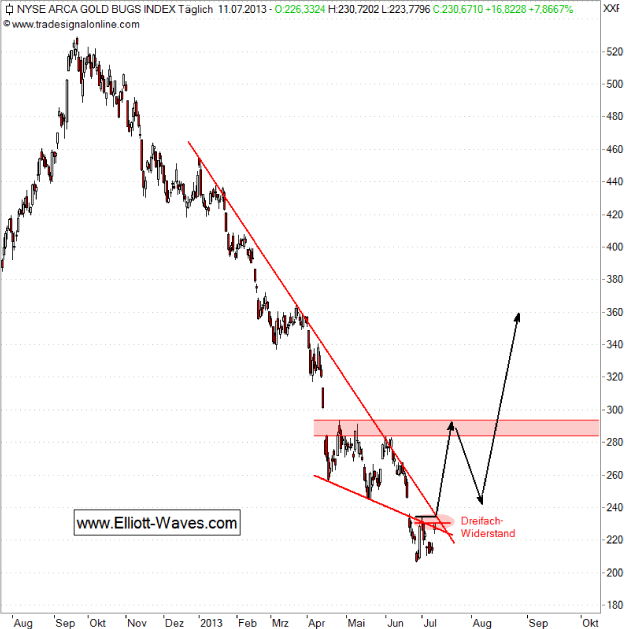

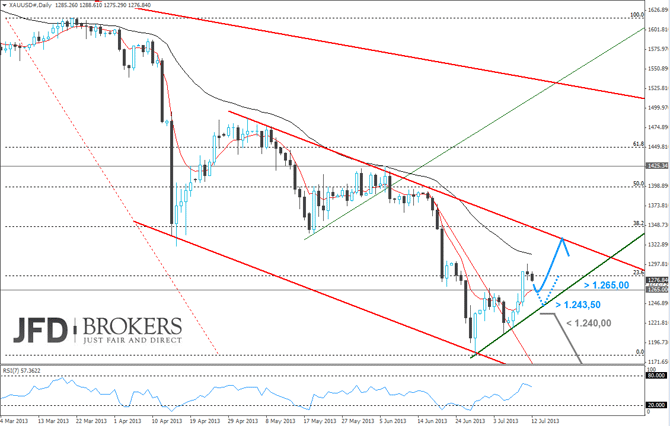

Long-term gold investors should be accumulating gold aggressively at these prices and further price drops may not be a bad thing for long-term investors. It is a bit counterintuitive, but the further the price drops, the more it will suffocate miners and cause future gold supply to plummet. We are already seeing gold supply dropping during a quarter where gold averaged over $1600 per ounce, how much more supply will be removed from the market as current prices are closer to $1300 per ounce? If investors can take a long-term view of gold, there is a huge opportunity here for patient investors to take advantage of the current gold price and buy gold that is produced at a loss by many miners.

We know it's difficult for investors to think long-term nowadays, but it is a necessity for wise investors. We think there will be a time when sentiment changes and traders and gold shorts realize that gold at $1300 is not sustainable and will make physical gold hard to acquire. This may cause quite a rush as investors (many retail and hedge funds jumping in on a gold downtrend) realize that the charts are not everything, and their lack of understanding of both the industry and the importance of mine supply to the physical market cause major losses. Hold tight gold investors because the physical market is very tight and the fundamentals are quite bullish.

Source:

http://seekingalpha.com/article/154...complete-2013-first-quarter-figures?source=cc