Market Nuggets: Comex Gold Boosted This Week By Combination Of Factors

Friday August 16, 2013 12:54 AM

Comex gold is on a pace to finish sharply higher for the week and already hit its loftiest level since mid-June. As gold rose Wednesday and Thursday, equities fell, although analysts appeared reluctant to put too much emphasis on the equity retreat for gold’s gains. “I think it’s kind of a coincidence,” says Charles Nedoss, market strategist with Kingsview Financial. “I’ve been watching them intraday where they’ve gone against it and have gone with it.” Other analysts put greater emphasis on other factors for gold’s move. Afshin Nabavi, head of trading with MKS (Switzerland) SA, cites technical momentum after gold broke up through the upper end of its previous band of $1,300 to $1,350 an ounce. Further, he says, the move occurred in thin liquidity, which tends to exacerbate price moves. “I’m looking for a retest of $1,400, probably sooner than later.” Jim Comiskey, senior executive with Archer Financial Services, also cites market chatter about recently declining inventories of precious metals in some Comex depositories. Comiskey and Nabavi also both point to the turmoil and political violence in Egypt as a gold-supportive influence. “The turmoil in Egypt could really, really ramp up. It already has, tragically,” Comiskey says. He also comments that many traders who were short in gold have been forced to cover their positions. Nabavi describes the recent stock-market weakness as simply “an additional excuse” for gold’s gains. “It wasn’t any one particular thing; it was a combination,” he adds. As of noon EDT, Comex December gold was at $1,368.20 an ounce, compared to the pit settlement of $1,312.20 last Friday. It peaked at $1,374.30, its strongest level since June 19.

By Allen Sykora of Kitco News; asykora@kitco.com

Market Nuggets: Nichols: Technicals, Asian Demand Portend More Gains For Gold

Friday August 16, 2013 11:42 AM

An improved technical-chart picture, physical demand in Asia and news this week that big-name hedge funds already dumped gold holdings in the second could all portend gains for prices going forward, says Jeffrey Nichols, managing director of American Precious Metals Advisors and senior economic consultant for Rosland Capital. “The technical picture has improved quite significantly, now that prices have both re-tested support near the $1,320 area and subsequently broke through several layers of overhead resistance to trade as high as $1,375 earlier today,” he says. “After yesterday's strong close -- and, importantly, with some follow-through on good physical demand in China, India, and other Asian markets overnight -- another strong close this afternoon in New York or one day next week would be sufficient to declare the nearly two-year price correction complete and welcome in a resumption of the long-term upward trend. Looking ahead, seasonal factors, especially the approaching festival season in India, and restocking by jewelry manufacturers after the summer holidays, will also contribute to gold's recovery.” News that hedge funds dumped gold in the second quarter helps explains the metal’s disappointing performance, Nichols says. “This news -- and, more importantly, gold's continuing technical and fundamental improvement -- suggest gold prices will move higher next week, next month, and beyond into autumn and winter.”

By Allen Sykora of Kitco News; asykora@kitco.com

Market Nuggets: TD Securities: Gold 200-Day Average May Come Back In Focus In Few Months

Friday August 16, 2013 11:42 AM

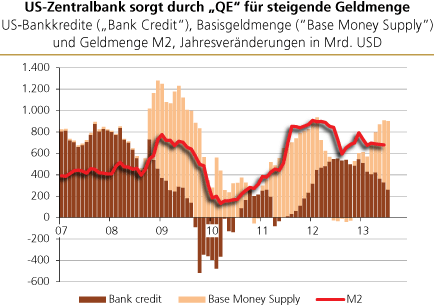

Spot gold remains well below the 200-day moving average, but this would change if the metal remains range-bound for a few more months, which in turn could mean potential for shorts to eventually exit, says TD Securities. “For quite some time the bears have had significant comfort in being short because the spot price has been significantly lower than the 200-day moving average,” the firm says. “Because of the sharp move lower a few months ago, however, the 200-day moving average will begin decaying rapidly soon. Hence, the range for gold for the next three months could be pivotal to a reversal in market sentiment technically. Consider if gold were to average $1,325 for the next 12 weeks; the 200-day moving average would drop from $1,516.52 to approximately $1374.50.” Further, if the 50-day average ended up closing in on the 200-day, this would be seen as a signal that a bullish move was in the works, TDS says. This could pressure shorts, particularly with expected tapering of Federal Reserve quantitative easing already priced in and concerns about controlling inflation, TDS adds.

By Allen Sykora of Kitco News; asykora@kitco.com

Market Nuggets: Kingsview’s Nedoss Looks For Comex Gold To Approach 100-Day Average

Friday August 16, 2013 9:52 AM

Comex gold is back within sight of the 100-day moving average, says Charles Nedoss, senior market strategist with Kingsview Financial. As of 9:37 a.m. EDT, December gold was $5.60 higher to $1,366.60 an ounce and hit a peak of $1,374.30 that was its strongest level since June 19. “You’re seeing follow-through. Yesterday technically was a huge day,” he says of Thursday’s sharp gain. The market had been consolidating above the 10- and 20-day moving averages but has now moved a ways above these. The 10-day average stands at $1,320.20 and the 20-day at $1,321.80. “The next resistance is $1,382.60, which is the 100-day, and I think we’re marching on our way there,” Nedoss says.

By Allen Sykora of Kitco News; asykora@kitco.com

Market Nuggets: Commerzbank: Silver ETF Holdings Rise Sharply This Week

Friday August 16, 2013 9:29 AM

Holdings of silver exchange-traded funds have increased in recent days and are up for the year, a contrast to lower holdings of metal by gold ETFs, says Commerzbank. Silver itself has risen 19% over the last eight trading days, the bank points out. “Its price rise was accompanied by a huge increase in silver ETF holdings, which have meanwhile reached a record level of nearly 20,000 tons,” Commerzbank says. “The silver ETFs tracked by Bloomberg have recorded inflows of 674 tons since the beginning of the week alone, including their highest daily inflow (447 tons) since mid-January. In contrast to the gold ETFs, the holdings of silver ETFs have increased by 975 tons since the beginning of the year. Coupled with a recovery of industrial demand, which accounts for more than 50% of total silver demand, this could lend support to the silver price.”

By Allen Sykora of Kitco News; asykora@kitco.com

Market Nuggets: LME Copper Hits Highest Level Since Early June

Friday August 16, 2013 9:06 AM

Base metals are continuing their August ascent. "Copper has climbed above the $7,400-per-metric-ton mark again for the first time since the beginning of June, while aluminum, nickel and lead are likewise trading at multi-week highs," says Commerzbank. "What is more, zinc has even achieved its highest level in five months, reaching nearly $2,000 per ton. The weak U.S. dollar, which depreciated noticeably against the euro during the later course of trading yesterday, is clearly lending support to prices." Another firm cautions, however, that base metals could be approaching chart resistance. "We have been friendly to the metals markets for some time now, but several complexes are nearing the top band of their widening trading ranges and could encounter more serious setbacks if those levels were approached," says INTL FCStone. "Specifically, we are now within sight of $7,550 resistance on copper, $1,975 on aluminum and $2,260 on lead, all three being potential flash points." As of 8:50 a.m. EDT, three-month LME copper was up $66.25 to $7,375.25 and peaked at $7,420, its strongest level since June 6.

By Allen Sykora of Kitco News; asykora@kitco.com

Market Nuggets: TD Securities Looks For Platinum To Be 'Overachiever' In Second Half

Friday August 16, 2013 8:36 AM

TD Securities says “a less morose view” of the Chinese economy, an end to the European recession, a recovering U.S. economy and ongoing production problems in South Africa should make platinum a “star performer” during the second half of 2013. “Platinum is set to outperform gold, silver and even our long-term favorite, palladium,” the firm says. “We see a Q4-2013 average platinum price of at least $1,700/oz—11% higher than the current level. Meanwhile, palladium is projected to average $825/oz, which is slightly more than 8.5% higher.” TDS looks for platinum to be in a 616,000-ounce supply deficit in 2013. Market symmetry should further help the metal. “What we mean by symmetry is that markets tend to have sharp rallies following sharp corrections. And this should be the case with platinum, as it saw poor performance relative to palladium earlier in the year when Europe, which is the key consumer of the metal, went from bad to worse. This will likely help it to rally more than the others in the coming months.” The bottom line, TDS concludes, is that the combination of supply/demand fundamentals and the fact that platinum suffered more than palladium earlier this year “will likely make it an overachiever.”

By Allen Sykora of Kitco News; asykora@kitco.com

Market Nuggets: Gartman Adding To Long Gold Position In Euro, Yen Terms

Friday August 16, 2013 8:19 AM

Investor and newsletter writer Dennis Gartman says he is adding to his long gold position, although continuing to do so in euro and Japanese yen terms. Gold broke through resistance around 1,000 euros per ounce Thursday and 131,000 yen. He attributes gold’s most recent bout of strength to the political violence in Egypt, expanding monetary aggregates in the U.S. and strength in other commodities, such as grains and cotton. He also points out that news reports this week show that some of the world’s largest gold investors, via the SPDR Gold Shares exchange-traded fund, liquidated some of their holdings in the second quarter. “Now that they are out and now that prices are rising, they shall almost certainly want back in, and where they’d been resistance in the past, they are support in the future,” Gartman says. He also points out that gold-mining shares have led the way higher. “Several months ago, we went on record as saying that the underperformance of miners relative to gold bullion was ending after years of being seemingly intractable,” Gartman says. “We stand by that statement. The market’s telling us to do so.”

By Allen Sykora of Kitco News; asykora@kitco.com

Market Nuggets: Sharps Pixley: Gold's Correlation with Stocks Turns Negative

Friday August 16, 2013 8:18 AM

Gold’s correlation with the stock market has been negative lately, says Sharps Pixley. “Weaker earnings reports in the U.S. and increasing violence out of Egypt have hurt global stock markets in the past two days,” the firm says. “The stock investors are not much cheered by the end of the euro region recession, with the Q2 GDP rising 0.3%. Gold has reasserted itself as the alternative asset to bonds and stocks. In fact, since the gold price has bottomed at the end of June, the daily correlation between the gold price and the S&P 500 index has turned negative. Since the recent trough on 27 June, the gold futures rebounded 12.34% while the S&P 500 Index only climbed 3.29%, reflecting the market's perception of the value in gold."