App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread (Archiv)

- Ersteller Maack

- Erstellt am

- Tagged users Kein(e)

- Status

- Für weitere Antworten geschlossen.

SILBER UND ROHÖL

Silber: Spekulanten auf dem Rückzug

Laut aktuellem COT-Report hat sowohl bei großen als auch bei kleinen Spekulanten der Optimismus in der Woche zum 24. September erneut abgenommen.

von Jörg Bernhard

Während die Anzahl offener Kontrakte (Open Interest) lediglich marginal zurückging, war bei den spekulativen Marktakteuren ein markanter Abbau der Netto-Long-Position (optimistische Markterwartung) zu beobachten. Bei den Großspekulanten (Non-Commercials) reduzierte sich diese von 13.806 auf 12.652 Kontrakte (-8,4 Prozent) und bei den Kleinspekulanten (Non-Reportables) ging es auf Wochensicht sogar von 8.448 auf 6.969 Futures (17,5 Prozent) bergab. Aus charttechnischer Sicht herrscht derzeit ein besonders hohes Maß an Spannung. Grund: Mit 21,78 Dollar notiert das Edelmetall nur noch knapp über der bei 21,50 Dollar angesiedelten massiven Unterstützungszone, wo zugleich die mittelfristige 100-Tage-Linie angesiedelt ist. Im September wurde diese Marke bislang erfolgreich verteidigt. Im Juni hielt sich das Edelmetall ebenfalls zwei Wochen darüber, musste danach allerdings einen Absacker unter 19 Dollar hinnehmen.

Am Montagvormittag präsentierte sich der Silberpreis mit relativ stabilen Notierungen. Bis gegen 8.00 Uhr (MESZ) ermäßigte sich der am aktivsten gehandelte Future auf Silber (Dezember) um 0,056 auf 21,775 Dollar pro Feinunze.

Rohöl: Negativer Wochenstart

Heute und morgen steht eine Reihe von Einkaufsmanagerindizes zur Bekanntgabe an. Die Akteure an den Energiemärkten dürften diese genau im Auge behalten. In den USA steht am heutigen Nachmittag der Chicago-Einkaufsmanagerindex (15.45 Uhr) an, am Dienstag müssen die Investoren dann auf diverse europäische sowie die US-Pendants Markit- und ISM-Einkaufsmanagerindex (beide 16.00 Uhr) reagieren. Laut Bloomberg-Umfragen unter Analysten sollen alle drei US-Indikatoren deutlich über der wichtigen Marke von 50 Punkten liegen, was als Indiz für eine wachsende Wirtschaft interpretiert wird. Zum Wochenauftakt drückt aber ein anderes Thema auf die Stimmung der Investoren: die Zahlungsprobleme der USA.

Am Montagvormittag präsentierte sich der Ölpreis mit fallenden Notierungen. Bis gegen 8.00 Uhr (MESZ) ermäßigte sich der nächstfällige WTI-Kontrakt um 1,31 auf 101,56 Dollar, während sein Pendant auf Brent um 0,87 auf 107,76 Dollar zurückfiel.

Silber: Spekulanten auf dem Rückzug

Laut aktuellem COT-Report hat sowohl bei großen als auch bei kleinen Spekulanten der Optimismus in der Woche zum 24. September erneut abgenommen.

von Jörg Bernhard

Während die Anzahl offener Kontrakte (Open Interest) lediglich marginal zurückging, war bei den spekulativen Marktakteuren ein markanter Abbau der Netto-Long-Position (optimistische Markterwartung) zu beobachten. Bei den Großspekulanten (Non-Commercials) reduzierte sich diese von 13.806 auf 12.652 Kontrakte (-8,4 Prozent) und bei den Kleinspekulanten (Non-Reportables) ging es auf Wochensicht sogar von 8.448 auf 6.969 Futures (17,5 Prozent) bergab. Aus charttechnischer Sicht herrscht derzeit ein besonders hohes Maß an Spannung. Grund: Mit 21,78 Dollar notiert das Edelmetall nur noch knapp über der bei 21,50 Dollar angesiedelten massiven Unterstützungszone, wo zugleich die mittelfristige 100-Tage-Linie angesiedelt ist. Im September wurde diese Marke bislang erfolgreich verteidigt. Im Juni hielt sich das Edelmetall ebenfalls zwei Wochen darüber, musste danach allerdings einen Absacker unter 19 Dollar hinnehmen.

Am Montagvormittag präsentierte sich der Silberpreis mit relativ stabilen Notierungen. Bis gegen 8.00 Uhr (MESZ) ermäßigte sich der am aktivsten gehandelte Future auf Silber (Dezember) um 0,056 auf 21,775 Dollar pro Feinunze.

Rohöl: Negativer Wochenstart

Heute und morgen steht eine Reihe von Einkaufsmanagerindizes zur Bekanntgabe an. Die Akteure an den Energiemärkten dürften diese genau im Auge behalten. In den USA steht am heutigen Nachmittag der Chicago-Einkaufsmanagerindex (15.45 Uhr) an, am Dienstag müssen die Investoren dann auf diverse europäische sowie die US-Pendants Markit- und ISM-Einkaufsmanagerindex (beide 16.00 Uhr) reagieren. Laut Bloomberg-Umfragen unter Analysten sollen alle drei US-Indikatoren deutlich über der wichtigen Marke von 50 Punkten liegen, was als Indiz für eine wachsende Wirtschaft interpretiert wird. Zum Wochenauftakt drückt aber ein anderes Thema auf die Stimmung der Investoren: die Zahlungsprobleme der USA.

Am Montagvormittag präsentierte sich der Ölpreis mit fallenden Notierungen. Bis gegen 8.00 Uhr (MESZ) ermäßigte sich der nächstfällige WTI-Kontrakt um 1,31 auf 101,56 Dollar, während sein Pendant auf Brent um 0,87 auf 107,76 Dollar zurückfiel.

US-ETATSTREIT HÄLT AN

Ölpreise mit Verlusten

Der andauernde Haushaltsstreit in den USA hat die Ölpreise am Montag unter Druck gesetzt.

Enttäuschend ausgefallene Konjunkturdaten aus China kamen erschwerend hinzu. Ein Barrel (159 Liter) der Nordseesorte Brent zur Lieferung im November kostete am Morgen 107,75 US-Dollar. Das waren 88 Cent weniger als am Freitag. Der Preis für ein Fass der amerikanischen Sorte WTI fiel um 1,35 Dollar auf 101,55 Dollar und damit beinahe auf den tiefsten Stand seit drei Monaten.

In den USA steht der erste Stillstand der öffentlichen Verwaltung seit 17 Jahren bevor. Eine rechtzeitige Lösung im erbitterten Streit über den Bundeshaushalt zwischen Präsident Barack Obama und den oppositionellen Republikanern erschien am Sonntag kaum noch möglich. Ein Scheitern der Verhandlungen könne die Weltwirtschaft vom Erholungskurs abbringen und die Ölpreise weiter belasten, sagte ein Händler.

In China fiel die finale Ausgabe des an den Märkten stark beachteten Einkaufsmanagerindex für den Industriesektor im September schwächer aus als von Analysten erwartet. Das vom Datendienstleister Markit und der Großbank HSBC veröffentlichte Stimmungsbarometer kletterte zwar von 50,1 Punkten im Vormonat auf 50,2 Zähler. Eine Erstschätzung hatte jedoch einen deutlich höheren Wert von 51,2 Punkten ergeben./hbr/stk

Ölpreise mit Verlusten

Der andauernde Haushaltsstreit in den USA hat die Ölpreise am Montag unter Druck gesetzt.

Enttäuschend ausgefallene Konjunkturdaten aus China kamen erschwerend hinzu. Ein Barrel (159 Liter) der Nordseesorte Brent zur Lieferung im November kostete am Morgen 107,75 US-Dollar. Das waren 88 Cent weniger als am Freitag. Der Preis für ein Fass der amerikanischen Sorte WTI fiel um 1,35 Dollar auf 101,55 Dollar und damit beinahe auf den tiefsten Stand seit drei Monaten.

In den USA steht der erste Stillstand der öffentlichen Verwaltung seit 17 Jahren bevor. Eine rechtzeitige Lösung im erbitterten Streit über den Bundeshaushalt zwischen Präsident Barack Obama und den oppositionellen Republikanern erschien am Sonntag kaum noch möglich. Ein Scheitern der Verhandlungen könne die Weltwirtschaft vom Erholungskurs abbringen und die Ölpreise weiter belasten, sagte ein Händler.

In China fiel die finale Ausgabe des an den Märkten stark beachteten Einkaufsmanagerindex für den Industriesektor im September schwächer aus als von Analysten erwartet. Das vom Datendienstleister Markit und der Großbank HSBC veröffentlichte Stimmungsbarometer kletterte zwar von 50,1 Punkten im Vormonat auf 50,2 Zähler. Eine Erstschätzung hatte jedoch einen deutlich höheren Wert von 51,2 Punkten ergeben./hbr/stk

GOLD UND ROHÖL

Gold: Keine Spur von Inflation

Obwohl die Finanzmärkte mit Liquidität förmlich überflutet werden, gibt es weiterhin kein Inflationsproblem.

von Jörg Bernhard

Am vergangenen Freitag meldete das Statistische Bundesamt für Deutschland einen Rückgang der Teuerungsrate von 1,5 auf 1,4 Prozent p.a. Um 11.00 Uhr wurde die europäische Inflation gemeldet. Mit ihr ging es sogar von 1,3 auf 1,1 Prozent nach unten. Dass sich das gelbe Edelmetall trotz dieser kontraproduktiven Faktoren relativ wacker hält, dürfte vor allem dem US-Haushaltsstreit zwischen Demokraten und Republikanern zu verdanken sein. Die Angst vor einem „Shutdown“, was massive Kürzungen staatlicher Ausgaben nach sich ziehen würde, bescherte dem sicheren Hafen wieder Käufer. Da ein politischer Kompromiss derzeit nicht in Sicht ist, könnte das Thema in dieser Woche noch an den Märkten weiter „gespielt“ werden.

Am Montagnachmittag präsentierte sich der Goldpreis mit nachgebenden Notierungen. Bis gegen 15.00 Uhr (MESZ) ermäßigte sich der am aktivsten gehandelte Future auf Gold (Dezember) um 11,50 auf 1.327,70 Dollar pro Feinunze.

Rohöl: „Shutdown“ drückt auf Stimmung

Dem Ölpreis bekam der Streit um den US-Staatshaushalt hingegen gar nicht gut. Die Zahlungsschwierigkeiten der US-Regierung könnten der Wirtschaft nämlich erhebliche Probleme bereiten. Und Mitte Oktober droht weiteres Ungemach: Dann wird nämlich das Schuldenlimit von 16,7 Billionen Dollar erreicht. Wird dieses nicht rechtzeitig erhöht, könnte es an den Finanzmärkten wieder stürmisch werden. Von 2001 bis heute stieg die Schuldengrenze von 5,95 Billionen auf 16,7 Billionen Dollar. Das Ende der Fahnenstange dürfte damit wohl kaum erreicht sein.

Am Montagnachmittag präsentierte sich der Ölpreis mit fallenden Notierungen. Bis gegen 15.00 Uhr (MESZ) ermäßigte sich der nächstfällige WTI-Kontrakt um 1,39 auf 101,48 Dollar, während sein Pendant auf Brent um 0,89 auf 107,74 Dollar zurückfiel.

Gold: Keine Spur von Inflation

Obwohl die Finanzmärkte mit Liquidität förmlich überflutet werden, gibt es weiterhin kein Inflationsproblem.

von Jörg Bernhard

Am vergangenen Freitag meldete das Statistische Bundesamt für Deutschland einen Rückgang der Teuerungsrate von 1,5 auf 1,4 Prozent p.a. Um 11.00 Uhr wurde die europäische Inflation gemeldet. Mit ihr ging es sogar von 1,3 auf 1,1 Prozent nach unten. Dass sich das gelbe Edelmetall trotz dieser kontraproduktiven Faktoren relativ wacker hält, dürfte vor allem dem US-Haushaltsstreit zwischen Demokraten und Republikanern zu verdanken sein. Die Angst vor einem „Shutdown“, was massive Kürzungen staatlicher Ausgaben nach sich ziehen würde, bescherte dem sicheren Hafen wieder Käufer. Da ein politischer Kompromiss derzeit nicht in Sicht ist, könnte das Thema in dieser Woche noch an den Märkten weiter „gespielt“ werden.

Am Montagnachmittag präsentierte sich der Goldpreis mit nachgebenden Notierungen. Bis gegen 15.00 Uhr (MESZ) ermäßigte sich der am aktivsten gehandelte Future auf Gold (Dezember) um 11,50 auf 1.327,70 Dollar pro Feinunze.

Rohöl: „Shutdown“ drückt auf Stimmung

Dem Ölpreis bekam der Streit um den US-Staatshaushalt hingegen gar nicht gut. Die Zahlungsschwierigkeiten der US-Regierung könnten der Wirtschaft nämlich erhebliche Probleme bereiten. Und Mitte Oktober droht weiteres Ungemach: Dann wird nämlich das Schuldenlimit von 16,7 Billionen Dollar erreicht. Wird dieses nicht rechtzeitig erhöht, könnte es an den Finanzmärkten wieder stürmisch werden. Von 2001 bis heute stieg die Schuldengrenze von 5,95 Billionen auf 16,7 Billionen Dollar. Das Ende der Fahnenstange dürfte damit wohl kaum erreicht sein.

Am Montagnachmittag präsentierte sich der Ölpreis mit fallenden Notierungen. Bis gegen 15.00 Uhr (MESZ) ermäßigte sich der nächstfällige WTI-Kontrakt um 1,39 auf 101,48 Dollar, während sein Pendant auf Brent um 0,89 auf 107,74 Dollar zurückfiel.

30.09.2013 13:00 | Redaktion

Michael Pento: Das dicke Ende kommt erst noch ...

In einem Interview mit King World News, das vergangene Woche veröffentlicht wurde, gewährt der Top-Ökonom Michael Pento einen Einblick in das Chaos, in welches die zentralen Strippenzieher uns seiner Ansicht nach derzeit hineinstürzen würden.

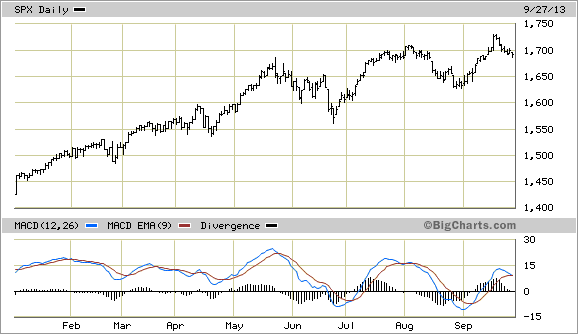

Seines Erachtens seien Fed und die US Treasury vorwiegend damit beschäftigt, beispiellose Blasen zu bilden. Die Erholung der Wirtschaft gründe seit jeher auf dem Konsum, der etwa 70% des BIP der USA entspreche. Dieser Konsum wiederum sei jedoch durch Schuldenaufnahmen gestützt, da ein wirkliches Einkommenswachstum auf der Seite der Konsumenten fehle. Diese Schulden schließlich basieren auf Blasen bei den Aktien, Anleihen und bei den Immobilien. Verursacher dieser Blasen: die Fed mit ihren niedrigen Zinssätzen und der Monetarisierung der Staatsschulden.

Die Federal Housing Administration (FHA), die Gelder für den Hausbau und -erwerb bereitstellt, hatte kürzlich ein voraussichtliches Defizit von 1 Mrd. USD verkündet. Aufgrund dessen werde die FHA die Staatskasse anzapfen müssen, welche jedoch bereits selbst in finanzielle Bedrängnis geraten sei. Stelle sich die Frage, warum die FHA überhaupt gerettet werden soll, wo sie doch hauptsächlich Sicherheiten für Kreditgeber wie Banken oder andere Finanzinstitutionen bereitstellt. Der Grund, so Pento, bestehe darin, dass diese Institutionen dank der durch die FHA geschaffenen Sicherheiten überhaupt erst derart günstige Kredite anbieten könnten. Damit habe sich Amerika erneut eine riesige Immobilienblase geschaffen, bei welcher die Immobilienpreise im zweistelligen Bereich gestiegen seien und die FHA zum ersten mal in ihrer 79-jährigen Geschichte eine Rettung brauchen wird.

Ein ähnliches Bild zeichne sich auch am Aktienmarkt ab: Gewinne im zweistelligen Bereich ohne entsprechendes Ertragswachstum. Gleichzeitig hätten sich die durchschnittlichen Renditen bei Staatsanleihen verglichen zu denen vor vierzig Jahren halbiert. Damit würden zum ersten Mal drei Blasen zur gleichen Zeit existieren, fährt Pento fort. Die eigentliche Katastrophe sei jedoch, dass sie dieses Mal weitaus größer seien als je zuvor und ihr Platzen verheerende Folgen haben werde.

Nach Ansicht des Ökonomen sei die Schuld hierfür ausschließlich bei der Fed zu suchen. So habe Narayana Kocherlakota etwa, Präsident der Fed von Minneapolis, selbst gesagt, die Fed solle lieber Anstrengungen unternehmen, um ihre bisherige Unterstützung der Wirtschaft zu stärken, statt die Zügel anzuziehen. Während der frühere Fed-Vorsitzende Volcker davon sprach, die Inflation bekämpfen zu wollen, so würde die Fed heute alles erdenklich Mögliche unternehmen, um eben diese anzutreiben, in der Hoffnung, auf diese Weise Wirtschaftswachstum zu generieren.

Pento zufolge sei dies die perfekte Umgebung für Gold. Gerade deshalb verstehe er nicht, warum der Goldpreis nicht schon längst nach oben geschossen ist, angesichts der jüngsten Aussagen der Fed und der Aussicht auf den Versuch einer Rettung der FHA. Seines Erachtens würden momentan dieselben Bedingungen vorherrschen, die Gold seit jeder beflügelt haben.

Nach Pentos Auffasung werde auf QE4 QE5 folgen, was schließlich in QE-unendlich münden werde und in die Fußstapfen Bernankes werde die "Königin der Fälscher", Janet Yellen, treten. Die Aussichten auf eine Straffung der Geldpolitik seien damit äußerst schlecht. Und selbst wenn sich die Fed einmal zu einer Verschärfung entscheiden sollte, so müsse diese inkonsequent bleiben, da die Notenbank geradezu süchtig danach sei, Blasen aufzupumpen, um dieses künstliche und vorübergehende anämische Wachstum zu erzeugen.

Sollte der tragische Kollaps tatsächlich eintreten, so werde dies nach Überzeugung Pentos in kompletter Verwüstung enden.

Michael Pento: Das dicke Ende kommt erst noch ...

In einem Interview mit King World News, das vergangene Woche veröffentlicht wurde, gewährt der Top-Ökonom Michael Pento einen Einblick in das Chaos, in welches die zentralen Strippenzieher uns seiner Ansicht nach derzeit hineinstürzen würden.

Seines Erachtens seien Fed und die US Treasury vorwiegend damit beschäftigt, beispiellose Blasen zu bilden. Die Erholung der Wirtschaft gründe seit jeher auf dem Konsum, der etwa 70% des BIP der USA entspreche. Dieser Konsum wiederum sei jedoch durch Schuldenaufnahmen gestützt, da ein wirkliches Einkommenswachstum auf der Seite der Konsumenten fehle. Diese Schulden schließlich basieren auf Blasen bei den Aktien, Anleihen und bei den Immobilien. Verursacher dieser Blasen: die Fed mit ihren niedrigen Zinssätzen und der Monetarisierung der Staatsschulden.

Die Federal Housing Administration (FHA), die Gelder für den Hausbau und -erwerb bereitstellt, hatte kürzlich ein voraussichtliches Defizit von 1 Mrd. USD verkündet. Aufgrund dessen werde die FHA die Staatskasse anzapfen müssen, welche jedoch bereits selbst in finanzielle Bedrängnis geraten sei. Stelle sich die Frage, warum die FHA überhaupt gerettet werden soll, wo sie doch hauptsächlich Sicherheiten für Kreditgeber wie Banken oder andere Finanzinstitutionen bereitstellt. Der Grund, so Pento, bestehe darin, dass diese Institutionen dank der durch die FHA geschaffenen Sicherheiten überhaupt erst derart günstige Kredite anbieten könnten. Damit habe sich Amerika erneut eine riesige Immobilienblase geschaffen, bei welcher die Immobilienpreise im zweistelligen Bereich gestiegen seien und die FHA zum ersten mal in ihrer 79-jährigen Geschichte eine Rettung brauchen wird.

Ein ähnliches Bild zeichne sich auch am Aktienmarkt ab: Gewinne im zweistelligen Bereich ohne entsprechendes Ertragswachstum. Gleichzeitig hätten sich die durchschnittlichen Renditen bei Staatsanleihen verglichen zu denen vor vierzig Jahren halbiert. Damit würden zum ersten Mal drei Blasen zur gleichen Zeit existieren, fährt Pento fort. Die eigentliche Katastrophe sei jedoch, dass sie dieses Mal weitaus größer seien als je zuvor und ihr Platzen verheerende Folgen haben werde.

Nach Ansicht des Ökonomen sei die Schuld hierfür ausschließlich bei der Fed zu suchen. So habe Narayana Kocherlakota etwa, Präsident der Fed von Minneapolis, selbst gesagt, die Fed solle lieber Anstrengungen unternehmen, um ihre bisherige Unterstützung der Wirtschaft zu stärken, statt die Zügel anzuziehen. Während der frühere Fed-Vorsitzende Volcker davon sprach, die Inflation bekämpfen zu wollen, so würde die Fed heute alles erdenklich Mögliche unternehmen, um eben diese anzutreiben, in der Hoffnung, auf diese Weise Wirtschaftswachstum zu generieren.

Pento zufolge sei dies die perfekte Umgebung für Gold. Gerade deshalb verstehe er nicht, warum der Goldpreis nicht schon längst nach oben geschossen ist, angesichts der jüngsten Aussagen der Fed und der Aussicht auf den Versuch einer Rettung der FHA. Seines Erachtens würden momentan dieselben Bedingungen vorherrschen, die Gold seit jeder beflügelt haben.

Nach Pentos Auffasung werde auf QE4 QE5 folgen, was schließlich in QE-unendlich münden werde und in die Fußstapfen Bernankes werde die "Königin der Fälscher", Janet Yellen, treten. Die Aussichten auf eine Straffung der Geldpolitik seien damit äußerst schlecht. Und selbst wenn sich die Fed einmal zu einer Verschärfung entscheiden sollte, so müsse diese inkonsequent bleiben, da die Notenbank geradezu süchtig danach sei, Blasen aufzupumpen, um dieses künstliche und vorübergehende anämische Wachstum zu erzeugen.

Sollte der tragische Kollaps tatsächlich eintreten, so werde dies nach Überzeugung Pentos in kompletter Verwüstung enden.

30.09.2013 13:45 | Redaktion

China: Zentralbank lockert Beschränkungen beim Goldhandel

Wie Reuters heute berichtete, plant die chinesische Zentralbank, die Anzahl derjenigen Unternehmen zu erhöhen, denen der Import und Export von Gold gestattet ist, sowie weitere Restriktionen bezüglich Einzelkäufe zu lockern. Dies könnte zu einem weiteren Anstieg der Goldimporte des Landes führen, welches ohnehin bereits auf dem besten Wege ist, Indien den Rang als weltgrößter Goldkonsument abzulaufen.

Der Entwurf beinhaltet unter anderem, dass in Zukunft weitere an der Shanghai Gold Exchange handelnde Banken sowie Goldproduzenten mit einer Jahresproduktion von über zehn Tonnen Import- und Exportlizenzen beantragen können. Der Handel ist derzeit nur neun Mitgliedsbanken gestattet. Sämtliche Transaktionen müssen bei der Börse registriert sein. Zudem obliegt es den Lizenzinhabern, sicherzustellen, dass das inländische Angebot und die Nachfrage ausgewogen bleiben, heißt es weiter. Die Zentralbank des Landes behalte sich jedoch die Kontrolle der gesamten Goldexportvolumina vor.

Ferner sollen Einzelpersonen zukünftig bis zu 200 Gramm des gelben Metalls importieren können, ohne dies bei der Zollbehörde zu melden oder darauf Steuern zahlen zu müssen.

In China gilt Gold traditionell als sichere Anlage. Zudem ist Goldschmuck für Feste wie etwa Hochzeiten sehr beliebt. Und so hat man den immensen Goldpreisrückgang Mitte April genutzt und verstärkt Barren, Münzen und Schmuck gekauft, was allmählich nicht nur zu einem erheblichen Aufgeld von 30 $ je Unze über Spot, sondern auch zu einer Goldknappheit geführt habe. Mit den neuen Regelungen soll nun Abhilfe geschaffen werden, so heißt es im Artikel, obgleich sich die Nachfrage inzwischen wieder beruhigt hat und auch das Aufgeld deutlich gesunken ist.

Wann genau die neuen Regelungen in Kraft treten sollen, gab die Zentralbank allerdings nicht bekannt.

China: Zentralbank lockert Beschränkungen beim Goldhandel

Wie Reuters heute berichtete, plant die chinesische Zentralbank, die Anzahl derjenigen Unternehmen zu erhöhen, denen der Import und Export von Gold gestattet ist, sowie weitere Restriktionen bezüglich Einzelkäufe zu lockern. Dies könnte zu einem weiteren Anstieg der Goldimporte des Landes führen, welches ohnehin bereits auf dem besten Wege ist, Indien den Rang als weltgrößter Goldkonsument abzulaufen.

Der Entwurf beinhaltet unter anderem, dass in Zukunft weitere an der Shanghai Gold Exchange handelnde Banken sowie Goldproduzenten mit einer Jahresproduktion von über zehn Tonnen Import- und Exportlizenzen beantragen können. Der Handel ist derzeit nur neun Mitgliedsbanken gestattet. Sämtliche Transaktionen müssen bei der Börse registriert sein. Zudem obliegt es den Lizenzinhabern, sicherzustellen, dass das inländische Angebot und die Nachfrage ausgewogen bleiben, heißt es weiter. Die Zentralbank des Landes behalte sich jedoch die Kontrolle der gesamten Goldexportvolumina vor.

Ferner sollen Einzelpersonen zukünftig bis zu 200 Gramm des gelben Metalls importieren können, ohne dies bei der Zollbehörde zu melden oder darauf Steuern zahlen zu müssen.

In China gilt Gold traditionell als sichere Anlage. Zudem ist Goldschmuck für Feste wie etwa Hochzeiten sehr beliebt. Und so hat man den immensen Goldpreisrückgang Mitte April genutzt und verstärkt Barren, Münzen und Schmuck gekauft, was allmählich nicht nur zu einem erheblichen Aufgeld von 30 $ je Unze über Spot, sondern auch zu einer Goldknappheit geführt habe. Mit den neuen Regelungen soll nun Abhilfe geschaffen werden, so heißt es im Artikel, obgleich sich die Nachfrage inzwischen wieder beruhigt hat und auch das Aufgeld deutlich gesunken ist.

Wann genau die neuen Regelungen in Kraft treten sollen, gab die Zentralbank allerdings nicht bekannt.

30.09.2013 07:00 | Prof. Dr. Thorsten Polleit

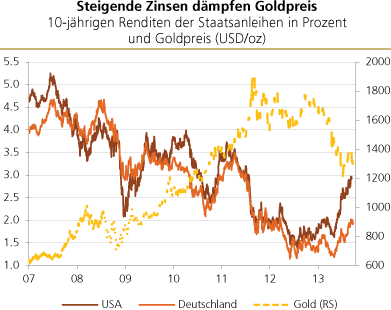

Goldpreis und Zins

Im Juli 2012 fielen die Renditen der 10-jährigen US-Staatsanleihen auf 1,4 Prozent: Investoren fragten verstärkt Anleihen nach, die Kurse stiegen und die Renditen gingen zurück.

Seither sind die Anleiherenditen wieder auf etwa 2,7 Prozent gestiegen. Die "Krisensorge" hat bei vielen Investoren nachgelassen, nicht wenige erwarten nun eine "Normalisierung" der Geldpolitiken.

Quelle: Thomson Financial

Vor allem seit die amerikanische Zentralbank (Fed) im Mai dieses Jahres in Aussicht gestellt hat, sie werde ihre Anleihekäufe reduzieren, sind die Langfristzinsen angestiegen - nicht nur in Amerika, sondern auch weltweit.

Denn es ist die Geld- und Zinspolitik der amerikanischen Zentralbank, die nach wie vor ganz entscheidend für das internationale Zinsumfeld ist; der US-Dollar ist schließlich nach wie vor die Weltreservewährung.

Zinskosten

Die Goldnachfrage ist von einer Reihe von Faktoren abhängig. Hierzu zählen zum Beispiel das weltweite Wirtschafts- und Bevölkerungswachstum, aber auch die (geo-)politische Risikolage.

Auch der Zins hat eine wichtige Bedeutung für die Edelmetallnachfrage. Grundsätzlich gilt: Je höher der Zins ist, desto höher sind die Kosten der Goldhaltung.

Wer Gold hält, dem entgehen schließlich Zinsen (Gold erzielt in der Tat keinen Zins), die er andernfalls mit dem Halten von zum Beispiel Anleihen und Termineinlagen verdienen würde.

Das ist auch der Grund, warum steigende Zinsen die Goldnachfrage dämpfen:

Steigen die Zinsen, wird das Halten von Gold tendenziell teurer und damit unattraktiver und bremst die Goldnachfrage. Und nimmt die Goldnachfrage ab aufgrund eines gestiegenen Zinses, so ver-mindert das natürlich auch tendenziell den Goldpreis (soweit das Goldangebot unverändert bleibt).

Der Zinsanstieg ist eine wichtige Erklärung, warum der Goldpreis seit Herbst 2012 merklich gesunken ist. Die wichtige Frage für Edelmetallinvestoren ist nun aber: Wird sich der Zinsanstieg weiter fortsetzen?

Einstieg in den Ausstieg?

Die Antwort auf diese Frage hängt entscheidend davon ab, ob die amerikanische Zentralbank ihre bisherigen Anleihekäufe zurückfahren oder gar einstellen wird.

Um diese Frage zu beantworten, bietet es sich an, die Entwicklung der US-Geldmenge M2 seit Ausbruch der internationalen Finanz- und Wirtschaftskrise zu betrachten.

Der Zuwachs von M2 nahm krisenbedingt in 2009 und 2010 ab. Das lag an einer Abschwächung der Bankkreditvergabe, die bereits 2008 begann nachzugeben, und die gegen Ende 2009/Anfang 2010 sogar rückläufig war.

http://goldseiten.de/artikel/183812--Goldpreis-und-Zins.html?seite=2

Goldpreis und Zins

Im Juli 2012 fielen die Renditen der 10-jährigen US-Staatsanleihen auf 1,4 Prozent: Investoren fragten verstärkt Anleihen nach, die Kurse stiegen und die Renditen gingen zurück.

Seither sind die Anleiherenditen wieder auf etwa 2,7 Prozent gestiegen. Die "Krisensorge" hat bei vielen Investoren nachgelassen, nicht wenige erwarten nun eine "Normalisierung" der Geldpolitiken.

Quelle: Thomson Financial

Vor allem seit die amerikanische Zentralbank (Fed) im Mai dieses Jahres in Aussicht gestellt hat, sie werde ihre Anleihekäufe reduzieren, sind die Langfristzinsen angestiegen - nicht nur in Amerika, sondern auch weltweit.

Denn es ist die Geld- und Zinspolitik der amerikanischen Zentralbank, die nach wie vor ganz entscheidend für das internationale Zinsumfeld ist; der US-Dollar ist schließlich nach wie vor die Weltreservewährung.

Zinskosten

Die Goldnachfrage ist von einer Reihe von Faktoren abhängig. Hierzu zählen zum Beispiel das weltweite Wirtschafts- und Bevölkerungswachstum, aber auch die (geo-)politische Risikolage.

Auch der Zins hat eine wichtige Bedeutung für die Edelmetallnachfrage. Grundsätzlich gilt: Je höher der Zins ist, desto höher sind die Kosten der Goldhaltung.

Wer Gold hält, dem entgehen schließlich Zinsen (Gold erzielt in der Tat keinen Zins), die er andernfalls mit dem Halten von zum Beispiel Anleihen und Termineinlagen verdienen würde.

Das ist auch der Grund, warum steigende Zinsen die Goldnachfrage dämpfen:

Steigen die Zinsen, wird das Halten von Gold tendenziell teurer und damit unattraktiver und bremst die Goldnachfrage. Und nimmt die Goldnachfrage ab aufgrund eines gestiegenen Zinses, so ver-mindert das natürlich auch tendenziell den Goldpreis (soweit das Goldangebot unverändert bleibt).

Der Zinsanstieg ist eine wichtige Erklärung, warum der Goldpreis seit Herbst 2012 merklich gesunken ist. Die wichtige Frage für Edelmetallinvestoren ist nun aber: Wird sich der Zinsanstieg weiter fortsetzen?

Einstieg in den Ausstieg?

Die Antwort auf diese Frage hängt entscheidend davon ab, ob die amerikanische Zentralbank ihre bisherigen Anleihekäufe zurückfahren oder gar einstellen wird.

Um diese Frage zu beantworten, bietet es sich an, die Entwicklung der US-Geldmenge M2 seit Ausbruch der internationalen Finanz- und Wirtschaftskrise zu betrachten.

Der Zuwachs von M2 nahm krisenbedingt in 2009 und 2010 ab. Das lag an einer Abschwächung der Bankkreditvergabe, die bereits 2008 begann nachzugeben, und die gegen Ende 2009/Anfang 2010 sogar rückläufig war.

http://goldseiten.de/artikel/183812--Goldpreis-und-Zins.html?seite=2

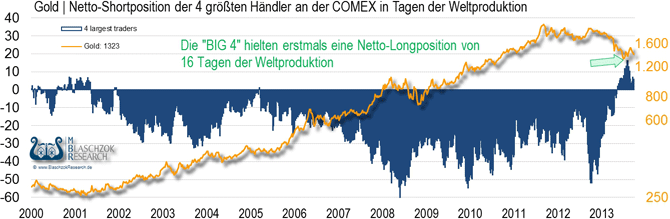

30.09.2013 11:22 | Eugen Weinberg

Politische Unsicherheiten belasten die Stimmung

Energie

Die Ölpreise stehen zu Beginn der neuen Handelswoche unter Druck. Der Brentölpreis handelt nur noch knapp über der wichtigen Unterstützung von 107,4 USD je Barrel. Der WTI-Preis ist auf 101,5 USD je Barrel gefallen und notiert damit auf dem niedrigsten Niveau seit Anfang Juli. Angesichts der politischen Unsicherheit in den USA und Italien (siehe Edelmetalle unten) und der sichtbaren Annäherung zwischen den USA und dem Iran droht den Ölpreisen in den kommenden Tagen ein weiterer Rückgang in Richtung 105 USD je Barrel bei Brent und 100 USD je Barrel bei WTI.

Verkaufsdruck könnte insbesondere seitens der spekulativen Finanzanleger ausgehen, welche sich angesichts der aktuellen Nachrichtenlage von ihren Netto-Long-Positionen trennen könnten. Bei WTI kam es in der Woche zum 24. September lediglich zu einem leichten Rückgang um 1,7 Tsd. Kontrakte. Ein stärkerer Rückgang dürfte durch die US-Notenbank verhindert worden sein, welche in der Berichtswoche das Anleihekaufvolumen nicht reduzierte und somit für einen kurzzeitigen Preisanstieg sorgte. Das Niveau von knapp 244 Tsd. Kontrakten war zum Stichtag der Erhebung aber noch immer hoch und das Korrekturpotenzial somit beträchtlich.

Die vier größten Abnehmer für iranisches Öl, China, Indien, Japan und Südkorea, haben ihre Ölimporte aus dem Iran in den ersten acht Monaten des Jahres um 16% gegenüber dem Vorjahr auf 927,9 Tsd. Barrel pro Tag reduziert. Im August beliefen sich die Importe auf lediglich 865,7 Tsd. Barrel pro Tag. Die jüngsten Entspannungssignale aus Teheran könnten in etwas höheren Lieferungen resultieren. Eine schnelle Rückkehr zum Vor-Sanktions-Niveau von 1,5 Mio. Barrel pro Tag ist allerdings unwahrscheinlich.

Edelmetalle

Der Goldpreis kann zu Beginn der neuen Handelswoche zwar nicht weiter zulegen, verteidigt aber trotz der Schwäche im gesamten Rohstoffsektor seine Gewinne vom Freitag und handelt bei rund 1.340 USD je Feinunze. Der sich zuspitzende Haushaltsstreit in den USA gibt unterschwellig Unterstützung. Das republikanisch dominierte Repräsentantenhaus und der mehrheitlich demokratisch-besetzte Kongress konnten sich bislang nicht auf einen Nothaushalt einigen, der die Ausgaben der Regierung bis Mitte Dezember sicherstellen würde. Dies könnte dazu führen, dass es im morgen beginnenden neuen Haushaltsjahr zu Behördenschließungen kommen könnte.

Unterstützung könnte Gold auch von der neuen politischen Krise in Italien erhalten, wo die Regierung nach dem Rückzug der Berlusconi-Partei auseinanderzufallen droht.

Die ETF-Anleger ziehen sich unterdessen weiter aus dem Goldmarkt zurück. Sie haben allein am Freitag wieder 4,7 Tonnen Gold verkauft, was auf Verkäufe zum Quartalsende zurückgeführt werden könnte. Die Bestände der von Bloomberg erfassten Gold-ETFs liegen mit 1.930 Tonnen auf dem tiefsten Stand seit Mai 2010. Die spekulativen Finanzanleger haben nach der Entscheidung der US-Notenbank Fed, die Anleihekäufe vorerst nicht zu reduzieren, ihre Netto-Long-Positionen bei Gold in der Woche zum 24. September um 17% auf 64 Tsd. Kontrakte ausgeweitet, was den zwischenzeitlichen Preisanstieg auf 1.375 USD je Feinunze erklären kann. Dagegen wurden die Netto-Long-Positionen bei Silber schon die dritte Woche in Folge auf nunmehr 10,5 Tsd. Kontrakte abgebaut.

Industriemetalle

Die Metallpreise können ihr positives Momentum von Ende letzter Woche nicht vollständig in die neue Handelswoche mit hinübernehmen und notieren weitgehend seitwärts. Der sich zuspitzende Haushaltsstreit in den USA, der sich in einer höheren Risikoaversion der Marktteilnehmer widerspiegelt, steht offenbar steigenden Preisen entgegen. Die Metalle halten sich aber immer noch besser als die anderen zyklischen Rohstoffe wie z.B. Energieträger.

Nach der datenarmen letzten Woche stehen in dieser Woche wieder eine Reihe von Datenveröffentlichungen im Mittelpunkt des Interesses - sowohl auf der Makroseite als auch metallspezifische. So werden morgen zum Beispiel die Einkaufsmanagerindizes für das verarbeitende Gewerbe in China und den USA veröffentlicht. Darüber hinaus halten die International Study Groups ihre Herbsttagungen zur Lage und zum Ausblick an den globalen Metallmärkten ab.

Von besonderem Interesse wird sein, inwiefern die Verbände die zukünftige Entwicklung des Angebots und der Nachfrage einschätzen. Die Marktreaktion auf die Veröffentlichungen könnte allerdings verhalten ausfallen, da morgen in China die "Golden Week" beginnt, während derer die Märkte im Reich der Mitte geschlossen bleiben. Die spekulativen Finanzanleger haben im Falle von Kupfer in der Woche zum 24. September wieder moderat Netto-Long-Positionen aufgebaut, was auf die vorläufige Beibehaltung der Anleihekäufe der US-Notenbank Fed zurückzuführen sein dürfte.

Agrarrohstoffe

Im heutigen Bericht des US-Landwirtschaftsministeriums USDA zu den US-Lagerbeständen am Stichtag 1. September erwartet der Markt einen höheren Maisbestand als bislang für das Ende der Saison 2012/13 in den Prognosen des USDA eingestellt. Dort rechnet das USDA damit, dass die Bestände mit 661 Mio. Scheffel (16,8 Mio. Tonnen) auf das niedrigste Niveau seit dem Ende der Saison 1995/96 abgesunken sind. Bei dem 17-Jahrestief dürfte es auch blieben, selbst wenn die Bestände etwas höher gemeldet werden.

Auch bei Sojabohnen werden die Endbestände der Saison 2012/13 gemeldet. Das USDA schätzt diese bislang mit 125 Mio. Scheffel (3,4 Mio. Tonnen) auf einem 9-Jahrestief, was realistisch sein dürfte. Im letzten Quartal der Saison liefen vor allem die Exporte auf Hochtouren: Mit 25,7 Mio. Tonnen wurde ein neuer Quartalsrekord gemeldet. Dafür war vor allem die chinesische Nachfrage nach US-Ware bedeutend, die gegenüber dem Vorjahresquartal um 28% stieg.

Der Rohzuckerpreis kann sich dem Abwärtsdruck eines wieder schwächeren Brasilianischen Real nicht entziehen. Die Währung des größten Zuckerproduzenten- und -exportlandes verlor in der vergangenen Woche so stark an Wert wie seit August nicht mehr. Dass die Analysten von Sucden für 2013/14 eine um 1,5% niedrigere Zuckerproduktion für das Hauptanbaugebiet Center-South schätzen, überraschte den Markt dagegen nicht, zumal es sich im Lichte der bisherigen Zahlen als eher optimistische Schätzung bewerten lässt.

http://goldseiten.de/artikel/183926--Politische-Unsicherheiten-belasten-die-Stimmung.html?seite=2

Politische Unsicherheiten belasten die Stimmung

Energie

Die Ölpreise stehen zu Beginn der neuen Handelswoche unter Druck. Der Brentölpreis handelt nur noch knapp über der wichtigen Unterstützung von 107,4 USD je Barrel. Der WTI-Preis ist auf 101,5 USD je Barrel gefallen und notiert damit auf dem niedrigsten Niveau seit Anfang Juli. Angesichts der politischen Unsicherheit in den USA und Italien (siehe Edelmetalle unten) und der sichtbaren Annäherung zwischen den USA und dem Iran droht den Ölpreisen in den kommenden Tagen ein weiterer Rückgang in Richtung 105 USD je Barrel bei Brent und 100 USD je Barrel bei WTI.

Verkaufsdruck könnte insbesondere seitens der spekulativen Finanzanleger ausgehen, welche sich angesichts der aktuellen Nachrichtenlage von ihren Netto-Long-Positionen trennen könnten. Bei WTI kam es in der Woche zum 24. September lediglich zu einem leichten Rückgang um 1,7 Tsd. Kontrakte. Ein stärkerer Rückgang dürfte durch die US-Notenbank verhindert worden sein, welche in der Berichtswoche das Anleihekaufvolumen nicht reduzierte und somit für einen kurzzeitigen Preisanstieg sorgte. Das Niveau von knapp 244 Tsd. Kontrakten war zum Stichtag der Erhebung aber noch immer hoch und das Korrekturpotenzial somit beträchtlich.

Die vier größten Abnehmer für iranisches Öl, China, Indien, Japan und Südkorea, haben ihre Ölimporte aus dem Iran in den ersten acht Monaten des Jahres um 16% gegenüber dem Vorjahr auf 927,9 Tsd. Barrel pro Tag reduziert. Im August beliefen sich die Importe auf lediglich 865,7 Tsd. Barrel pro Tag. Die jüngsten Entspannungssignale aus Teheran könnten in etwas höheren Lieferungen resultieren. Eine schnelle Rückkehr zum Vor-Sanktions-Niveau von 1,5 Mio. Barrel pro Tag ist allerdings unwahrscheinlich.

Edelmetalle

Der Goldpreis kann zu Beginn der neuen Handelswoche zwar nicht weiter zulegen, verteidigt aber trotz der Schwäche im gesamten Rohstoffsektor seine Gewinne vom Freitag und handelt bei rund 1.340 USD je Feinunze. Der sich zuspitzende Haushaltsstreit in den USA gibt unterschwellig Unterstützung. Das republikanisch dominierte Repräsentantenhaus und der mehrheitlich demokratisch-besetzte Kongress konnten sich bislang nicht auf einen Nothaushalt einigen, der die Ausgaben der Regierung bis Mitte Dezember sicherstellen würde. Dies könnte dazu führen, dass es im morgen beginnenden neuen Haushaltsjahr zu Behördenschließungen kommen könnte.

Unterstützung könnte Gold auch von der neuen politischen Krise in Italien erhalten, wo die Regierung nach dem Rückzug der Berlusconi-Partei auseinanderzufallen droht.

Die ETF-Anleger ziehen sich unterdessen weiter aus dem Goldmarkt zurück. Sie haben allein am Freitag wieder 4,7 Tonnen Gold verkauft, was auf Verkäufe zum Quartalsende zurückgeführt werden könnte. Die Bestände der von Bloomberg erfassten Gold-ETFs liegen mit 1.930 Tonnen auf dem tiefsten Stand seit Mai 2010. Die spekulativen Finanzanleger haben nach der Entscheidung der US-Notenbank Fed, die Anleihekäufe vorerst nicht zu reduzieren, ihre Netto-Long-Positionen bei Gold in der Woche zum 24. September um 17% auf 64 Tsd. Kontrakte ausgeweitet, was den zwischenzeitlichen Preisanstieg auf 1.375 USD je Feinunze erklären kann. Dagegen wurden die Netto-Long-Positionen bei Silber schon die dritte Woche in Folge auf nunmehr 10,5 Tsd. Kontrakte abgebaut.

Industriemetalle

Die Metallpreise können ihr positives Momentum von Ende letzter Woche nicht vollständig in die neue Handelswoche mit hinübernehmen und notieren weitgehend seitwärts. Der sich zuspitzende Haushaltsstreit in den USA, der sich in einer höheren Risikoaversion der Marktteilnehmer widerspiegelt, steht offenbar steigenden Preisen entgegen. Die Metalle halten sich aber immer noch besser als die anderen zyklischen Rohstoffe wie z.B. Energieträger.

Nach der datenarmen letzten Woche stehen in dieser Woche wieder eine Reihe von Datenveröffentlichungen im Mittelpunkt des Interesses - sowohl auf der Makroseite als auch metallspezifische. So werden morgen zum Beispiel die Einkaufsmanagerindizes für das verarbeitende Gewerbe in China und den USA veröffentlicht. Darüber hinaus halten die International Study Groups ihre Herbsttagungen zur Lage und zum Ausblick an den globalen Metallmärkten ab.

Von besonderem Interesse wird sein, inwiefern die Verbände die zukünftige Entwicklung des Angebots und der Nachfrage einschätzen. Die Marktreaktion auf die Veröffentlichungen könnte allerdings verhalten ausfallen, da morgen in China die "Golden Week" beginnt, während derer die Märkte im Reich der Mitte geschlossen bleiben. Die spekulativen Finanzanleger haben im Falle von Kupfer in der Woche zum 24. September wieder moderat Netto-Long-Positionen aufgebaut, was auf die vorläufige Beibehaltung der Anleihekäufe der US-Notenbank Fed zurückzuführen sein dürfte.

Agrarrohstoffe

Im heutigen Bericht des US-Landwirtschaftsministeriums USDA zu den US-Lagerbeständen am Stichtag 1. September erwartet der Markt einen höheren Maisbestand als bislang für das Ende der Saison 2012/13 in den Prognosen des USDA eingestellt. Dort rechnet das USDA damit, dass die Bestände mit 661 Mio. Scheffel (16,8 Mio. Tonnen) auf das niedrigste Niveau seit dem Ende der Saison 1995/96 abgesunken sind. Bei dem 17-Jahrestief dürfte es auch blieben, selbst wenn die Bestände etwas höher gemeldet werden.

Auch bei Sojabohnen werden die Endbestände der Saison 2012/13 gemeldet. Das USDA schätzt diese bislang mit 125 Mio. Scheffel (3,4 Mio. Tonnen) auf einem 9-Jahrestief, was realistisch sein dürfte. Im letzten Quartal der Saison liefen vor allem die Exporte auf Hochtouren: Mit 25,7 Mio. Tonnen wurde ein neuer Quartalsrekord gemeldet. Dafür war vor allem die chinesische Nachfrage nach US-Ware bedeutend, die gegenüber dem Vorjahresquartal um 28% stieg.

Der Rohzuckerpreis kann sich dem Abwärtsdruck eines wieder schwächeren Brasilianischen Real nicht entziehen. Die Währung des größten Zuckerproduzenten- und -exportlandes verlor in der vergangenen Woche so stark an Wert wie seit August nicht mehr. Dass die Analysten von Sucden für 2013/14 eine um 1,5% niedrigere Zuckerproduktion für das Hauptanbaugebiet Center-South schätzen, überraschte den Markt dagegen nicht, zumal es sich im Lichte der bisherigen Zahlen als eher optimistische Schätzung bewerten lässt.

http://goldseiten.de/artikel/183926--Politische-Unsicherheiten-belasten-die-Stimmung.html?seite=2

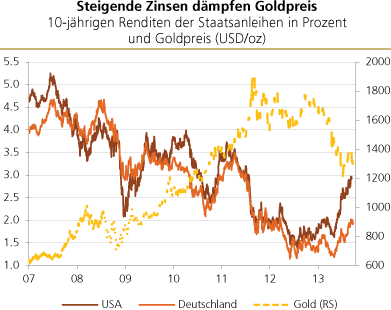

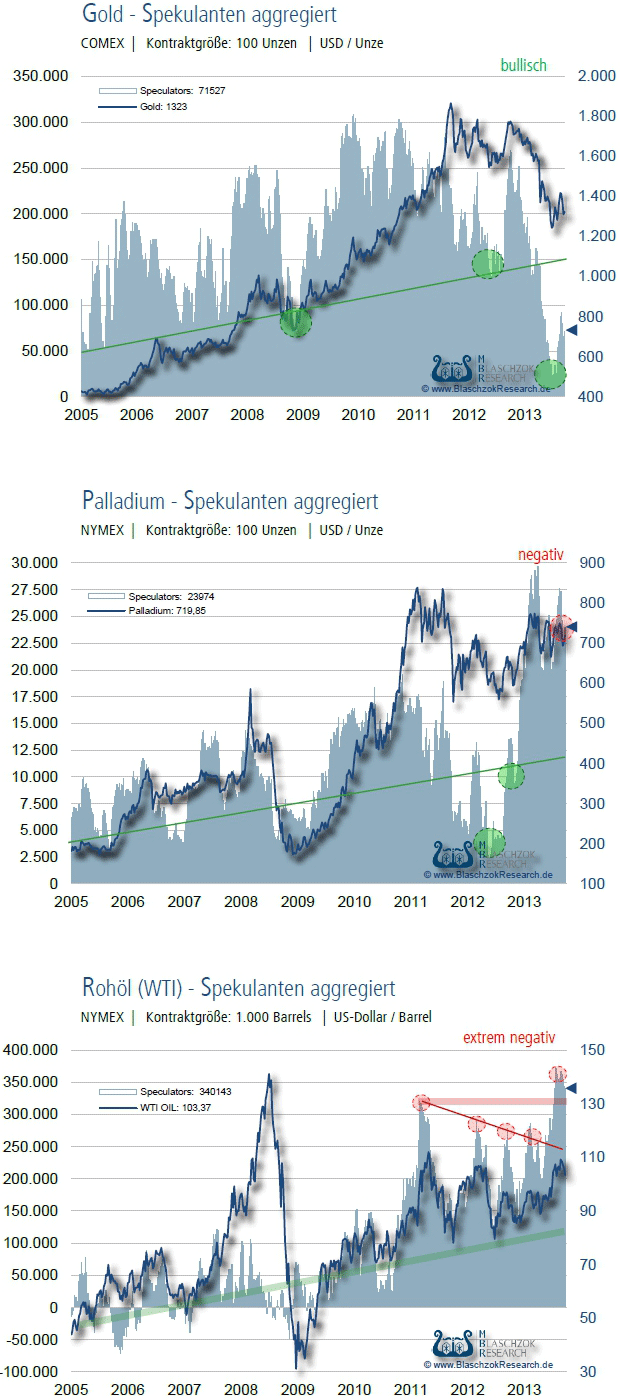

30.09.2013 17:05 | Markus Blaschzok

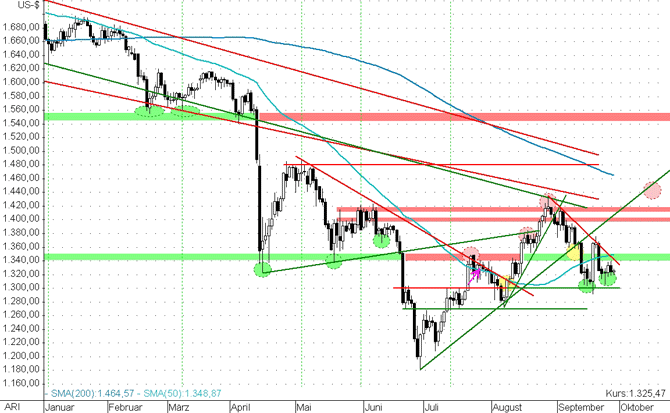

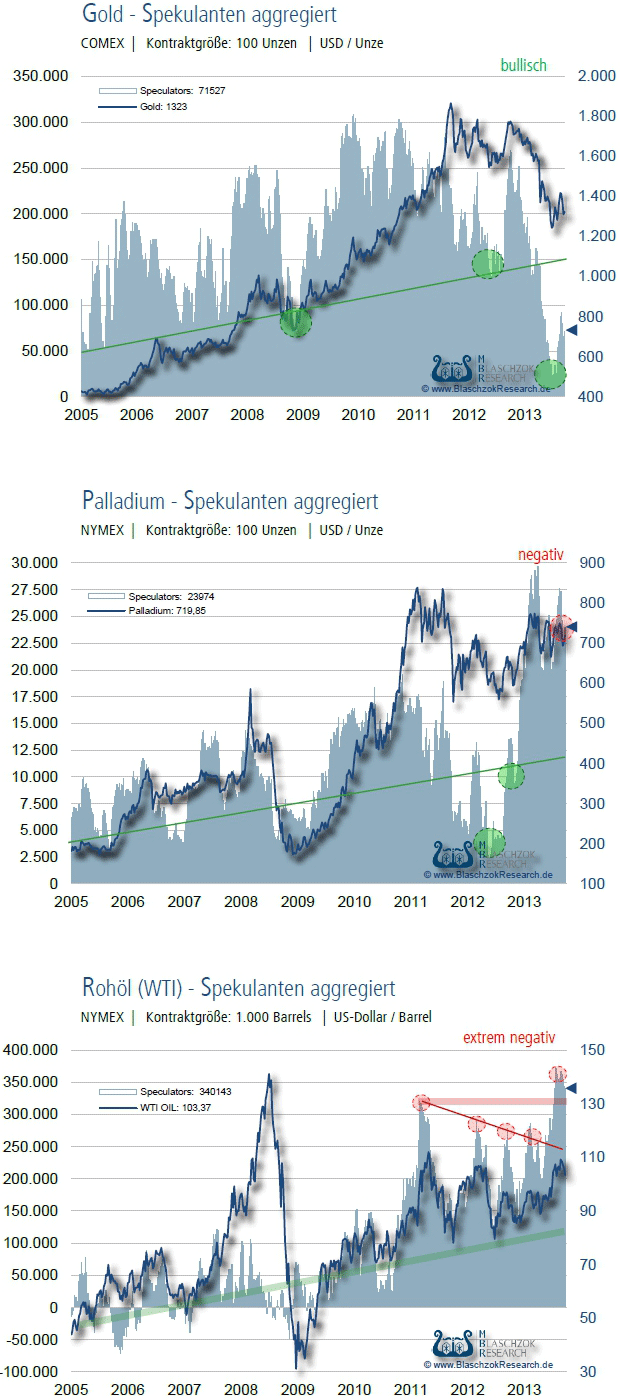

CoT-Report

In den letzten Wochen war eine extreme Schwäche in den CoT-Daten für Gold ablesbar. Von irgendwo her kam großes physisches Angebot auf den Markt, das vermutlich Bestandteil der Preismanipulation unter die Marke von 1.350 USD war. Das Bild zeigt sich auch in dieser Woche noch nicht ganz normal, denn der Aufbau von netto 9 Tsd. Kontrakten beim Managed Money ist für einen Preisanstieg von gerade einmal 13 USD etwas zu viel des Guten. Das dürfte sich bei den aktuellen Preisen, den COMEX-Lagerhausdaten und der stabilen asiatischen Nachfrage, insbesondere in den saisonal starken Monaten, nicht so darstellen.

Im besten Fall wird es einige Wochen dauern, bis das natürliche Angebotsdefizit die Positionierung zum Preis wieder verbessert hat. Im Augenblick sind die Daten jedenfalls immer noch schlechter als vor einem Monat. Die Spekulanten stellen weiterhin Shortpositionen glatt und trauen sich noch nicht auf steigende Preise zu setzen, was auch das rückläufige Open Interest zeigt. Mittelfristig ist die niedrige Positionierung aber weiterhin extrem bullisch und bietet die Basis für einen langandauernden Bullenmarkt.

Die Daten für den Euro sind jetzt sehr bärisch und unser CoT-Indikator liefert ein rotes Warnsignal. Ein finaler Anstieg bis 1,37 USD scheint möglich, doch man sollte bereits jetzt sehr vorsichtig sein. Wir erwarten für die nächsten Tage oder ein bis zwei Wochen eine Meldung der EZB zu möglichen Lockerungen oder eine wieder stärker in den medialen Fokus rückende Eurokrise, was den Sentimentwechsel einläuten könnte.

Palladium konnte zur Vorwoche entgegen dem Gold relative Stärke in den Daten vorweisen, während die mittelfristige Positionierung weiterhin extrem negativ bleibt.

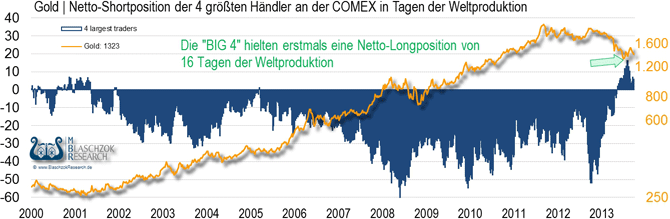

Die US-Aufsichtsbehörde CFTC hat nun offiziell bekannt gegeben, dass diese im Silbermarkt keinerlei Beweise für eine Manipulation finden konnte und alle Beschwerden dazu abgewiesen. In der Vergangenheit habe ich immer wieder darauf hingewiesen, dass die Manipulation über verschiedene Kanäle läuft und JP Morgan

Die kürzliche offizielle Erklärung der US-Aufsichtsbehörde, dass diese keine Hinweise zu einer Manipulation im Silbermarkt finden konnte, obwohl ihre eigenen CoT-Daten dies deutlich belegen, ist politisch motiviert. Deren eigenen Regeln schreiben vor, dass kein Händler eine größere Position als 2,5% bis 3% des Open Interest halten sollte. Die großen 4 Händler im Silber, die wir wöchentlich beobachten, hielten teilweise 89% aller Shortkontrakte und 26% des True Open Interest vor einem Jahr. Damit wurden die Grenzen um bis zu dem Zehnfachen überschritten. Da hinter der Manipulation die US-Regierung steht, die über eine Drückung von Gold und Silber einen Anstieg der Marktzinsen zu verhindern versucht, kann die Aufsichtsbehörde auch nicht gegen ihren Arbeitgeber vorgehen, wenn dieser diesen Markteingriff für rechtens erklärt. Seit langer Zeit weisen wir darauf hin, dass verschiedene staatliche Einrichtungen, wie der ESF (Exchange Stabilization Fonds) explizit die Aufgabe hat im Gold- und Silbermarkt zu intervenieren.

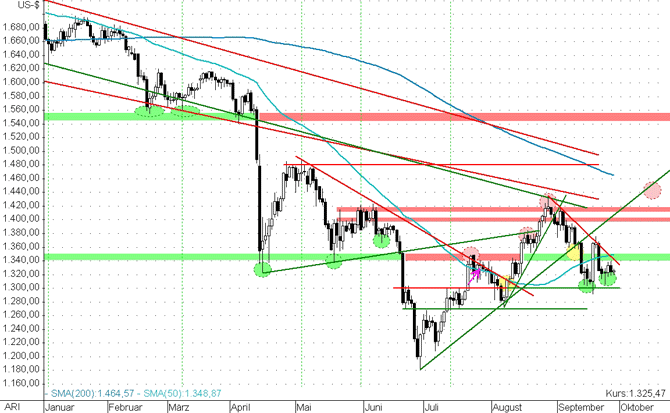

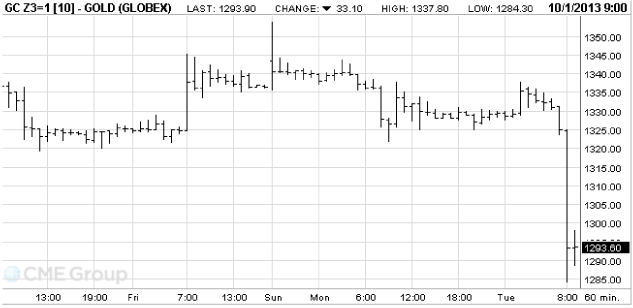

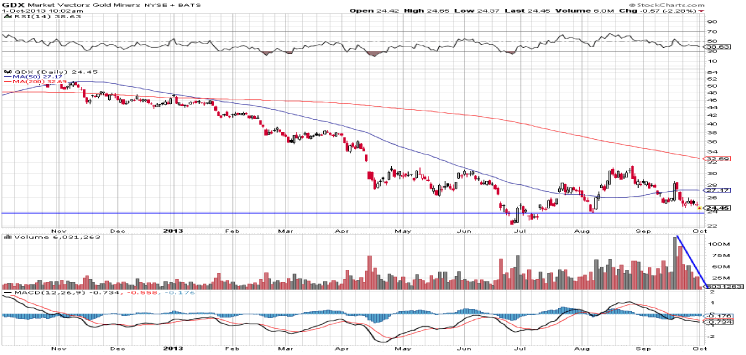

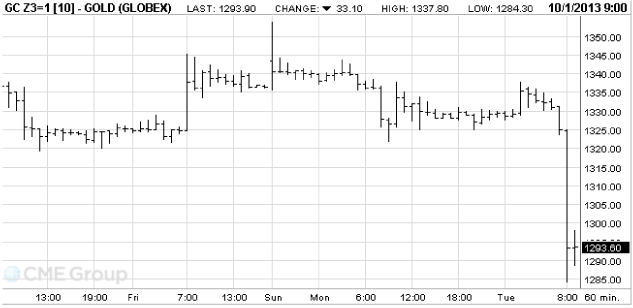

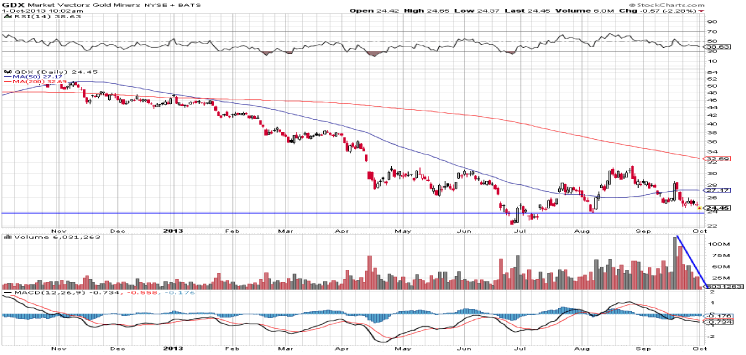

Technische Analyse zu Gold

Gold hatte in der letzten Nacht im asiatischen Handel den Versuch unternommen, den Abwärtstrend mit Preisen über 1.350 USD zu überwinden. Was eigentlich bullisch ist, könnte auch ein Abfischen von Shortpositionen im Vorfeld einer weiteren Manipulation unter 1.300 USD gewesen sein. Die US-Schuldenobergrenze sollte heute oder morgen in letzter Minute angehoben werden - oder spätestens bis 17. Oktober, da bis dahin die Reserven reichen werden. Wahre Gefahr erwarten wir nicht, jedoch böte dies die perfekte Entschuldigung für eine Manipulation des Preises.

Nach der Drückung unter 1.350 USD und der kurzfristigen Schwäche in den CoT-Daten sind wir uns über die Entwicklung der nächsten Handelstage unsicher. Gelingt in den nächsten Tagen der Sprung über den Abwärtstrend mit Preisen über 1.350 USD, so ist der Weg nach oben frei. Trader sollten unter 1.300 USD den Markt hingegen verlassen haben, und in diesem Bereich einen Stop Loss platzieren. Gold ist kurzfristig überverkauft und der Markt an sich scheint nach oben zu wollen, wobei mit der Entscheidung zu der Schuldenobergrenze und den US-Arbeitsmarktdaten am Freitag kurzfristig marktbeeinflussende Meldungen anstehen, die für eine gegensätzliche Reaktion sorgen könnten. Darum sollte man sich einfach an den genannten Stop Loss und Stop Buy Marken orientieren.

CoT-Report

In den letzten Wochen war eine extreme Schwäche in den CoT-Daten für Gold ablesbar. Von irgendwo her kam großes physisches Angebot auf den Markt, das vermutlich Bestandteil der Preismanipulation unter die Marke von 1.350 USD war. Das Bild zeigt sich auch in dieser Woche noch nicht ganz normal, denn der Aufbau von netto 9 Tsd. Kontrakten beim Managed Money ist für einen Preisanstieg von gerade einmal 13 USD etwas zu viel des Guten. Das dürfte sich bei den aktuellen Preisen, den COMEX-Lagerhausdaten und der stabilen asiatischen Nachfrage, insbesondere in den saisonal starken Monaten, nicht so darstellen.

Im besten Fall wird es einige Wochen dauern, bis das natürliche Angebotsdefizit die Positionierung zum Preis wieder verbessert hat. Im Augenblick sind die Daten jedenfalls immer noch schlechter als vor einem Monat. Die Spekulanten stellen weiterhin Shortpositionen glatt und trauen sich noch nicht auf steigende Preise zu setzen, was auch das rückläufige Open Interest zeigt. Mittelfristig ist die niedrige Positionierung aber weiterhin extrem bullisch und bietet die Basis für einen langandauernden Bullenmarkt.

Die Daten für den Euro sind jetzt sehr bärisch und unser CoT-Indikator liefert ein rotes Warnsignal. Ein finaler Anstieg bis 1,37 USD scheint möglich, doch man sollte bereits jetzt sehr vorsichtig sein. Wir erwarten für die nächsten Tage oder ein bis zwei Wochen eine Meldung der EZB zu möglichen Lockerungen oder eine wieder stärker in den medialen Fokus rückende Eurokrise, was den Sentimentwechsel einläuten könnte.

Palladium konnte zur Vorwoche entgegen dem Gold relative Stärke in den Daten vorweisen, während die mittelfristige Positionierung weiterhin extrem negativ bleibt.

Die US-Aufsichtsbehörde CFTC hat nun offiziell bekannt gegeben, dass diese im Silbermarkt keinerlei Beweise für eine Manipulation finden konnte und alle Beschwerden dazu abgewiesen. In der Vergangenheit habe ich immer wieder darauf hingewiesen, dass die Manipulation über verschiedene Kanäle läuft und JP Morgan

Die kürzliche offizielle Erklärung der US-Aufsichtsbehörde, dass diese keine Hinweise zu einer Manipulation im Silbermarkt finden konnte, obwohl ihre eigenen CoT-Daten dies deutlich belegen, ist politisch motiviert. Deren eigenen Regeln schreiben vor, dass kein Händler eine größere Position als 2,5% bis 3% des Open Interest halten sollte. Die großen 4 Händler im Silber, die wir wöchentlich beobachten, hielten teilweise 89% aller Shortkontrakte und 26% des True Open Interest vor einem Jahr. Damit wurden die Grenzen um bis zu dem Zehnfachen überschritten. Da hinter der Manipulation die US-Regierung steht, die über eine Drückung von Gold und Silber einen Anstieg der Marktzinsen zu verhindern versucht, kann die Aufsichtsbehörde auch nicht gegen ihren Arbeitgeber vorgehen, wenn dieser diesen Markteingriff für rechtens erklärt. Seit langer Zeit weisen wir darauf hin, dass verschiedene staatliche Einrichtungen, wie der ESF (Exchange Stabilization Fonds) explizit die Aufgabe hat im Gold- und Silbermarkt zu intervenieren.

Technische Analyse zu Gold

Gold hatte in der letzten Nacht im asiatischen Handel den Versuch unternommen, den Abwärtstrend mit Preisen über 1.350 USD zu überwinden. Was eigentlich bullisch ist, könnte auch ein Abfischen von Shortpositionen im Vorfeld einer weiteren Manipulation unter 1.300 USD gewesen sein. Die US-Schuldenobergrenze sollte heute oder morgen in letzter Minute angehoben werden - oder spätestens bis 17. Oktober, da bis dahin die Reserven reichen werden. Wahre Gefahr erwarten wir nicht, jedoch böte dies die perfekte Entschuldigung für eine Manipulation des Preises.

Nach der Drückung unter 1.350 USD und der kurzfristigen Schwäche in den CoT-Daten sind wir uns über die Entwicklung der nächsten Handelstage unsicher. Gelingt in den nächsten Tagen der Sprung über den Abwärtstrend mit Preisen über 1.350 USD, so ist der Weg nach oben frei. Trader sollten unter 1.300 USD den Markt hingegen verlassen haben, und in diesem Bereich einen Stop Loss platzieren. Gold ist kurzfristig überverkauft und der Markt an sich scheint nach oben zu wollen, wobei mit der Entscheidung zu der Schuldenobergrenze und den US-Arbeitsmarktdaten am Freitag kurzfristig marktbeeinflussende Meldungen anstehen, die für eine gegensätzliche Reaktion sorgen könnten. Darum sollte man sich einfach an den genannten Stop Loss und Stop Buy Marken orientieren.

P.M. Kitco Roundup: Comex Gold Weaker as U.S. Government Partial Shutdown Imminent

Monday September 30, 2013 1:54 PM

(Kitco News) - Comex gold futures prices ended the U.S. day session moderately lower Monday. It was a “risk-off” day to start the new trading week and this last day of the month and of the quarter. Focus of traders and investors worldwide is the U.S. budget impasse that threatens a partial shut- down of the U.S. government starting Tuesday—which would be the first government shutdown in 17 years. December Comex gold was last down $10.90 at $1,328.30 an ounce. Spot gold was last quoted down $8.00 at $1328.75. December Comex silver last traded down $0.121 at $21.71 an ounce.

There has been no apparent progress made by U.S. legislators on agreement on the U.S. budget. Also, in just two weeks the U.S. government will hit its borrowing limit. These issues are presently an underlying bearish factor for many markets and could become a major bearish factor in the next couple weeks, if no progress is made among U.S. lawmakers and the Obama administration. Fresh budget news Monday evening coming out of Washington could be market-sensitive.

Gold may be seeing some buying interest due to safe-haven demand amid the U.S. budget and spending debacle. However, it can also be argued recent selling pressure in gold was because it has acted more like a raw commodity ahead of the U.S. budget deadlines. It’s likely one of these scenarios will more clearly come to the forefront for gold this week.

The other factor causing a “risk-off” day in the market place Monday is turmoil in the Italian government that threatens to collapse it. Italian stocks and bonds were under pressure Monday.

In an important development for many markets, last Friday afternoon President Obama said he talked on the telephone with the Iranian president, regarding Iran’s pledge not to make nuclear weapons and both countries working to establish more normal relations—after more than 30 years of animosity. A thawing in U.S.-Iran relations, a de-escalation of the Syria-U.S. confrontation over its chemical weapons and the surprising progress the U.S. had made the past few years on dramatically increasing its own crude oil production all suggest the Middle East may become less of a powder keg for world markets in the coming months, or longer. Others would argue the notion of a stable Middle East is still just a pipe dream.

Reports Monday said the Chinese government will relax its restrictions on public trading of gold, allowing more public and business participation in gold trading.

The London P.M. gold fix is $1,326.50 versus the previous P.M. fixing of $1,341.00.

Technically, December gold futures prices closed nearer the session low Monday. A five-week-old downtrend is in place on the daily bar chart. The gold market bears have the overall near-term technical advantage. The gold bulls’ next upside near-term price breakout objective is to produce a close above solid technical resistance at $1,375.40. Bears' next near-term downside breakout price objective is closing prices below solid technical support at the September low of $1,291.50. First resistance is seen at $1,340.00 and then at Monday’s high of $1,353.80. First support is seen at Monday’s low of $1,322.00 and then at last week’s low of $1,305.50. Wyckoff’s Market Rating: 4.0

December silver futures closed down $0.106 an ounce at $21.725 today. Prices closed near mid-range. Silver bears have the overall near-term technical advantage. A five-week-old downtrend is in place on the daily bar chart. Silver bulls’ next upside price breakout objective is closing prices above solid technical resistance at $23.445 an ounce. The next downside price breakout objective for the bears is closing prices below solid technical support at the September low of $21.225. First resistance is seen at last week’s high of $22.175 and then at $22.50. Next support is seen at Monday’s low of $21.435 and then at last week’s low of $21.30. Wyckoff's Market Rating: 4.0.

December N.Y. copper closed down 65 points at 332.35 cents Monday. Prices closed nearer the session high. Copper bulls and bears are on a level near-term technical playing field. Copper bulls' next upside breakout objective is pushing and closing prices above solid technical resistance at the September high of 335.95 cents. The next downside price breakout objective for the bears is closing prices below solid technical support at the September low of 319.05 cents. First resistance is seen at Monday’s high of 333.95 cents and then at 335.00 cents. First support is seen at Monday’s low of 329.40 cents and then at 327.50 cents. Wyckoff's Market Rating: 5.0.

Monday September 30, 2013 1:54 PM

(Kitco News) - Comex gold futures prices ended the U.S. day session moderately lower Monday. It was a “risk-off” day to start the new trading week and this last day of the month and of the quarter. Focus of traders and investors worldwide is the U.S. budget impasse that threatens a partial shut- down of the U.S. government starting Tuesday—which would be the first government shutdown in 17 years. December Comex gold was last down $10.90 at $1,328.30 an ounce. Spot gold was last quoted down $8.00 at $1328.75. December Comex silver last traded down $0.121 at $21.71 an ounce.

There has been no apparent progress made by U.S. legislators on agreement on the U.S. budget. Also, in just two weeks the U.S. government will hit its borrowing limit. These issues are presently an underlying bearish factor for many markets and could become a major bearish factor in the next couple weeks, if no progress is made among U.S. lawmakers and the Obama administration. Fresh budget news Monday evening coming out of Washington could be market-sensitive.

Gold may be seeing some buying interest due to safe-haven demand amid the U.S. budget and spending debacle. However, it can also be argued recent selling pressure in gold was because it has acted more like a raw commodity ahead of the U.S. budget deadlines. It’s likely one of these scenarios will more clearly come to the forefront for gold this week.

The other factor causing a “risk-off” day in the market place Monday is turmoil in the Italian government that threatens to collapse it. Italian stocks and bonds were under pressure Monday.

In an important development for many markets, last Friday afternoon President Obama said he talked on the telephone with the Iranian president, regarding Iran’s pledge not to make nuclear weapons and both countries working to establish more normal relations—after more than 30 years of animosity. A thawing in U.S.-Iran relations, a de-escalation of the Syria-U.S. confrontation over its chemical weapons and the surprising progress the U.S. had made the past few years on dramatically increasing its own crude oil production all suggest the Middle East may become less of a powder keg for world markets in the coming months, or longer. Others would argue the notion of a stable Middle East is still just a pipe dream.

Reports Monday said the Chinese government will relax its restrictions on public trading of gold, allowing more public and business participation in gold trading.

The London P.M. gold fix is $1,326.50 versus the previous P.M. fixing of $1,341.00.

Technically, December gold futures prices closed nearer the session low Monday. A five-week-old downtrend is in place on the daily bar chart. The gold market bears have the overall near-term technical advantage. The gold bulls’ next upside near-term price breakout objective is to produce a close above solid technical resistance at $1,375.40. Bears' next near-term downside breakout price objective is closing prices below solid technical support at the September low of $1,291.50. First resistance is seen at $1,340.00 and then at Monday’s high of $1,353.80. First support is seen at Monday’s low of $1,322.00 and then at last week’s low of $1,305.50. Wyckoff’s Market Rating: 4.0

December silver futures closed down $0.106 an ounce at $21.725 today. Prices closed near mid-range. Silver bears have the overall near-term technical advantage. A five-week-old downtrend is in place on the daily bar chart. Silver bulls’ next upside price breakout objective is closing prices above solid technical resistance at $23.445 an ounce. The next downside price breakout objective for the bears is closing prices below solid technical support at the September low of $21.225. First resistance is seen at last week’s high of $22.175 and then at $22.50. Next support is seen at Monday’s low of $21.435 and then at last week’s low of $21.30. Wyckoff's Market Rating: 4.0.

December N.Y. copper closed down 65 points at 332.35 cents Monday. Prices closed nearer the session high. Copper bulls and bears are on a level near-term technical playing field. Copper bulls' next upside breakout objective is pushing and closing prices above solid technical resistance at the September high of 335.95 cents. The next downside price breakout objective for the bears is closing prices below solid technical support at the September low of 319.05 cents. First resistance is seen at Monday’s high of 333.95 cents and then at 335.00 cents. First support is seen at Monday’s low of 329.40 cents and then at 327.50 cents. Wyckoff's Market Rating: 5.0.

Jobs Report Won’t Be Released Oct. 4 If U.S. Government Shut

By Victoria Stilwell & Julianna Goldman - Sep 30, 2013 10:41 PM GMT+0200

The U.S. Labor Department won’t release its monthly employment report if the federal government is closed on Oct. 4, the day of the scheduled release, according to an Obama administration official.

The official, who wasn’t authorized to discuss the process and spoke on condition of anonymity, couldn’t say how the report might be affected if the government is shut down and re-opens before the end of the week.

Enlarge image Job Fair

A job recruiter looks at a job seeker's resume at the Choice Career Fairs job fair in Arlington, Virginia, on June 6, 2013. Photographer: Andrew Harrer/Bloomberg

The U.S. government is poised at midnight for its first partial shutdown in 17 years. Republicans and Democrats remained at odds over whether to tie any changes to the 2010 Affordable Care Act to a short-term extension of government funding.

The Bureau of Labor Statistics will suspend operations and close its offices tomorrow morning if there is a lapse in appropriations, Steve Barr, a Labor Department spokesman, said in an interview. The agency “will continue to assess the situation” in the event of a shutdown, he said. The bureau is an agency of the Labor Department.

The jobs report is closely watched for clues to Federal Reserve policy and the health of the economy. The central bank has said it will keep its benchmark interest rate near zero for at least as long as the unemployment rate exceeds 6.5 percent and the outlook for inflation is no more than 2.5 percent.

Employers probably added 181,000 workers to payrolls in September, according to the median forecast in a Bloomberg survey of economists. That would be the biggest gain in five months. The jobless rate is forecast to hold at 7.3 percent.

Agriculture Data

The U.S. Department of Agriculture will suspend crop and livestock reports during a shutdown. The National Agricultural Statistics Service will not issue reports while employees are furloughed from government duty, spokeswoman Sue King said in an e-mail. Reports suspended include those detailing global supply and demand for agricultural commodities, she said.

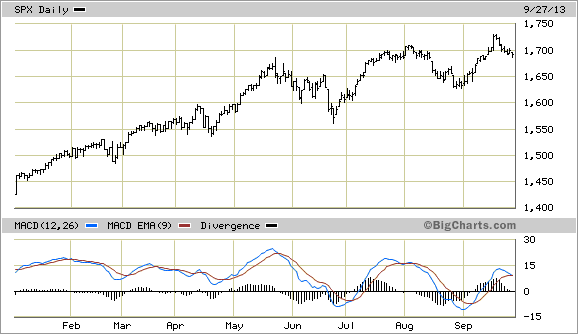

U.S. stocks slid on concern lawmakers will be unable to avert a shutdown. The Standard & Poor’s 500 (SPX) Index fell 0.6 percent to 1,681.55 at the close of trading in New York. The benchmark gauge has added 3 percent this month, extending its quarterly gain to 4.7 percent, as the Fed kept its $85 billion of monthly bond-buying.

In contingency plans posted on its website last week, the Labor Department left open the possibility of publishing certain data compiled by BLS should a release be seen as part of an “orderly cessation of activities.” It cited the example of the 1995 federal government shutdown that occurred after consumer price index figures had been prepared and not yet released to the public.

‘Orderly Cessation’

The risk of disclosure of the data was considered unacceptable and releasing the report “was deemed to be part of the orderly cessation of activities,” Erica Groshen, commissioner of the BLS, said in the memo last week.

Suspending operations tomorrow wouldn’t involve releasing any economic data from the BLS, Barr said. Weekly data on claims for unemployment benefits, issued by the Employment and Training Administration, will continue to be published, according to the Labor Department’s plans.

Data supplied by private companies, including tomorrow’s Institute for Supply Management factory index and employment figures from the ADP Research Institute on Oct. 2, would not be affected, according to Joseph LaVorgna, chief U.S. economist at Deutsche Bank Securities Inc. in New York.

“Our sense is that a disruption beyond 24 hours would result in a postponement of the jobs report, and in turn, the ADP report would take on far greater significance,” LaVorgna said today in a note to clients. If the BLS employment report is delayed, “we will be comfortable relying on the ADP series as a close proxy of September hiring.”

Growth Impact

A shutdown could reduce fourth-quarter economic growth by as much as 1.4 percentage points, depending on its duration, according to some economists. The biggest effect would come from the output lost from furloughed workers.

The U.S. Treasury Department would continue to release the results of its debt auctions in the event of a government shutdown, a department official said. The Treasury would keep paying interest on the government’s debt and maintain collections and daily cash management in the event of a shutdown, it said earlier.

The publication of the U.S. monthly budget statement may be delayed, said the Treasury official, who provided the information today on the condition of not being further identified. The next budget release, which provides updates on the U.S. federal deficit, is scheduled for Oct. 10.

Another Treasury report, the monthly statement on the cross-border flow of portfolio assets, planned for Oct. 16, may be delayed, said the department official.

Debt Limit

A brief government shutdown won’t lead to any significant change of the Treasury’s forecast for when the country will breach the debt limit, a spokeswoman said yesterday in an e-mail. The Treasury has said measures to avoid breaching the debt ceiling will be exhausted on Oct. 17.

The Commerce Department will suspend the release of economic data provided by its agencies in a shutdown, it said in its contingency plan. Data on construction spending, scheduled for release tomorrow, as well as factory orders, retail sales and gross domestic product are all reported by agencies within the department.

The Fed would continue to operate if the government shuts down because it’s a self-funded agency that doesn’t depend on congressional appropriations.

By Victoria Stilwell & Julianna Goldman - Sep 30, 2013 10:41 PM GMT+0200

The U.S. Labor Department won’t release its monthly employment report if the federal government is closed on Oct. 4, the day of the scheduled release, according to an Obama administration official.

The official, who wasn’t authorized to discuss the process and spoke on condition of anonymity, couldn’t say how the report might be affected if the government is shut down and re-opens before the end of the week.

Enlarge image Job Fair

A job recruiter looks at a job seeker's resume at the Choice Career Fairs job fair in Arlington, Virginia, on June 6, 2013. Photographer: Andrew Harrer/Bloomberg

The U.S. government is poised at midnight for its first partial shutdown in 17 years. Republicans and Democrats remained at odds over whether to tie any changes to the 2010 Affordable Care Act to a short-term extension of government funding.

The Bureau of Labor Statistics will suspend operations and close its offices tomorrow morning if there is a lapse in appropriations, Steve Barr, a Labor Department spokesman, said in an interview. The agency “will continue to assess the situation” in the event of a shutdown, he said. The bureau is an agency of the Labor Department.

The jobs report is closely watched for clues to Federal Reserve policy and the health of the economy. The central bank has said it will keep its benchmark interest rate near zero for at least as long as the unemployment rate exceeds 6.5 percent and the outlook for inflation is no more than 2.5 percent.

Employers probably added 181,000 workers to payrolls in September, according to the median forecast in a Bloomberg survey of economists. That would be the biggest gain in five months. The jobless rate is forecast to hold at 7.3 percent.

Agriculture Data

The U.S. Department of Agriculture will suspend crop and livestock reports during a shutdown. The National Agricultural Statistics Service will not issue reports while employees are furloughed from government duty, spokeswoman Sue King said in an e-mail. Reports suspended include those detailing global supply and demand for agricultural commodities, she said.

U.S. stocks slid on concern lawmakers will be unable to avert a shutdown. The Standard & Poor’s 500 (SPX) Index fell 0.6 percent to 1,681.55 at the close of trading in New York. The benchmark gauge has added 3 percent this month, extending its quarterly gain to 4.7 percent, as the Fed kept its $85 billion of monthly bond-buying.

In contingency plans posted on its website last week, the Labor Department left open the possibility of publishing certain data compiled by BLS should a release be seen as part of an “orderly cessation of activities.” It cited the example of the 1995 federal government shutdown that occurred after consumer price index figures had been prepared and not yet released to the public.

‘Orderly Cessation’

The risk of disclosure of the data was considered unacceptable and releasing the report “was deemed to be part of the orderly cessation of activities,” Erica Groshen, commissioner of the BLS, said in the memo last week.

Suspending operations tomorrow wouldn’t involve releasing any economic data from the BLS, Barr said. Weekly data on claims for unemployment benefits, issued by the Employment and Training Administration, will continue to be published, according to the Labor Department’s plans.

Data supplied by private companies, including tomorrow’s Institute for Supply Management factory index and employment figures from the ADP Research Institute on Oct. 2, would not be affected, according to Joseph LaVorgna, chief U.S. economist at Deutsche Bank Securities Inc. in New York.

“Our sense is that a disruption beyond 24 hours would result in a postponement of the jobs report, and in turn, the ADP report would take on far greater significance,” LaVorgna said today in a note to clients. If the BLS employment report is delayed, “we will be comfortable relying on the ADP series as a close proxy of September hiring.”

Growth Impact

A shutdown could reduce fourth-quarter economic growth by as much as 1.4 percentage points, depending on its duration, according to some economists. The biggest effect would come from the output lost from furloughed workers.

The U.S. Treasury Department would continue to release the results of its debt auctions in the event of a government shutdown, a department official said. The Treasury would keep paying interest on the government’s debt and maintain collections and daily cash management in the event of a shutdown, it said earlier.

The publication of the U.S. monthly budget statement may be delayed, said the Treasury official, who provided the information today on the condition of not being further identified. The next budget release, which provides updates on the U.S. federal deficit, is scheduled for Oct. 10.

Another Treasury report, the monthly statement on the cross-border flow of portfolio assets, planned for Oct. 16, may be delayed, said the department official.

Debt Limit

A brief government shutdown won’t lead to any significant change of the Treasury’s forecast for when the country will breach the debt limit, a spokeswoman said yesterday in an e-mail. The Treasury has said measures to avoid breaching the debt ceiling will be exhausted on Oct. 17.

The Commerce Department will suspend the release of economic data provided by its agencies in a shutdown, it said in its contingency plan. Data on construction spending, scheduled for release tomorrow, as well as factory orders, retail sales and gross domestic product are all reported by agencies within the department.

The Fed would continue to operate if the government shuts down because it’s a self-funded agency that doesn’t depend on congressional appropriations.

LBMA Coverage: Is Europe Wasting A Good Crisis? - Keynote Speaker

By Kitco News

Monday September 30, 2013 4:42 PM

(Kitco News) -The European Central Bank should continue to lower interest rates to help spur growth and help Europe out of its current recession, said Francesco Papadia, chairman of Primary Collateralized Securities and former director general for market operations at the ECB.

Papadia was a keynote speaker at the global London Bullion Market Association/London Platinum Palladium Precious Metals Conference, being held in Rome, and talked to Kitco News’ Daniela Cambone about the state of the European economy.

Papadia said there is a battle ensuing between the ECB and markets. Although the ECB provided forward guidance saying that it will keep rates low or even lower, he said markets continue to price in a rate hike.

“I’m not clear how this tug-of-war will end - who will win. My sense is if the governing council really wants to win this war then it should lower interest rates,” he said. “If they would lower [interest rates] to 25 basis points they would really impress on the market their will.”

During his speech at the LMBA, Papadia talked about whether Europe is in a position to grow and profit from its current crisis.

“Historical experience shows that Europe progresses in crisis,” he said. “The question that I put forward is whether Europe is indeed using this crisis to progress in the economic field, in the monetary and financial field and institutional field.”

To answer his question, Papadia said he likes the direction the euro zone is heading in, but the speed in which it has been progressing is only “sufficient.” He added it is too soon to tell if Europe will benefit from the crisis.

However, Papadia said he is hopeful about the European economy.

“I find it easier to be optimistic now than I did maybe 12 or 18 months ago,” he said.

Looking at the gold market, Papadia, said that the yellow metal continues to be a legitimate reserve asset for central banks and it is more of a question of how much each bank wants to hold in its reserves.

By Kitco News

Monday September 30, 2013 4:42 PM

(Kitco News) -The European Central Bank should continue to lower interest rates to help spur growth and help Europe out of its current recession, said Francesco Papadia, chairman of Primary Collateralized Securities and former director general for market operations at the ECB.

Papadia was a keynote speaker at the global London Bullion Market Association/London Platinum Palladium Precious Metals Conference, being held in Rome, and talked to Kitco News’ Daniela Cambone about the state of the European economy.

Papadia said there is a battle ensuing between the ECB and markets. Although the ECB provided forward guidance saying that it will keep rates low or even lower, he said markets continue to price in a rate hike.

“I’m not clear how this tug-of-war will end - who will win. My sense is if the governing council really wants to win this war then it should lower interest rates,” he said. “If they would lower [interest rates] to 25 basis points they would really impress on the market their will.”

During his speech at the LMBA, Papadia talked about whether Europe is in a position to grow and profit from its current crisis.

“Historical experience shows that Europe progresses in crisis,” he said. “The question that I put forward is whether Europe is indeed using this crisis to progress in the economic field, in the monetary and financial field and institutional field.”

To answer his question, Papadia said he likes the direction the euro zone is heading in, but the speed in which it has been progressing is only “sufficient.” He added it is too soon to tell if Europe will benefit from the crisis.

However, Papadia said he is hopeful about the European economy.

“I find it easier to be optimistic now than I did maybe 12 or 18 months ago,” he said.

Looking at the gold market, Papadia, said that the yellow metal continues to be a legitimate reserve asset for central banks and it is more of a question of how much each bank wants to hold in its reserves.

Where Are The Stops? Tuesday, October 1: Gold And Silver

Tuesday October 01, 2013 08:49

Below are today's likely price locations of buy and sell stop orders for the active Comex gold and silver futures markets. The asterisks (**) denote the most critical stop order placement level of the day (or likely where the heaviest concentration of stop orders are placed on this day).

See below a detailed explanation of stop orders and why knowing, beforehand, where they are likely located can be beneficial to a trader.

December Gold Buy Stops Sell Stops

$1,320.00 **$1,291.50

$1,325.00 $1,285.00

**$1,337.80 $1,271.80

$1,350.00 $1,260.00

December Silver Buy Stops Sell Stops

$21.225 **$20.65

$21.50 $20.50

**$22.00 $20.25

$22.175 $20.0

Tuesday October 01, 2013 08:49

Below are today's likely price locations of buy and sell stop orders for the active Comex gold and silver futures markets. The asterisks (**) denote the most critical stop order placement level of the day (or likely where the heaviest concentration of stop orders are placed on this day).

See below a detailed explanation of stop orders and why knowing, beforehand, where they are likely located can be beneficial to a trader.

December Gold Buy Stops Sell Stops

$1,320.00 **$1,291.50

$1,325.00 $1,285.00

**$1,337.80 $1,271.80

$1,350.00 $1,260.00

December Silver Buy Stops Sell Stops

$21.225 **$20.65

$21.50 $20.50

**$22.00 $20.25

$22.175 $20.0

UNGÜNSTIGE PERSPEKTIVEN

Baumwolle: China will Importe senken

Volle Lager und Chinas neue Agrarpolitik belasten den Preis für Baumwolle.

von Kerstin Kramer, Euro am Sonntag

Die Aussichten auf gute Ernten in Indien und Brasilien sowie weltweit gut gefüllte Lagerhäuser drücken den Baumwollpreis. Seit Mitte August verlor er neun Prozent auf 0,84 US-Dollar je Pfund. Für die Saison 2013/2014 stellt das International Cotton Advisory Committee einen Produktionsüberschuss und steigende Lagerbestände in Aussicht. Bereits in den vergangenen drei Jahren war das Angebot größer als die Nachfrage. Auch Änderungen in Chinas Subventionspolitik belasten. Das Land, das für etwa ein Drittel der globalen Nachfrage steht, will die Einfuhr des Rohstoffs reduzieren.

Bislang decken chinesische Textilproduzenten ihren Bedarf größtenteils am Weltmarkt, weil Baumwolle dort günstiger ist als auf dem Heimatmarkt. Denn um den Anbau attraktiv zu machen, kauft Peking Fasern aus heimischer Produktion zu höheren Preisen als auf dem Weltmarkt. Werden Anbauer aber künftig wie geplant direkt gefördert, dürften der Preis im Inland und die Importquote sinken. Spekulationsfreudige Anleger können mit dem Mini-Short-Zertifikat der RBS auf einen weiter sinkenden Weltmarktpreis spekulieren. Der Hebel beträgt 2,06. Die Stop-Loss-Marke liegt mit 1,15 US-Dollar 35 Prozent vom aktuellen Kurs entfernt (ISIN: DE 000 AA3 GW8 1).

Baumwolle: China will Importe senken

Volle Lager und Chinas neue Agrarpolitik belasten den Preis für Baumwolle.

von Kerstin Kramer, Euro am Sonntag