App installieren

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Anmerkung: This feature may not be available in some browsers.

Du verwendest einen veralteten Browser. Es ist möglich, dass diese oder andere Websites nicht korrekt angezeigt werden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Du solltest ein Upgrade durchführen oder einen alternativen Browser verwenden.

Rohstoffthread (Archiv)

- Ersteller Maack

- Erstellt am

- Tagged users Kein(e)

- Status

- Für weitere Antworten geschlossen.

GOLD UND ROHÖL

Gold: Sicherer Hafen außer Betrieb

Die Sorge um die weitere Entwicklung des US-Staatshaushalts löste überraschenderweise einen Goldpreissturz aus. Das Motto lautete: Cash is King.

von Jörg Bernhard

Nach dem gestrigen Absacker um über drei Prozent auf das niedrigste Niveau seit fast acht Wochen scheint nun aber wieder etwas Ruhe an den Goldmärkten eingekehrt zu sein. Die Verkaufswelle war durch zwei Faktoren begünstigt worden. Zum einen drückte eine große Verkaufsorder an der Terminbörse Comex auf die Stimmung der Marktakteure. Zum anderen generierte der Rutsch unter die Marke von 1.300 Dollar chartinduzierte Verkäufe. Zwei andere Argumente waren eher fundamentaler Natur. Warum sollte man Gold besitzen, wenn Staatsbedienstete keine Gehälter erhalten und eine schwache Konjunktur die Kaufkraft möglicherweise belastet? Die Zahlungsprobleme des Staats und die enorme Staatsverschuldung dies- wie jenseits des Atlantiks traten dabei in den Hintergrund, könnte aber über kurz oder lang zum Gesprächsthema an den Märkten werden.

Am Mittwochvormittag präsentierte sich der Goldpreis mit relativ erholten Notierungen. Bis gegen 8.00 Uhr (MESZ) verteuerte sich der am aktivsten gehandelte Future auf Gold (Dezember) um 6,30 auf 1.292,40 Dollar pro Feinunze.

Rohöl: Üppiges Angebot

Beim Ölpreis überwiegen derzeit ganz klar die Molltöne. Nachlassende geopolitische Risiken, aufkommende Konjunktursorgen sowie gestiegene Lagermengen haben den Ölpreis den vierten Tag in Folge in tiefere Regionen fallen lassen. Am Dienstagabend meldete das American Petroleum Institute einen Zuwachs der gelagerten Ölmengen um 4,6 Millionen Barrel. Laut einer Reuters-Umfrage unter Analysten soll der für den Nachmittag angekündigte Wochenbericht der US-Energiebehörde (16.30 Uhr) ein Plus von 2,3 Millionen ausweisen. Fazit: Öl gibt es weiterhin in Hülle und Fülle.

Am Mittwochvormittag präsentierte sich der Ölpreis mit nachgebenden Notierungen. Bis gegen 8.00 Uhr (MESZ) ermäßigte sich der nächstfällige WTI-Kontrakt um 0,52 auf 101,52 Dollar, während sein Pendant auf Brent um 0,43 auf 107,51 Dollar zurückfiel.

Gold: Sicherer Hafen außer Betrieb

Die Sorge um die weitere Entwicklung des US-Staatshaushalts löste überraschenderweise einen Goldpreissturz aus. Das Motto lautete: Cash is King.

von Jörg Bernhard

Nach dem gestrigen Absacker um über drei Prozent auf das niedrigste Niveau seit fast acht Wochen scheint nun aber wieder etwas Ruhe an den Goldmärkten eingekehrt zu sein. Die Verkaufswelle war durch zwei Faktoren begünstigt worden. Zum einen drückte eine große Verkaufsorder an der Terminbörse Comex auf die Stimmung der Marktakteure. Zum anderen generierte der Rutsch unter die Marke von 1.300 Dollar chartinduzierte Verkäufe. Zwei andere Argumente waren eher fundamentaler Natur. Warum sollte man Gold besitzen, wenn Staatsbedienstete keine Gehälter erhalten und eine schwache Konjunktur die Kaufkraft möglicherweise belastet? Die Zahlungsprobleme des Staats und die enorme Staatsverschuldung dies- wie jenseits des Atlantiks traten dabei in den Hintergrund, könnte aber über kurz oder lang zum Gesprächsthema an den Märkten werden.

Am Mittwochvormittag präsentierte sich der Goldpreis mit relativ erholten Notierungen. Bis gegen 8.00 Uhr (MESZ) verteuerte sich der am aktivsten gehandelte Future auf Gold (Dezember) um 6,30 auf 1.292,40 Dollar pro Feinunze.

Rohöl: Üppiges Angebot

Beim Ölpreis überwiegen derzeit ganz klar die Molltöne. Nachlassende geopolitische Risiken, aufkommende Konjunktursorgen sowie gestiegene Lagermengen haben den Ölpreis den vierten Tag in Folge in tiefere Regionen fallen lassen. Am Dienstagabend meldete das American Petroleum Institute einen Zuwachs der gelagerten Ölmengen um 4,6 Millionen Barrel. Laut einer Reuters-Umfrage unter Analysten soll der für den Nachmittag angekündigte Wochenbericht der US-Energiebehörde (16.30 Uhr) ein Plus von 2,3 Millionen ausweisen. Fazit: Öl gibt es weiterhin in Hülle und Fülle.

Am Mittwochvormittag präsentierte sich der Ölpreis mit nachgebenden Notierungen. Bis gegen 8.00 Uhr (MESZ) ermäßigte sich der nächstfällige WTI-Kontrakt um 0,52 auf 101,52 Dollar, während sein Pendant auf Brent um 0,43 auf 107,51 Dollar zurückfiel.

ROHSTOFF-TRADER-KOLUMNE

Arktis – Kampf um Rohstoff-Gefriertruhe entbrannt!

Jahrzehnte lang interessierten sich nahezu ausschließlich Forscher und wagemutige Abenteurer für die Arktis.

Nachdem man allerdings erkannt hat, dass unter dem ewigen Eis möglicherweise Rohstoffe aller Art schlummern, kommt der Region eine nicht zu unterschätzende wirtschaftliche Bedeutung zu. Damit ist der Kampf um die globale Rohstoff-Gefriertruhe entfacht und es stellt sich die Frage, welches Land diesbezüglich schlussendlich die Nase vorne haben wird.

Gewaltige Vorkommen vermutet!

Auf die Schnelle lässt sich dies natürlich nicht beantworten. Aber eines ist klar: Demjenigen, der den Zugang erhält, winkt ein Preis, der einem Lotto-Jackpot gleichkommt. Denn in der Arktis werden gewaltige Rohstoff-Vorkommen vermutet. Schätzungsweise lagern dort rund ein Viertel der weltweiten Öl- und Gas-Vorkommen sowie beträchtliche Mengen an Kohle und Diamanten.

Russland macht Druck

Internationalen Verträgen zufolge gehört die Arktis allerdings nicht einem Staat sondern der gesamten Menschheit. Anders sieht das Russland. Präsident Putin wies unlängst darauf hin, dass er einen Großteil des Meeres-Bodens in der Arktis als natürliche Festland-Verlängerung wertet. Daraus leitet er das Recht zum Abbau der dort befindlichen Natur-Schätze ab. Ob die Russen die übrigen Länder mit dieser Argumentation überzeugen können, bleibt abzuwarten. Zumindest versprach Putin im Rahmen der Arktis-Konferenz eine Umwelt verträgliche Ausbeutung der Rohstoffe, was angesichts des überaus empfindlichen Öko-Systems eigentlich eine Selbstverständlichkeit sein sollte.

Arktis – Kampf um Rohstoff-Gefriertruhe entbrannt!

Jahrzehnte lang interessierten sich nahezu ausschließlich Forscher und wagemutige Abenteurer für die Arktis.

Nachdem man allerdings erkannt hat, dass unter dem ewigen Eis möglicherweise Rohstoffe aller Art schlummern, kommt der Region eine nicht zu unterschätzende wirtschaftliche Bedeutung zu. Damit ist der Kampf um die globale Rohstoff-Gefriertruhe entfacht und es stellt sich die Frage, welches Land diesbezüglich schlussendlich die Nase vorne haben wird.

Gewaltige Vorkommen vermutet!

Auf die Schnelle lässt sich dies natürlich nicht beantworten. Aber eines ist klar: Demjenigen, der den Zugang erhält, winkt ein Preis, der einem Lotto-Jackpot gleichkommt. Denn in der Arktis werden gewaltige Rohstoff-Vorkommen vermutet. Schätzungsweise lagern dort rund ein Viertel der weltweiten Öl- und Gas-Vorkommen sowie beträchtliche Mengen an Kohle und Diamanten.

Russland macht Druck

Internationalen Verträgen zufolge gehört die Arktis allerdings nicht einem Staat sondern der gesamten Menschheit. Anders sieht das Russland. Präsident Putin wies unlängst darauf hin, dass er einen Großteil des Meeres-Bodens in der Arktis als natürliche Festland-Verlängerung wertet. Daraus leitet er das Recht zum Abbau der dort befindlichen Natur-Schätze ab. Ob die Russen die übrigen Länder mit dieser Argumentation überzeugen können, bleibt abzuwarten. Zumindest versprach Putin im Rahmen der Arktis-Konferenz eine Umwelt verträgliche Ausbeutung der Rohstoffe, was angesichts des überaus empfindlichen Öko-Systems eigentlich eine Selbstverständlichkeit sein sollte.

ROHÖL UND SILBER

Rohöl: Versuch einer Bodenbildung

Auf dem Weg in tiefere Regionen scheint der Ölpreis eine Pause einzulegen. Gründe zum Verkauf des fossilen Energieträgers gibt es allerdings zuhauf.

von Jörg Bernhard

Weil die geopolitischen Risiken (Stichwort Syrien und Iran) nachgelassen haben und Libyen beim Hochfahren der Ölproduktion ebenfalls Fortschritte macht, ging es mit Ölpreis seit Ende August deutlich bergab. Vom libyschen Ölminister Abdelbari Arusi war heute zu hören, dass man wieder die Hälfte der „normalen“ Kapazitäten wieder erreicht habe und in den kommenden Tagen mit weiteren Fortschritten zu rechne. Vor dem Hintergrund dieses negativen Datenszenarios kann man die stabile Tendenz des Ölpreises fast schon als relative Stärke interpretieren.

Am Mittwochnachmittag präsentierte sich der Ölpreis mit stabilen Notierungen. Bis gegen 14.45 Uhr (MESZ) verteuerte sich der nächstfällige WTI-Kontrakt um 0,07 auf 102,11 Dollar, während sein Pendant auf Brent um 0,38 auf 108,32 Dollar anzog.

Silber: Verkaufswelle überstanden

Der überraschende Edelmetall-Ausverkauf zum Wochenstart machte auch vor Silber nicht Halt. Die charttechnische Situation hat sich aufgrund des Unterschreitens einer massiven Unterstützungszone deutlich eingetrübt. Marktbeobachter machten für den Absturz einmal mehr die Terminmärkte verantwortlich. Die Enttäuschung, dass die Zahlungsprobleme der USA keine Flucht in Gold & Silber nach sich zog, generierte unter Spekulanten eine regelrechte Verkaufswelle. Damit eröffnete sich Abwärtspotenzial in Richtung der psychologisch wichtigen Marke von 20 Dollar. Hier zu Lande könnten Anleger die physische Nachfrage bei Silbermünzen in Schwung bringen. Grund: Ab Januar 2014 müssen Anleger statt des bisher gültigen ermäßigten Mehrwertsteuersatz von sieben Prozent, 19 Prozent an den überschuldeten Vater Staat abdrücken. Niedrige Silberpreise könnten dabei die Kaufentscheidung erleichtern.

Am Mittwochnachmittag präsentierte sich der Silberpreis mit erholten Notierungen. Bis gegen 14.45 Uhr (MESZ) verteuerte sich der am aktivsten gehandelte Future auf Silber (Dezember) um 0,135 auf 21,31 Dollar pro Feinunze.

Rohöl: Versuch einer Bodenbildung

Auf dem Weg in tiefere Regionen scheint der Ölpreis eine Pause einzulegen. Gründe zum Verkauf des fossilen Energieträgers gibt es allerdings zuhauf.

von Jörg Bernhard

Weil die geopolitischen Risiken (Stichwort Syrien und Iran) nachgelassen haben und Libyen beim Hochfahren der Ölproduktion ebenfalls Fortschritte macht, ging es mit Ölpreis seit Ende August deutlich bergab. Vom libyschen Ölminister Abdelbari Arusi war heute zu hören, dass man wieder die Hälfte der „normalen“ Kapazitäten wieder erreicht habe und in den kommenden Tagen mit weiteren Fortschritten zu rechne. Vor dem Hintergrund dieses negativen Datenszenarios kann man die stabile Tendenz des Ölpreises fast schon als relative Stärke interpretieren.

Am Mittwochnachmittag präsentierte sich der Ölpreis mit stabilen Notierungen. Bis gegen 14.45 Uhr (MESZ) verteuerte sich der nächstfällige WTI-Kontrakt um 0,07 auf 102,11 Dollar, während sein Pendant auf Brent um 0,38 auf 108,32 Dollar anzog.

Silber: Verkaufswelle überstanden

Der überraschende Edelmetall-Ausverkauf zum Wochenstart machte auch vor Silber nicht Halt. Die charttechnische Situation hat sich aufgrund des Unterschreitens einer massiven Unterstützungszone deutlich eingetrübt. Marktbeobachter machten für den Absturz einmal mehr die Terminmärkte verantwortlich. Die Enttäuschung, dass die Zahlungsprobleme der USA keine Flucht in Gold & Silber nach sich zog, generierte unter Spekulanten eine regelrechte Verkaufswelle. Damit eröffnete sich Abwärtspotenzial in Richtung der psychologisch wichtigen Marke von 20 Dollar. Hier zu Lande könnten Anleger die physische Nachfrage bei Silbermünzen in Schwung bringen. Grund: Ab Januar 2014 müssen Anleger statt des bisher gültigen ermäßigten Mehrwertsteuersatz von sieben Prozent, 19 Prozent an den überschuldeten Vater Staat abdrücken. Niedrige Silberpreise könnten dabei die Kaufentscheidung erleichtern.

Am Mittwochnachmittag präsentierte sich der Silberpreis mit erholten Notierungen. Bis gegen 14.45 Uhr (MESZ) verteuerte sich der am aktivsten gehandelte Future auf Silber (Dezember) um 0,135 auf 21,31 Dollar pro Feinunze.

02.10.2013 09:30 | Presse

Gesunde Korrektur bei Edelmetallen

Platin muss kämpfen

Minenaktien korrigieren

Stillstand bei Basismetallen

Bad Salzuflen, 2. Oktober 2013 - Nach der Erholung in den Vormonaten mussten die Edelmetallpreise im September eine Korrektur hinnehmen. Gold schloss mit einem Kurs von 1.329 US-Dollar pro Unze ab und verbuchte ein Minus von 4,7 Prozent. Silber konnte die relative Stärke zum Gold in den letzten Wochen nicht halten und musste einen Verlust von 7,7 Prozent hinnehmen. "Nach der kräftigen Erholung im Juli und August ist das eine vernünftige und gesunde Korrektur", sagt Martin Siegel, Edelmetallexperte und Geschäftsführer der Stabilitas GmbH. Dennoch sollten die Kurse jetzt wieder nach oben drehen, sonst könne man nicht von einer Trendwende sprechen. Zwar stieg der Goldpreis nach der überraschenden Bekanntgabe der US-Notenbank weiterhin frisches Geld in die Märkte zu pumpen, konnte diesen Trend jedoch nicht halten.

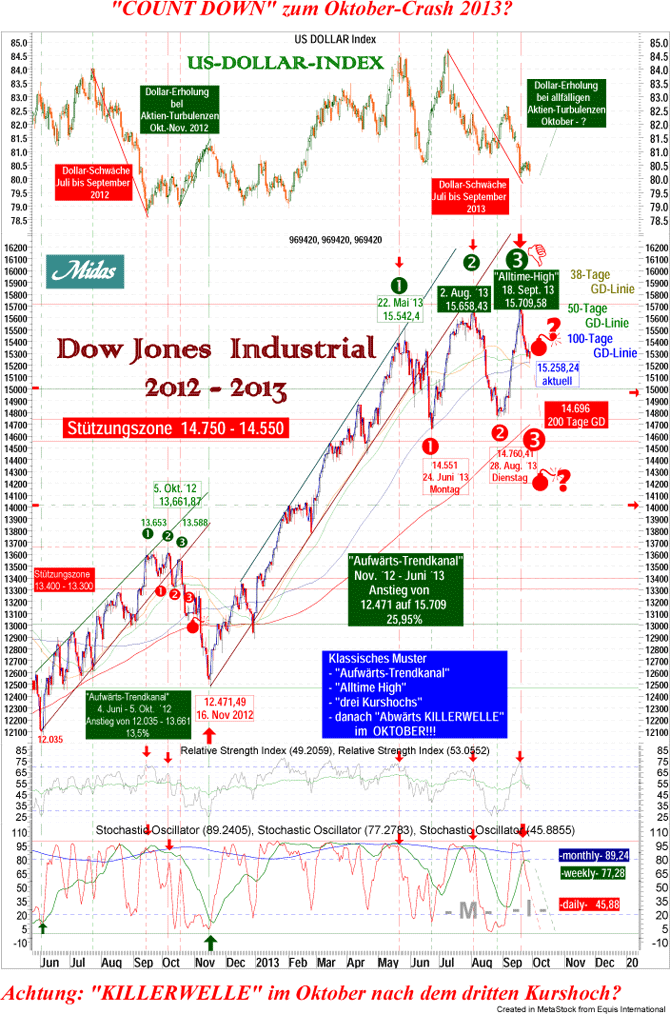

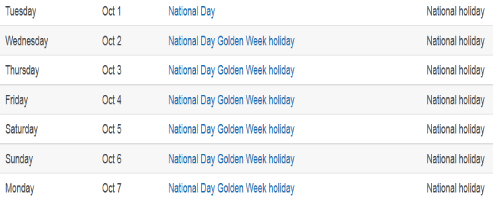

"So überraschend war die Fed-Bekanntgabe gar nicht. Der US-Notenbank bleibt gar nichts anderes übrig, als weiterhin frisches Geld zu drucken, denn sonst würgen sie die Wirtschaft ab", sagt Siegel. Auch der Einfluss der anstehenden "Goldenen Woche" in China auf den Goldpreis sei relativ gering. Zwischen dem 1. und 7. Oktober haben Chinesen Ferien zum Nationalfeiertag und erhalten an vielen Urlaubsorten hohe Rabatte auf das gelbe Edelmetall. "Dieses Gold muss aber schon vor Monaten importiert worden sein und der Goldpreis hätte deutlich steigen müssen. Dies ist aber nicht passiert", sagt Siegel. Dennoch habe China Indien als größten Goldimporteur abgelöst. Ein Grund dafür sei die dritte Importsteuererhöhung der indischen Regierung auf Gold in diesem Jahr, die inzwischen bei 15 Prozent liegt. "China ist mittlerweile der fundamentale Anker für den Goldpreis", so der Edelmetallexperte.

Platin erwischte einen schwachen Monat und verlor 7,6 Prozent. Bei einem Kurs von 1.404 USD pro Unze wird das Metall aber weiterhin teurer als Gold gehandelt. Eine bessere Entwicklung kann Palladium mit einem leichten Plus von 0,4 Prozent vorweisen. "Palladium wird insbesondere für Katalysatoren bei Benzin-Motoren verwendet und profitiert weiterhin von den boomenden Automärkten in den USA und China", sagt Siegel. Im Gegensatz dazu habe Platin als Industriemetall für die Herstellung von Diesel-Katalysatoren hauptsächlich mit der Flaute in der europäischen Autoindustrie zu kämpfen.

Die Aktien der Minengesellschaften folgten der negativen Entwicklung der physischen Edelmetalle und haben im vergangenen Monat etwas nachgegeben. "Auch hier ist nichts Ungewöhnliches festzustellen. Wie auch Gold und Silber befinden sich die Minenaktien in einer Korrekturbewegung", sagt Siegel. Im Vergleich zum physischen Silber haben die Silberaktien mit einem Minus von rund 17 Prozent jedoch deutlich mehr verloren. Von einer Trendwende könne man also noch nicht sprechen.

Die Seitwärtsentwicklung bei den Basismetallen geht weiter. Aluminium (+ 1,7 Prozent), Kupfer (+ 2,7 Prozent), Nickel (+ 1,1 Prozent) und Zink (+ 0,6 Prozent) konnten leichte Gewinne einfahren. Blei hingegen verlor im September 2,4 Prozent. "Bei den Basismetallen ist es ruhig geworden. Die Bodenbildung wird auf einem relativ tiefen Niveau fortgesetzt und es geht zumindest nicht mehr abwärts", sagt Siegel.

Gesunde Korrektur bei Edelmetallen

Platin muss kämpfen

Minenaktien korrigieren

Stillstand bei Basismetallen

Bad Salzuflen, 2. Oktober 2013 - Nach der Erholung in den Vormonaten mussten die Edelmetallpreise im September eine Korrektur hinnehmen. Gold schloss mit einem Kurs von 1.329 US-Dollar pro Unze ab und verbuchte ein Minus von 4,7 Prozent. Silber konnte die relative Stärke zum Gold in den letzten Wochen nicht halten und musste einen Verlust von 7,7 Prozent hinnehmen. "Nach der kräftigen Erholung im Juli und August ist das eine vernünftige und gesunde Korrektur", sagt Martin Siegel, Edelmetallexperte und Geschäftsführer der Stabilitas GmbH. Dennoch sollten die Kurse jetzt wieder nach oben drehen, sonst könne man nicht von einer Trendwende sprechen. Zwar stieg der Goldpreis nach der überraschenden Bekanntgabe der US-Notenbank weiterhin frisches Geld in die Märkte zu pumpen, konnte diesen Trend jedoch nicht halten.

"So überraschend war die Fed-Bekanntgabe gar nicht. Der US-Notenbank bleibt gar nichts anderes übrig, als weiterhin frisches Geld zu drucken, denn sonst würgen sie die Wirtschaft ab", sagt Siegel. Auch der Einfluss der anstehenden "Goldenen Woche" in China auf den Goldpreis sei relativ gering. Zwischen dem 1. und 7. Oktober haben Chinesen Ferien zum Nationalfeiertag und erhalten an vielen Urlaubsorten hohe Rabatte auf das gelbe Edelmetall. "Dieses Gold muss aber schon vor Monaten importiert worden sein und der Goldpreis hätte deutlich steigen müssen. Dies ist aber nicht passiert", sagt Siegel. Dennoch habe China Indien als größten Goldimporteur abgelöst. Ein Grund dafür sei die dritte Importsteuererhöhung der indischen Regierung auf Gold in diesem Jahr, die inzwischen bei 15 Prozent liegt. "China ist mittlerweile der fundamentale Anker für den Goldpreis", so der Edelmetallexperte.

Platin erwischte einen schwachen Monat und verlor 7,6 Prozent. Bei einem Kurs von 1.404 USD pro Unze wird das Metall aber weiterhin teurer als Gold gehandelt. Eine bessere Entwicklung kann Palladium mit einem leichten Plus von 0,4 Prozent vorweisen. "Palladium wird insbesondere für Katalysatoren bei Benzin-Motoren verwendet und profitiert weiterhin von den boomenden Automärkten in den USA und China", sagt Siegel. Im Gegensatz dazu habe Platin als Industriemetall für die Herstellung von Diesel-Katalysatoren hauptsächlich mit der Flaute in der europäischen Autoindustrie zu kämpfen.

Die Aktien der Minengesellschaften folgten der negativen Entwicklung der physischen Edelmetalle und haben im vergangenen Monat etwas nachgegeben. "Auch hier ist nichts Ungewöhnliches festzustellen. Wie auch Gold und Silber befinden sich die Minenaktien in einer Korrekturbewegung", sagt Siegel. Im Vergleich zum physischen Silber haben die Silberaktien mit einem Minus von rund 17 Prozent jedoch deutlich mehr verloren. Von einer Trendwende könne man also noch nicht sprechen.

Die Seitwärtsentwicklung bei den Basismetallen geht weiter. Aluminium (+ 1,7 Prozent), Kupfer (+ 2,7 Prozent), Nickel (+ 1,1 Prozent) und Zink (+ 0,6 Prozent) konnten leichte Gewinne einfahren. Blei hingegen verlor im September 2,4 Prozent. "Bei den Basismetallen ist es ruhig geworden. Die Bodenbildung wird auf einem relativ tiefen Niveau fortgesetzt und es geht zumindest nicht mehr abwärts", sagt Siegel.

02.10.2013 10:13 | Johann A. Saiger

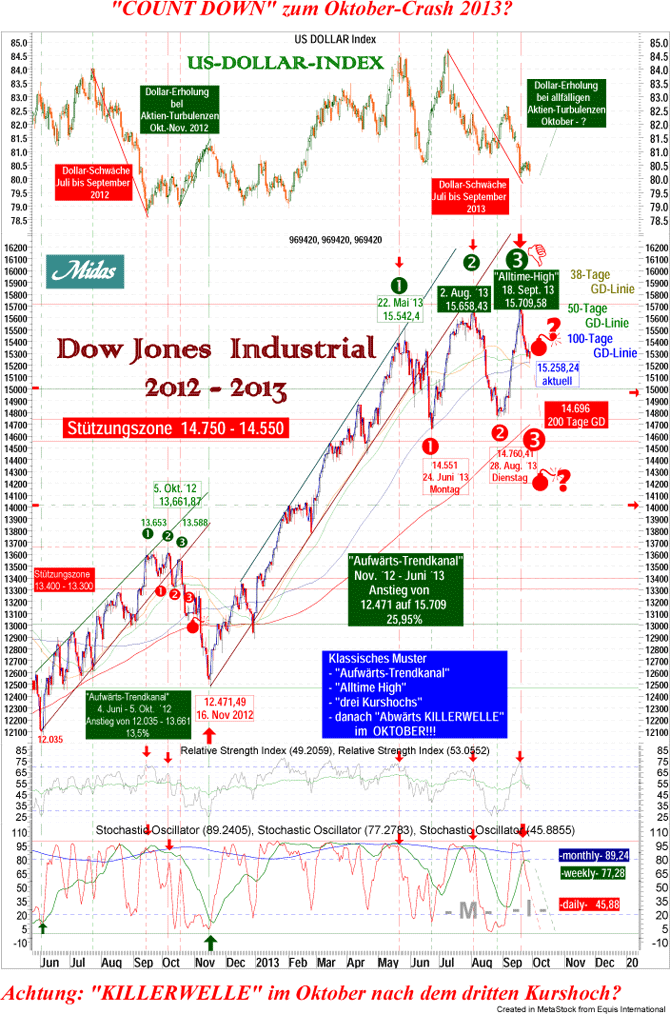

Countdown Oktober-Crash 2013 - Vorsicht: “Killerwelle!”

Zu den von uns in den letzten Monaten aufgezeigten Szenarien bezüglich eines möglicherweise bevorstehenden "CRASH 2013" können wir nunmehr schon erheblich deutlichere Aussagen treffen. Die Hinweise für einen möglichen Oktober-Crash 2013 haben sich

erheblich verstärkt.

Vor allen markanten Oktober-Crashs (1929 und 1987) aber auch vor allen Oktober-Mini-Crashs (1927, 1989 und 1997) und sogar vor eher minimalen Oktober Kursturbulenzen (wie 2012) hat sich immer ein ganz bestimmtes Kursmuster im Chart des Dow Jones Industrial gezeigt.Wenn es sodann nach der Ausbildung dieses "ominösen Chartmusters" im Oktober zu einer "Abwärtswelle" gekommen ist, so hat sich diese noch immer als eine "Killerwelle" mit irritierend trügerischem Anfangsverlauf erwiesen. Im Endstadium dieser Abwärtswelle war noch immer ein mehr oder weniger extremer "Oktober-Crash" feststellbar. (Sehen Sie sich dazu bitte alle Charts in dieser Ausgabe ganz genau an)!

Nach dem "Alltime-High" des Dow Jones Industrial vom 18. September hat diese verdächtige Abwärtswelle (Killerwelle) eingesetzt.

Sollte diese auch diesmal so "funktionieren" wie 1927, 1929, 1987, 1989, 1997 … dann wären etwa gegen Monatsmitte Oktober Crash-Überraschungen zu erwarten!

Download: "Midas-Brief Sonderausgabe" (PDF), vom 30. September 2013

Countdown Oktober-Crash 2013 - Vorsicht: “Killerwelle!”

Zu den von uns in den letzten Monaten aufgezeigten Szenarien bezüglich eines möglicherweise bevorstehenden "CRASH 2013" können wir nunmehr schon erheblich deutlichere Aussagen treffen. Die Hinweise für einen möglichen Oktober-Crash 2013 haben sich

erheblich verstärkt.

Vor allen markanten Oktober-Crashs (1929 und 1987) aber auch vor allen Oktober-Mini-Crashs (1927, 1989 und 1997) und sogar vor eher minimalen Oktober Kursturbulenzen (wie 2012) hat sich immer ein ganz bestimmtes Kursmuster im Chart des Dow Jones Industrial gezeigt.Wenn es sodann nach der Ausbildung dieses "ominösen Chartmusters" im Oktober zu einer "Abwärtswelle" gekommen ist, so hat sich diese noch immer als eine "Killerwelle" mit irritierend trügerischem Anfangsverlauf erwiesen. Im Endstadium dieser Abwärtswelle war noch immer ein mehr oder weniger extremer "Oktober-Crash" feststellbar. (Sehen Sie sich dazu bitte alle Charts in dieser Ausgabe ganz genau an)!

Nach dem "Alltime-High" des Dow Jones Industrial vom 18. September hat diese verdächtige Abwärtswelle (Killerwelle) eingesetzt.

Sollte diese auch diesmal so "funktionieren" wie 1927, 1929, 1987, 1989, 1997 … dann wären etwa gegen Monatsmitte Oktober Crash-Überraschungen zu erwarten!

Download: "Midas-Brief Sonderausgabe" (PDF), vom 30. September 2013

02.10.2013 13:07 | Hannes Huster

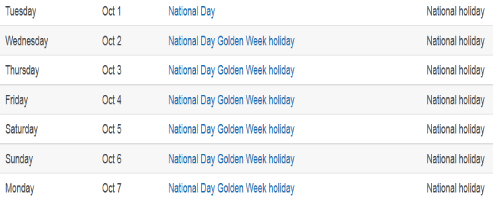

Goldener Oktober startet mit einem Tritt unter die Gürtellinie

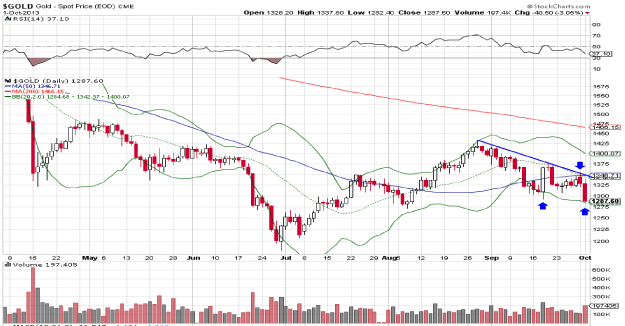

Wie bereits gestern Nachmittag berichtet, brach der Goldpreis am frühen Nachmittag um mehr als 50 US-Dollar ein. Vernünftige Gründe für diese abrupte Bewegung suchte man vergebens. Sowohl bei Aktienmärkten, bei den Rentenpapieren oder den Währungen gab es keine Bewegungen, die auch nur im Geringsten den zügigen Absturz erklären würden.

So müssen wir etwas tiefer graben. Anfang Oktober beginnt in China die "Goldene Woche". Es sind also Ferien in dem Land, mit der weltweit stärksten Goldnachfrage. Obwohl nicht alle Banken und Marktteilnehmer im Urlaub sind, nutzen viele diese Tage um die Bücher zu schließen.

Aus der Vergangenheit wissen wir, dass gewisse westliche Adressen immer dann den Goldpreis attackieren, wenn die Chinesen nicht am Platz sind. Der Zeitpunkt des gestrigen Einbruches passt also wieder einmal genau mit dem Ferienkalender in China zusammen.

Weiterhin war das Timing aufgrund des Government Shut Downs in den USA gut genutzt. Wäre Gold mit diesem Ereignis über 1.350 USD gestiegen, hätte eine hohe Wahrscheinlichkeit bestanden, dass Anleger verstärkt den Sicherheitsgedanken in den Vordergrund schieben und auf den Zug aufspringen. Denn auch technisch hätte Gold über 1.350 USD ein Kaufsignal generiert:

Um diese Marke notieren aktuell der kurzfristige Abwärtstrend, die 50-Tagelinie und das mittlere Bollinger-Band. Zudem hätte der MACD ein Kaufsignal für Gold angezeigt. Mit der Bewegung gestern wurde erneut technisch Schaden angerichtet, was auch immer das Ziel solcher Aktionen ist. Trader werden ausgestoppt und kurzfristig orientiere Anleger verschreckt.

Interessant ist auch, dass die Abwärtsbewegung gestern bis knapp unterhalb des Niveaus vom 18.09.2013 anhielt (untere Pfeile im Chart). Am 18.09.2013 fand die FED-Sitzung statt und es wurde beschlossen, QE4 weiter fortzuführen. Die Shorties wurden an diesem Tag eiskalt erwischt, nachdem in den Tagen vor der Sitzung im asiatischen Handel offensichtlich gedrückt wurde.

Es war also das Minimum-Ziel, Gold zumindest auf dieses Niveau zu bringen, um die Fehlspekulation auf die FED-sitzung wieder zu bereinigen.

Fazit:

Dass beim Gold etwas nicht mit rechten Dingen zugeht, wissen wir seit Langem. Die Bewegung gestern war ein weiteres Beispiel. Es wurden 197.405 Kontrakte gehandelt, was 19,74 Millionen Unzen Papiergold entspricht bzw. 614 Tonnen Gold. Bei einer Minenproduktion von etwa 2.200 Tonnen pro Jahr bzw. einem Gesamtangebot von 2.800 Tonnen sprechen wir also über knapp 28% der weltweiten Minenförderung bzw. knapp 22% des gesamten Goldangebotes!

Goldener Oktober startet mit einem Tritt unter die Gürtellinie

Wie bereits gestern Nachmittag berichtet, brach der Goldpreis am frühen Nachmittag um mehr als 50 US-Dollar ein. Vernünftige Gründe für diese abrupte Bewegung suchte man vergebens. Sowohl bei Aktienmärkten, bei den Rentenpapieren oder den Währungen gab es keine Bewegungen, die auch nur im Geringsten den zügigen Absturz erklären würden.

So müssen wir etwas tiefer graben. Anfang Oktober beginnt in China die "Goldene Woche". Es sind also Ferien in dem Land, mit der weltweit stärksten Goldnachfrage. Obwohl nicht alle Banken und Marktteilnehmer im Urlaub sind, nutzen viele diese Tage um die Bücher zu schließen.

Aus der Vergangenheit wissen wir, dass gewisse westliche Adressen immer dann den Goldpreis attackieren, wenn die Chinesen nicht am Platz sind. Der Zeitpunkt des gestrigen Einbruches passt also wieder einmal genau mit dem Ferienkalender in China zusammen.

Weiterhin war das Timing aufgrund des Government Shut Downs in den USA gut genutzt. Wäre Gold mit diesem Ereignis über 1.350 USD gestiegen, hätte eine hohe Wahrscheinlichkeit bestanden, dass Anleger verstärkt den Sicherheitsgedanken in den Vordergrund schieben und auf den Zug aufspringen. Denn auch technisch hätte Gold über 1.350 USD ein Kaufsignal generiert:

Um diese Marke notieren aktuell der kurzfristige Abwärtstrend, die 50-Tagelinie und das mittlere Bollinger-Band. Zudem hätte der MACD ein Kaufsignal für Gold angezeigt. Mit der Bewegung gestern wurde erneut technisch Schaden angerichtet, was auch immer das Ziel solcher Aktionen ist. Trader werden ausgestoppt und kurzfristig orientiere Anleger verschreckt.

Interessant ist auch, dass die Abwärtsbewegung gestern bis knapp unterhalb des Niveaus vom 18.09.2013 anhielt (untere Pfeile im Chart). Am 18.09.2013 fand die FED-Sitzung statt und es wurde beschlossen, QE4 weiter fortzuführen. Die Shorties wurden an diesem Tag eiskalt erwischt, nachdem in den Tagen vor der Sitzung im asiatischen Handel offensichtlich gedrückt wurde.

Es war also das Minimum-Ziel, Gold zumindest auf dieses Niveau zu bringen, um die Fehlspekulation auf die FED-sitzung wieder zu bereinigen.

Fazit:

Dass beim Gold etwas nicht mit rechten Dingen zugeht, wissen wir seit Langem. Die Bewegung gestern war ein weiteres Beispiel. Es wurden 197.405 Kontrakte gehandelt, was 19,74 Millionen Unzen Papiergold entspricht bzw. 614 Tonnen Gold. Bei einer Minenproduktion von etwa 2.200 Tonnen pro Jahr bzw. einem Gesamtangebot von 2.800 Tonnen sprechen wir also über knapp 28% der weltweiten Minenförderung bzw. knapp 22% des gesamten Goldangebotes!

02.10.2013 07:02 | Jim Willie CB

Flash-Trading: Jetzt auch bei US-Staatsanleihen

Der Zusammenbruch des US-Staatsanleihenmarktes schreitet fort, er ist ein Teil der allgemeinen, globalen Ablehnung des US-Dollars, der die Welt im Sturm erobert. Wer selbst in den USA lebt, bekommt davon natürlich nichts mit, da der Dollar hier nur als die eigene Währung wahrgenommen wird. Ausgehend von allgemeinen Beobachtungen und Unterhaltungen, die Jackass in den letzten 20 Jahren mit normalen US-Bürgern und Investorenvolk gehabt hat, ist er der Auffassung, dass nur 5% bis 10% der US-Amerikaner sich darüber im Klaren sind, dass der US-Dollar als globales Finanzinstrument dient und die Grundlage für die Abwicklung von Handelsgeschäften ist, was aber gewaltige Konsequenzen hat. Eine große Entwicklung hat begonnen - ganz wie ein metabolisches Lebenserhaltungssystem, welches mit Zinsswap-Derivatkontrakten zusammenspielt.

Zeit zwei Jahren oder länger ist der Markt für US-Staatsanleihen nun schon schwer abhängig von künstlicher Nachfrage ausgehend von Derivaten. Komplette Aufwärtsbewegungen an den Anleihemärken wurden mit einem Hebel von 50:1 fabriziert, mit vollster Unterstützung der Finanznetzwerkpropaganda. Ohne die freischwebende Derivat-Pfeiler-Unterstützung wäre der US-Staatsanleiheturm schon vor einigen Jahren eingebrochen. Jetzt ist ein neues Stützungssystem an der Reihe: eine gefährliche “Reise nach Jerusalem“, die sich seit längerer Zeit im US-Aktienmarkt festgesetzt hat. Und dieses Spiel hat endlich auch den Anleihemarkt erreicht. Flash Trading!!

Die US Fed, die US-Regierung und die großen US-Banken mussten schnellstmöglich die Bewegungen bei der 10-jährigen US-Staatsanleihe (auch bekannt als TNX) stoppen. Ein Anstieg über 3% musste verhindert werden. Ein Blutbad bei den Zinsswaps und beim sich auflösenden Carry Trade mit US-Staatsanleihen musste verhindert werden. Sie mussten verhindern, dass Stop-Loss-Aufträge ausgelöst werden. Sie mussten den Rest der Welt daran hindern, massenhaft US-Staatsanleihen aus ihren Reservemanagement-Systemen zu verkaufen - die Fundamente der jeweiligen nationalen Bankensysteme. Also forderten sich die US Fed und die großen US-Banken gegenseitig auf, künstlich hohe Nachfrage nach US-Staatsanleihen zu generieren, welche wie in einer Flash-Trading-Privatorgie untereinander verkauft wurden. Mit diesem korrupten Prozess wurde der TNX schnell wieder unter die Marke von 2,9% gedrückt. Fed-Chef Bernanke nahm dann wieder Abstand von der “Taper-Bedrohung" und die US-Staatanleihen starteten zu einer lächerlichen Rally.

Jackass hatte diesen Rückzug exakt so prognostiziert, ein Bluff nach einem gescheiterten Testballon. Dann griffen die Banker auf die versteckte Arbeit der Computeralgorithmen zurück. Sie veränderten die Grunddynamiken des Rentenmarktes. Die Korruption wird von einem noch tieferen Niveau ausgeführt. Verteidigung mittels Flash-Trading ist erbärmlich und wird in den kommenden Wochen aufgedeckt werden. Die Vereinigten Staaten sind dabei, sich an verschiedenen Fronten nun komplett zu isolieren, denn ihre Geldpolitik ist mit ihrer militärischen Politik verschmolzen - und beide sind schon lange mit ihrer Bankenpolitik verschmolzen.

Die Krankheit zeigt sich in einem wirkungsvollen Diagramm

Als Einleitung schauen Sie sich bitten ein vielsagendes Diagramm an. Kein anderes könnte besser das Scheitern der Geldpolitik der letzten fünf Jahr demonstrieren, und auch die nicht existente Erholung der US-Wirtschaft. Sinkende Geldumlaufgeschwindigkeit bedeutet, dass das System schrittweise kollabiert. Die Zuführung neuen Falschgelds löst nicht ansatzweise das wichtigste Fundamentalproblem - Insolvenz der Banken, Unternehmen, Haushalte und des US-Staates. Drückt man dem Manager eines Pleiteunternehmens eine 20 $-Note in die Hand, ist der insolvente Zustand des Unternehmens damit nicht beseitigt. Sie verschafft dem Manager nur die Möglichkeit, einen Teilzeitbeschäftigten für ein paar Stunden mehr zu bezahlen. Die ahnungslose Kaste korrupter Ökonomen kann weder erkennen noch zugeben, dass die QE & Nullzins-Geldpolitik (Hammer & Sichel) das Kapital durch steigende Kostenstrukturen zerstört.

Kapitalzerstörung passiert in den Unternehmen, die ihre Gewinnspannen verlieren, das Geschäft oder ein Geschäftssegment dichtmachen, Arbeitsplätze streichen und die Betriebsausrüstung einmotten oder liquidieren. Aus wirtschaftspolitischer Sicht ist das der größte bilde Fleck. Offensichtlich dienen die Ökonomen dem Syndikat, das über die Rücknahme toxischer Anleihen vom kostenlosen Geld profitiert. Die US Fed erzeugt keinen Dauerstimulus, sondern viel eher Dauerzerstörung. Hammer & Sichel sind Symbole des kommunistischen Politbüros - kein Unterschied im Vergleich zu den geplanten Finanzstrukturen in den Vereinigten Staaten.

Panik hinter den Mauern der Fed

Ein Ereignis wurde aus einer unerwarteten Ecke aufgetischt - allerdings von einer verlässlichen Quelle, die mit einem Banker befreundet ist. Der Anleihemarkt hat sich in eine Flash-Trading-Arena inmitten des Bankensyndikats verwandelt, um die Anleihekurse zu stützen. Das ist ein explosives Ereignis und Hinweis darauf, dass die unhaltbaren Staatsanleihekurse mit internen Reihum-Verkäufen in den Kreisen der Federal Reserve Banken gestützt werden. Schlimmer noch: Es wird sogar darüber spekuliert, dass die US Fed als Finanzfirma plötzlich auch Kapitalregeln - und somit auch einem inhärenten Insolvenzrisiko - unterworfen sein wird. Sie hat geschädigte Anlagen im Umfang von mehr als 3 Billionen $ angehäuft, von denen viele wahrhaftig toxisch sind. Das “Taper-Gerede” aus der US Fed war ein widerliches Desaster, bei dem der Zentralbank die Finanzfäkalien um die Ohren gehauen wurden.

Der große neue Motor, der die Spaltung der US Fed vorantreiben wird, ist die Umkehr des Staatsanleihen-Carry-Trade der US-Großbanken. Erinnern Sie sich nur daran, wie sie damals 2011 und 2012 wie Junkie-Deppen mit der Wiederauffüllung ihrer Bilanzen durch einfach zu hebelnde Gewinne geprahlt hatten. Das fällt jetzt wieder auf sie zurück - zu den geschmissenen Fäkalien kommen nun noch Flatulenzen. In den Berichten der Finanznetzwerke wird darüber natürlich kein Wort verloren. Die Auflösung und Rückführung der Anleihe-Carry-Trades ist ein ganz einfaches Phänomen, das jeder fähige Anleiheanalyst beobachten und antizipieren kann. Es ist die Kehrseite des Locker-Geld-Machens - nämlich massive Verluste.

Vor zwei Wochen kam eine außergewöhnliche Kurzmitteilung von einem vertrauten Kollegen. Sie könnte in bislang noch unbekannter Hinsicht wichtig werden. Der Markt für US-Staatsanleihen ist kaputt und der US-Dollar lässt sich nicht mehr verteidigen. Die Kurzmitteilung lautet folgendermaßen:

http://goldseiten.de/artikel/183924--Flash-Trading~-Jetzt-auch-bei-US-Staatsanleihen-.html?seite=2

Flash-Trading: Jetzt auch bei US-Staatsanleihen

Der Zusammenbruch des US-Staatsanleihenmarktes schreitet fort, er ist ein Teil der allgemeinen, globalen Ablehnung des US-Dollars, der die Welt im Sturm erobert. Wer selbst in den USA lebt, bekommt davon natürlich nichts mit, da der Dollar hier nur als die eigene Währung wahrgenommen wird. Ausgehend von allgemeinen Beobachtungen und Unterhaltungen, die Jackass in den letzten 20 Jahren mit normalen US-Bürgern und Investorenvolk gehabt hat, ist er der Auffassung, dass nur 5% bis 10% der US-Amerikaner sich darüber im Klaren sind, dass der US-Dollar als globales Finanzinstrument dient und die Grundlage für die Abwicklung von Handelsgeschäften ist, was aber gewaltige Konsequenzen hat. Eine große Entwicklung hat begonnen - ganz wie ein metabolisches Lebenserhaltungssystem, welches mit Zinsswap-Derivatkontrakten zusammenspielt.

Zeit zwei Jahren oder länger ist der Markt für US-Staatsanleihen nun schon schwer abhängig von künstlicher Nachfrage ausgehend von Derivaten. Komplette Aufwärtsbewegungen an den Anleihemärken wurden mit einem Hebel von 50:1 fabriziert, mit vollster Unterstützung der Finanznetzwerkpropaganda. Ohne die freischwebende Derivat-Pfeiler-Unterstützung wäre der US-Staatsanleiheturm schon vor einigen Jahren eingebrochen. Jetzt ist ein neues Stützungssystem an der Reihe: eine gefährliche “Reise nach Jerusalem“, die sich seit längerer Zeit im US-Aktienmarkt festgesetzt hat. Und dieses Spiel hat endlich auch den Anleihemarkt erreicht. Flash Trading!!

Die US Fed, die US-Regierung und die großen US-Banken mussten schnellstmöglich die Bewegungen bei der 10-jährigen US-Staatsanleihe (auch bekannt als TNX) stoppen. Ein Anstieg über 3% musste verhindert werden. Ein Blutbad bei den Zinsswaps und beim sich auflösenden Carry Trade mit US-Staatsanleihen musste verhindert werden. Sie mussten verhindern, dass Stop-Loss-Aufträge ausgelöst werden. Sie mussten den Rest der Welt daran hindern, massenhaft US-Staatsanleihen aus ihren Reservemanagement-Systemen zu verkaufen - die Fundamente der jeweiligen nationalen Bankensysteme. Also forderten sich die US Fed und die großen US-Banken gegenseitig auf, künstlich hohe Nachfrage nach US-Staatsanleihen zu generieren, welche wie in einer Flash-Trading-Privatorgie untereinander verkauft wurden. Mit diesem korrupten Prozess wurde der TNX schnell wieder unter die Marke von 2,9% gedrückt. Fed-Chef Bernanke nahm dann wieder Abstand von der “Taper-Bedrohung" und die US-Staatanleihen starteten zu einer lächerlichen Rally.

Jackass hatte diesen Rückzug exakt so prognostiziert, ein Bluff nach einem gescheiterten Testballon. Dann griffen die Banker auf die versteckte Arbeit der Computeralgorithmen zurück. Sie veränderten die Grunddynamiken des Rentenmarktes. Die Korruption wird von einem noch tieferen Niveau ausgeführt. Verteidigung mittels Flash-Trading ist erbärmlich und wird in den kommenden Wochen aufgedeckt werden. Die Vereinigten Staaten sind dabei, sich an verschiedenen Fronten nun komplett zu isolieren, denn ihre Geldpolitik ist mit ihrer militärischen Politik verschmolzen - und beide sind schon lange mit ihrer Bankenpolitik verschmolzen.

Die Krankheit zeigt sich in einem wirkungsvollen Diagramm

Als Einleitung schauen Sie sich bitten ein vielsagendes Diagramm an. Kein anderes könnte besser das Scheitern der Geldpolitik der letzten fünf Jahr demonstrieren, und auch die nicht existente Erholung der US-Wirtschaft. Sinkende Geldumlaufgeschwindigkeit bedeutet, dass das System schrittweise kollabiert. Die Zuführung neuen Falschgelds löst nicht ansatzweise das wichtigste Fundamentalproblem - Insolvenz der Banken, Unternehmen, Haushalte und des US-Staates. Drückt man dem Manager eines Pleiteunternehmens eine 20 $-Note in die Hand, ist der insolvente Zustand des Unternehmens damit nicht beseitigt. Sie verschafft dem Manager nur die Möglichkeit, einen Teilzeitbeschäftigten für ein paar Stunden mehr zu bezahlen. Die ahnungslose Kaste korrupter Ökonomen kann weder erkennen noch zugeben, dass die QE & Nullzins-Geldpolitik (Hammer & Sichel) das Kapital durch steigende Kostenstrukturen zerstört.

Kapitalzerstörung passiert in den Unternehmen, die ihre Gewinnspannen verlieren, das Geschäft oder ein Geschäftssegment dichtmachen, Arbeitsplätze streichen und die Betriebsausrüstung einmotten oder liquidieren. Aus wirtschaftspolitischer Sicht ist das der größte bilde Fleck. Offensichtlich dienen die Ökonomen dem Syndikat, das über die Rücknahme toxischer Anleihen vom kostenlosen Geld profitiert. Die US Fed erzeugt keinen Dauerstimulus, sondern viel eher Dauerzerstörung. Hammer & Sichel sind Symbole des kommunistischen Politbüros - kein Unterschied im Vergleich zu den geplanten Finanzstrukturen in den Vereinigten Staaten.

Panik hinter den Mauern der Fed

Ein Ereignis wurde aus einer unerwarteten Ecke aufgetischt - allerdings von einer verlässlichen Quelle, die mit einem Banker befreundet ist. Der Anleihemarkt hat sich in eine Flash-Trading-Arena inmitten des Bankensyndikats verwandelt, um die Anleihekurse zu stützen. Das ist ein explosives Ereignis und Hinweis darauf, dass die unhaltbaren Staatsanleihekurse mit internen Reihum-Verkäufen in den Kreisen der Federal Reserve Banken gestützt werden. Schlimmer noch: Es wird sogar darüber spekuliert, dass die US Fed als Finanzfirma plötzlich auch Kapitalregeln - und somit auch einem inhärenten Insolvenzrisiko - unterworfen sein wird. Sie hat geschädigte Anlagen im Umfang von mehr als 3 Billionen $ angehäuft, von denen viele wahrhaftig toxisch sind. Das “Taper-Gerede” aus der US Fed war ein widerliches Desaster, bei dem der Zentralbank die Finanzfäkalien um die Ohren gehauen wurden.

Der große neue Motor, der die Spaltung der US Fed vorantreiben wird, ist die Umkehr des Staatsanleihen-Carry-Trade der US-Großbanken. Erinnern Sie sich nur daran, wie sie damals 2011 und 2012 wie Junkie-Deppen mit der Wiederauffüllung ihrer Bilanzen durch einfach zu hebelnde Gewinne geprahlt hatten. Das fällt jetzt wieder auf sie zurück - zu den geschmissenen Fäkalien kommen nun noch Flatulenzen. In den Berichten der Finanznetzwerke wird darüber natürlich kein Wort verloren. Die Auflösung und Rückführung der Anleihe-Carry-Trades ist ein ganz einfaches Phänomen, das jeder fähige Anleiheanalyst beobachten und antizipieren kann. Es ist die Kehrseite des Locker-Geld-Machens - nämlich massive Verluste.

Vor zwei Wochen kam eine außergewöhnliche Kurzmitteilung von einem vertrauten Kollegen. Sie könnte in bislang noch unbekannter Hinsicht wichtig werden. Der Markt für US-Staatsanleihen ist kaputt und der US-Dollar lässt sich nicht mehr verteidigen. Die Kurzmitteilung lautet folgendermaßen:

http://goldseiten.de/artikel/183924--Flash-Trading~-Jetzt-auch-bei-US-Staatsanleihen-.html?seite=2

02.10.2013 11:28 | Eugen Weinberg

Rätselhafter Preisrutsch bei Gold und Silber

Energie

Der Abwärtstrend bei den Ölpreisen setzt sich fort. Der Brentpreis fiel auf 106,8 USD je Barrel und damit auf das niedrigste Niveau seit knapp zwei Monaten. WTI war mit 101 USD je Barrel zwischenzeitlich so billig wie zuletzt vor drei Monaten. Die gestrigen Verluste fielen allerdings geringer aus als bei den meisten anderen Rohstoffen. In Abwesenheit preisunterstützender Nachrichten belasten weiterhin die nachlassenden geopolitischen Risiken und das reichliche Angebot. Hinzu kommt die Unsicherheit über die Auswirkungen der Haushaltskrise auf die Ölnachfrage in den USA. Diese sollten überschaubar sein, sofern sich die Schließung der öffentlichen Einrichtungen nicht über mehrere Wochen hinzieht.

Davon geht derzeit offensichtlich kaum jemand aus, wie die gelassene Reaktion der Aktienmärkte zeigt. Das reichlich verfügbare Angebot scheint sich inzwischen auch in steigenden US-Rohölvorräten widerzuspiegeln. Wie das API gestern nach Handelsschluss berichtete, verzeichneten die Rohöllagerbestände in der vergangenen Woche einen Anstieg um 4,6 Mio. Barrel.

Hauptverantwortlich dafür waren eine geringere Rohölverarbeitung der Raffinerien und höhere Importe. Die offiziellen Lagerdaten des US-Energieministeriums heute Nachmittag dürften ein ähnliches Bild zeichnen und damit auch das bereits in der vorherigen Woche gezeigte Bild bestätigen. Die Ölpreise sollten vor diesem Hintergrund weiter nachgeben.

Edelmetalle

Der Goldpreis ist gestern Nachmittag um 3% eingebrochen und hat in der Nacht bei 1.277 USD je Feinunze ein 8-Wochentief markiert. Silber gab sogar zeitweise um 5% auf 20,6 USD je Feinunze nach, konnte sich im Gegensatz zu Gold über Nacht aber etwas erholen. Der Preissturz ist insofern erstaunlich, da das vorläufige Scheitern der Haushaltsverhandlungen in den USA eigentlich für steigende Edelmetallpreise gesprochen hätte und der US-Dollar auf handelsgewichteter Basis auf ein 8-Monatstief gefallen ist.

Kurzfristig orientierte Marktteilnehmer, die aufgrund des Haushaltsstreits auf einen steigenden Goldpreis gesetzt hatten, wurden durch die ausbleibende Preisreaktion auf dem falschen Fuß erwischt und mussten ihre Long-Positionen glattstellen. Der dadurch ausgelöste Rutsch unter die psychologisch wichtige Marke von 1.300 USD je Feinunze dürfte technische Anschlussverkäufe ausgelöst haben. Aufschluss hierüber könnten die CFTC-Daten zur Marktpositionierung am Freitag geben.

Offensichtlich herrscht unter den Marktteilnehmern Zuversicht, dass es aufgrund des steigenden öffentlichen Drucks zu einer schnellen Einigung im Haushaltsstreit kommt und auch die Schuldengrenze rechtzeitig angehoben wird, so dass eine Zahlungsunfähigkeit der USA vermieden wird. Zudem mangelt es derzeit an physischem Kaufinteresse, da China aufgrund der "Golden Week" nicht auf dem Markt aktiv ist und in Indien weiterhin versucht wird, die Goldimporte zu dämpfen. Zu diesem Zweck gibt es nun sogar Pläne, auf nicht genutztes Gold von privaten Haushalten und Tempeln zurückzugreifen. Der Verband der indischen Schmuckhändler will auf diese Weise innerhalb von drei Jahren 1.500 Tonnen Gold mobilisieren.

Industriemetalle

Im Einklang mit dem gesamten Rohstoffmarkt stehen auch die Metallpreise unter Druck. Sie weisen dabei gerade im Vergleich zu Aktien weiter eine schwache Entwicklung auf. Auch ein schwächerer US-Dollar hatte keine positiven Auswirkungen auf die Preise. Da seit gestern die chinesischen Märkte aufgrund der "Golden Week" geschlossen sind, erhalten die Metalle auch von dieser Seite derzeit keine Unterstützung. Chinas Metallnachfrage war zuletzt sehr robust, was sich unter anderem in hohen Importen bemerkbar gemacht hatte.

Weitgehend unbeeindruckt von der Entwicklung bei den Metallen zeigt sich der Eisenerzpreis, der bei 131,4 USD je Tonne notiert. Das staatliche australische Rohstoffprognoseinstitut BREE hat seine Prognose für die chinesischen Eisenerzimporte deutlich angehoben. Demnach soll China im nächsten Jahr 872 Mio. Tonnen Eisenerz einführen, 8,3% mehr als noch Mitte des Jahres unterstellt. 2018 sollen die Importe sogar die Marke von 1 Mrd. Tonne erreichen.

Die verstärkte Nachfrage wird durch eine hohe Stahlproduktion aufgrund des andauernden Wachstums im Bausektor getrieben. Da das Angebot allerdings mit der Nachfrage Schritt halten kann, dürfte es nicht zu Preissprüngen kommen. Einschätzungen des Prognoseinstituts zufolge wird Australien im nächsten Jahr 669 Mio. Tonnen exportieren, gut 17% mehr als 2013. Dies ist der Inbetriebnahme zahlreicher neuer Minenprojekte geschuldet.

Agrarrohstoffe

Die Sojabohnenpreise in Chicago haben gestern weiter nachgegeben. Höher als erwartete US-Lagerbestände, die Verbesserung des Pflanzenzustandes in der vergangenen Woche, der Fortschritt bei der US-Sojabohnenernte bei guter Witterung und die mit der Haushaltskrise in den USA einhergehende Unsicherheit haben alle ihr Schärflein dazu beigetragen. Vor allem die beiden erstgenannten Aspekte dürften den Markt noch längerfristig im Griff haben, da sie das Gesamtangebot an Sojabohnen erhöhen.

Aufgrund von Substitutionsmöglichkeiten im Verbrauch haben zwar auch andere Ölsaatenmärkte Auswirkungen auf den Markt für Sojabohnen, auch wenn diese aufgrund eines Produktionsanteils von 60% als marktbestimmende Ölsaat gelten. Von anderer Seite kommt aber ebenfalls wenig Unterstützung für die Preise: Bei Raps ist in der laufenden Saison auch mit einer globalen Rekordernte und einem Ende der Serie von Angebotsdefiziten zu rechnen. Die Erwartungen an Kanadas Rapsernte wurden angesichts sehr guter Witterung wiederholt angehoben und es dürfte eine Rekordmenge von knapp 17 Mio. Tonnen eingefahren werden.

Die Produktion der EU konnte sich nach zwei enttäuschenden Jahren ebenfalls erholen und dürfte 20,5 Mio. Tonnen erbracht haben. Diese beiden Erzeuger stellen über die Hälfte der weltweiten Rapsproduktion. Auch bei Sonnenblumen rechnen Beobachter wie das auf Ölsaaten spezialisierte Analysehaus Oil World mit einer Rekordproduktion in der laufenden Saison.

http://goldseiten.de/artikel/184221--Raetselhafter-Preisrutsch-bei-Gold-und-Silber.html?seite=2

Rätselhafter Preisrutsch bei Gold und Silber

Energie

Der Abwärtstrend bei den Ölpreisen setzt sich fort. Der Brentpreis fiel auf 106,8 USD je Barrel und damit auf das niedrigste Niveau seit knapp zwei Monaten. WTI war mit 101 USD je Barrel zwischenzeitlich so billig wie zuletzt vor drei Monaten. Die gestrigen Verluste fielen allerdings geringer aus als bei den meisten anderen Rohstoffen. In Abwesenheit preisunterstützender Nachrichten belasten weiterhin die nachlassenden geopolitischen Risiken und das reichliche Angebot. Hinzu kommt die Unsicherheit über die Auswirkungen der Haushaltskrise auf die Ölnachfrage in den USA. Diese sollten überschaubar sein, sofern sich die Schließung der öffentlichen Einrichtungen nicht über mehrere Wochen hinzieht.

Davon geht derzeit offensichtlich kaum jemand aus, wie die gelassene Reaktion der Aktienmärkte zeigt. Das reichlich verfügbare Angebot scheint sich inzwischen auch in steigenden US-Rohölvorräten widerzuspiegeln. Wie das API gestern nach Handelsschluss berichtete, verzeichneten die Rohöllagerbestände in der vergangenen Woche einen Anstieg um 4,6 Mio. Barrel.

Hauptverantwortlich dafür waren eine geringere Rohölverarbeitung der Raffinerien und höhere Importe. Die offiziellen Lagerdaten des US-Energieministeriums heute Nachmittag dürften ein ähnliches Bild zeichnen und damit auch das bereits in der vorherigen Woche gezeigte Bild bestätigen. Die Ölpreise sollten vor diesem Hintergrund weiter nachgeben.

Edelmetalle

Der Goldpreis ist gestern Nachmittag um 3% eingebrochen und hat in der Nacht bei 1.277 USD je Feinunze ein 8-Wochentief markiert. Silber gab sogar zeitweise um 5% auf 20,6 USD je Feinunze nach, konnte sich im Gegensatz zu Gold über Nacht aber etwas erholen. Der Preissturz ist insofern erstaunlich, da das vorläufige Scheitern der Haushaltsverhandlungen in den USA eigentlich für steigende Edelmetallpreise gesprochen hätte und der US-Dollar auf handelsgewichteter Basis auf ein 8-Monatstief gefallen ist.

Kurzfristig orientierte Marktteilnehmer, die aufgrund des Haushaltsstreits auf einen steigenden Goldpreis gesetzt hatten, wurden durch die ausbleibende Preisreaktion auf dem falschen Fuß erwischt und mussten ihre Long-Positionen glattstellen. Der dadurch ausgelöste Rutsch unter die psychologisch wichtige Marke von 1.300 USD je Feinunze dürfte technische Anschlussverkäufe ausgelöst haben. Aufschluss hierüber könnten die CFTC-Daten zur Marktpositionierung am Freitag geben.

Offensichtlich herrscht unter den Marktteilnehmern Zuversicht, dass es aufgrund des steigenden öffentlichen Drucks zu einer schnellen Einigung im Haushaltsstreit kommt und auch die Schuldengrenze rechtzeitig angehoben wird, so dass eine Zahlungsunfähigkeit der USA vermieden wird. Zudem mangelt es derzeit an physischem Kaufinteresse, da China aufgrund der "Golden Week" nicht auf dem Markt aktiv ist und in Indien weiterhin versucht wird, die Goldimporte zu dämpfen. Zu diesem Zweck gibt es nun sogar Pläne, auf nicht genutztes Gold von privaten Haushalten und Tempeln zurückzugreifen. Der Verband der indischen Schmuckhändler will auf diese Weise innerhalb von drei Jahren 1.500 Tonnen Gold mobilisieren.

Industriemetalle

Im Einklang mit dem gesamten Rohstoffmarkt stehen auch die Metallpreise unter Druck. Sie weisen dabei gerade im Vergleich zu Aktien weiter eine schwache Entwicklung auf. Auch ein schwächerer US-Dollar hatte keine positiven Auswirkungen auf die Preise. Da seit gestern die chinesischen Märkte aufgrund der "Golden Week" geschlossen sind, erhalten die Metalle auch von dieser Seite derzeit keine Unterstützung. Chinas Metallnachfrage war zuletzt sehr robust, was sich unter anderem in hohen Importen bemerkbar gemacht hatte.

Weitgehend unbeeindruckt von der Entwicklung bei den Metallen zeigt sich der Eisenerzpreis, der bei 131,4 USD je Tonne notiert. Das staatliche australische Rohstoffprognoseinstitut BREE hat seine Prognose für die chinesischen Eisenerzimporte deutlich angehoben. Demnach soll China im nächsten Jahr 872 Mio. Tonnen Eisenerz einführen, 8,3% mehr als noch Mitte des Jahres unterstellt. 2018 sollen die Importe sogar die Marke von 1 Mrd. Tonne erreichen.

Die verstärkte Nachfrage wird durch eine hohe Stahlproduktion aufgrund des andauernden Wachstums im Bausektor getrieben. Da das Angebot allerdings mit der Nachfrage Schritt halten kann, dürfte es nicht zu Preissprüngen kommen. Einschätzungen des Prognoseinstituts zufolge wird Australien im nächsten Jahr 669 Mio. Tonnen exportieren, gut 17% mehr als 2013. Dies ist der Inbetriebnahme zahlreicher neuer Minenprojekte geschuldet.

Agrarrohstoffe

Die Sojabohnenpreise in Chicago haben gestern weiter nachgegeben. Höher als erwartete US-Lagerbestände, die Verbesserung des Pflanzenzustandes in der vergangenen Woche, der Fortschritt bei der US-Sojabohnenernte bei guter Witterung und die mit der Haushaltskrise in den USA einhergehende Unsicherheit haben alle ihr Schärflein dazu beigetragen. Vor allem die beiden erstgenannten Aspekte dürften den Markt noch längerfristig im Griff haben, da sie das Gesamtangebot an Sojabohnen erhöhen.

Aufgrund von Substitutionsmöglichkeiten im Verbrauch haben zwar auch andere Ölsaatenmärkte Auswirkungen auf den Markt für Sojabohnen, auch wenn diese aufgrund eines Produktionsanteils von 60% als marktbestimmende Ölsaat gelten. Von anderer Seite kommt aber ebenfalls wenig Unterstützung für die Preise: Bei Raps ist in der laufenden Saison auch mit einer globalen Rekordernte und einem Ende der Serie von Angebotsdefiziten zu rechnen. Die Erwartungen an Kanadas Rapsernte wurden angesichts sehr guter Witterung wiederholt angehoben und es dürfte eine Rekordmenge von knapp 17 Mio. Tonnen eingefahren werden.

Die Produktion der EU konnte sich nach zwei enttäuschenden Jahren ebenfalls erholen und dürfte 20,5 Mio. Tonnen erbracht haben. Diese beiden Erzeuger stellen über die Hälfte der weltweiten Rapsproduktion. Auch bei Sonnenblumen rechnen Beobachter wie das auf Ölsaaten spezialisierte Analysehaus Oil World mit einer Rekordproduktion in der laufenden Saison.

http://goldseiten.de/artikel/184221--Raetselhafter-Preisrutsch-bei-Gold-und-Silber.html?seite=2

02.10.2013 10:56 | Robert Schröder

Gold - Bald neue Jahrestiefs?

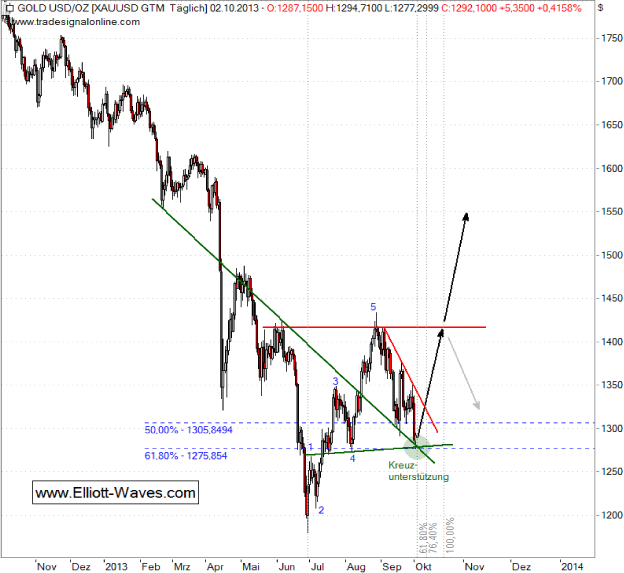

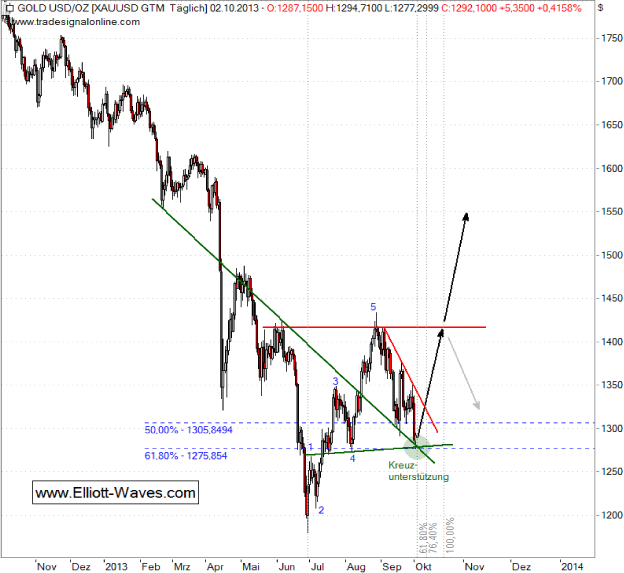

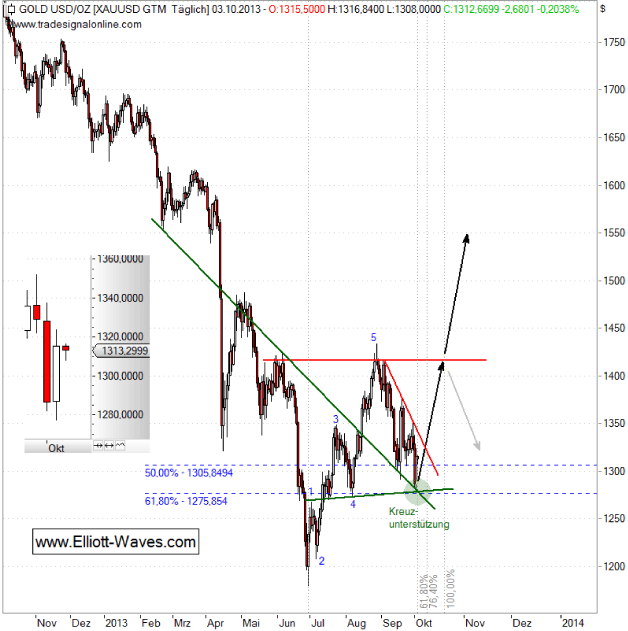

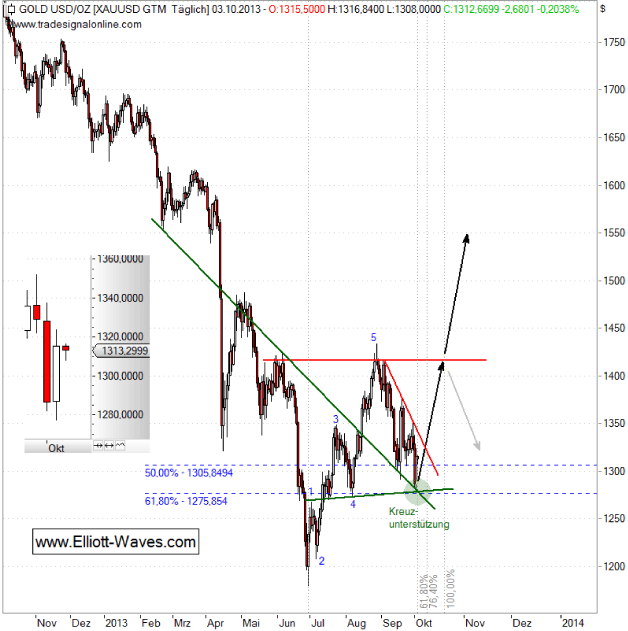

Mit dem Goldpreis stimmt etwas nicht. Trotz positiver Saisonalität, die ab September eigentlich tendenziell steigende Kurse vorgibt, sehen wir seit Ende August wieder deutlich fallende Kurse. Gestern erst ging es um über 3% butterweich unter die 1.300 USD Marke. Was ist da los? Müssen wir uns wieder auf neue Jahrestiefs einstellen?

Zugegeben, Gold ist seit Wochen eher schwierig zu handhaben und zu analysieren. Erst mit meiner letzten Analyse vom 11. September "Wie könnte sich Gold bis zum Jahresende entwickeln?" lag ich deutlich daneben. Statt Richtung 1.500 USD, ging es in die andere Richtung, wie wir jetzt wissen.

Statt eines noch unfertigen 5-teiligen Aufwärtsimpulses, muss ich nun nach der jüngsten Abwärtsbewegung davon ausgehen, dass Gold mit dem Augusthoch bei 1.434 USD schon einen kompletten Zyklus ausgebildet hat. Der Rutsch unter die 1.300 USD Marke stellt demnach lediglich die entsprechende Gegenbewegung dar, die zum aktuellen Zeitpunkt schon sehr weit fortgeschritten ist bzw. sogar schon fertig sein könnte.

Toll, hinterher sind wir immer schlauer. Was bedeutet das denn jetzt?

Meiner Meinung nach ist bei Gold jetzt nicht die Zeit gekommen, um das Handtuch zu werfen. Die Abwärtsbewegung der letzten fünf Wochen mag nach "viel" aussehen, im Verhältnis zur vorherigen Aufwärtsbewegung, bewegen wir uns aber im Rahmen einer ganz normalen Korrektur.

Zum Einen wurde mit dem Tief heute Nacht bei 1.277,30 USD nahezu genau das 61,8%-ige Korrektur-Retracement erreicht. Zum Anderen sitz dort eine solide Kreuzunterstützung. Des Weiteren nimmt die laufende Korrektur jetzt auch ziemlich genau die 0,618 fache zeitliche Ausdehnung des 5-teiligen Aufwärtsimpulses an. Wir sehen damit also sowohl in der Preis- als auch in der Zeitebene ein ideales Korrekturniveau. Was wollen wir mehr?

Aufgrund dieser charttechnischen Situation gehe ich davon aus, dass Gold nun wieder kurz vor dem nächsten Sprung steht. Sollte heute ein positiver Tag mit möglichst langer weißer Tageskerze - die gestrige rote lange Tageskerze sollte schnell negiert werden - werden, käme morgen direkt das Signal, um long zu gehen. Ziel wäre dann zunächst das Augusthoch bei ca. 1.420/34 USD. Neue Jahrestiefs sehe ich aus der Formation nicht auf uns zukommen.

Als SL bietet sich dann das letzte signifikante Tief an. Ob es bis dahin bei 1.277,30 USD bleibt, ist derzeit allerdings noch offen. Daher gilt es, wie schon geschrieben, den heutigen Tag abzuwarten.

Gold - Bald neue Jahrestiefs?

Mit dem Goldpreis stimmt etwas nicht. Trotz positiver Saisonalität, die ab September eigentlich tendenziell steigende Kurse vorgibt, sehen wir seit Ende August wieder deutlich fallende Kurse. Gestern erst ging es um über 3% butterweich unter die 1.300 USD Marke. Was ist da los? Müssen wir uns wieder auf neue Jahrestiefs einstellen?

Zugegeben, Gold ist seit Wochen eher schwierig zu handhaben und zu analysieren. Erst mit meiner letzten Analyse vom 11. September "Wie könnte sich Gold bis zum Jahresende entwickeln?" lag ich deutlich daneben. Statt Richtung 1.500 USD, ging es in die andere Richtung, wie wir jetzt wissen.

Statt eines noch unfertigen 5-teiligen Aufwärtsimpulses, muss ich nun nach der jüngsten Abwärtsbewegung davon ausgehen, dass Gold mit dem Augusthoch bei 1.434 USD schon einen kompletten Zyklus ausgebildet hat. Der Rutsch unter die 1.300 USD Marke stellt demnach lediglich die entsprechende Gegenbewegung dar, die zum aktuellen Zeitpunkt schon sehr weit fortgeschritten ist bzw. sogar schon fertig sein könnte.

Toll, hinterher sind wir immer schlauer. Was bedeutet das denn jetzt?

Meiner Meinung nach ist bei Gold jetzt nicht die Zeit gekommen, um das Handtuch zu werfen. Die Abwärtsbewegung der letzten fünf Wochen mag nach "viel" aussehen, im Verhältnis zur vorherigen Aufwärtsbewegung, bewegen wir uns aber im Rahmen einer ganz normalen Korrektur.

Zum Einen wurde mit dem Tief heute Nacht bei 1.277,30 USD nahezu genau das 61,8%-ige Korrektur-Retracement erreicht. Zum Anderen sitz dort eine solide Kreuzunterstützung. Des Weiteren nimmt die laufende Korrektur jetzt auch ziemlich genau die 0,618 fache zeitliche Ausdehnung des 5-teiligen Aufwärtsimpulses an. Wir sehen damit also sowohl in der Preis- als auch in der Zeitebene ein ideales Korrekturniveau. Was wollen wir mehr?

Aufgrund dieser charttechnischen Situation gehe ich davon aus, dass Gold nun wieder kurz vor dem nächsten Sprung steht. Sollte heute ein positiver Tag mit möglichst langer weißer Tageskerze - die gestrige rote lange Tageskerze sollte schnell negiert werden - werden, käme morgen direkt das Signal, um long zu gehen. Ziel wäre dann zunächst das Augusthoch bei ca. 1.420/34 USD. Neue Jahrestiefs sehe ich aus der Formation nicht auf uns zukommen.

Als SL bietet sich dann das letzte signifikante Tief an. Ob es bis dahin bei 1.277,30 USD bleibt, ist derzeit allerdings noch offen. Daher gilt es, wie schon geschrieben, den heutigen Tag abzuwarten.

02.10.2013 12:38 | Christian Kämmerer

Gold - Sie waren vorbereitet!

Einleitung:

Wie zuletzt an dieser Stelle vermutet, sollte der Goldpreis unterhalb von 1.350,00 USD weiter rückschlagsgefährdet bleiben. Der Versuch zu Wochenbeginn über eben dieses Niveau anzusteigen scheiterte klar und äußerst dynamisch rauschte das Edelmetall, insbesondere gestern ab 14:00 Uhr (MEZ) wieder in Richtung der Unterstützungszone von 1.280,00 bis 1.285,00 USD.

Der Blick auf die Saisonalität stützt für die kommenden 20 Tage die Annahme einer Fortsetzung der schwächeren Preisentwicklung. Wenngleich die letzten Monate eines Handelsjahre wiederum stets bullisch für den Goldpreis verliefen. Handelt es sich daher um baldige Einstiegspreise?

Statistic-Board - Created by ForexBull

Tendenz:

Während des heutigen Handels markierte der Goldpreis bereits wieder ein frisches Verlaufstief bei 1.277,30 USD. Die Unterstützung bei 1.280,00 USD schwankt dementsprechend und unter Trendfolgegesichtspunkten erscheint auch die Aufgabe dieses Niveaus wahrscheinlich. Weitere Rücksetzer unter 1.272,47 USD dürften dabei die nächste Verkaufsspirale starten und für Verluste bis 1.208,00 bzw. bis unter die 1.200,00-USD-Marke führen.

Mutige Goldbugs können konträr dazu auf eine Verteidigung des aktuell erreichten Unterstützungsniveaus mit engem Stopp-Loss spekulieren. Doch Obacht, heute tagt noch um 13:45/14:30 Uhr (MEZ) die EZB und überdies spricht noch am späten Abend um 21:30 Uhr (MEZ) FED-Chef Ben Bernanke in St. Louis. Wirklich bullisch wären überdies nach wie vor erst Preise über 1.350,00 USD anzusehen. Zugewinne von bis zu 100,00 USD je Unze bis hin zur Region von 1.450,00 USD könnten dabei durchaus möglich werden.

Daily Chart - Created Using MT4-JFD-Brokers

Gold - Sie waren vorbereitet!

Einleitung:

Wie zuletzt an dieser Stelle vermutet, sollte der Goldpreis unterhalb von 1.350,00 USD weiter rückschlagsgefährdet bleiben. Der Versuch zu Wochenbeginn über eben dieses Niveau anzusteigen scheiterte klar und äußerst dynamisch rauschte das Edelmetall, insbesondere gestern ab 14:00 Uhr (MEZ) wieder in Richtung der Unterstützungszone von 1.280,00 bis 1.285,00 USD.

Der Blick auf die Saisonalität stützt für die kommenden 20 Tage die Annahme einer Fortsetzung der schwächeren Preisentwicklung. Wenngleich die letzten Monate eines Handelsjahre wiederum stets bullisch für den Goldpreis verliefen. Handelt es sich daher um baldige Einstiegspreise?

Statistic-Board - Created by ForexBull

Tendenz:

Während des heutigen Handels markierte der Goldpreis bereits wieder ein frisches Verlaufstief bei 1.277,30 USD. Die Unterstützung bei 1.280,00 USD schwankt dementsprechend und unter Trendfolgegesichtspunkten erscheint auch die Aufgabe dieses Niveaus wahrscheinlich. Weitere Rücksetzer unter 1.272,47 USD dürften dabei die nächste Verkaufsspirale starten und für Verluste bis 1.208,00 bzw. bis unter die 1.200,00-USD-Marke führen.

Mutige Goldbugs können konträr dazu auf eine Verteidigung des aktuell erreichten Unterstützungsniveaus mit engem Stopp-Loss spekulieren. Doch Obacht, heute tagt noch um 13:45/14:30 Uhr (MEZ) die EZB und überdies spricht noch am späten Abend um 21:30 Uhr (MEZ) FED-Chef Ben Bernanke in St. Louis. Wirklich bullisch wären überdies nach wie vor erst Preise über 1.350,00 USD anzusehen. Zugewinne von bis zu 100,00 USD je Unze bis hin zur Region von 1.450,00 USD könnten dabei durchaus möglich werden.

Daily Chart - Created Using MT4-JFD-Brokers

Weltbevölkerung wächst auf 9,7 Milliarden Menschen

Bis zum Jahr 2050

02.10.2013, 06:50

Die Weltbevölkerung könnte einer aktuellen Studie zufolge bis zum Jahr 2050 von derzeit 7,1 auf 9,7 Milliarden Menschen wachsen. Bis zum Ende des Jahrhunderts könnten sogar bis zu elf Milliarden Menschen auf der Erde leben, hieß es am Mittwoch in einer Untersuchung des französischen Demografieforschungsinstituts Ined.

Demnach werde allein in Asien die Einwohnerzahl bis zum Jahr 2050 von derzeit 4,3 auf 5,2 Milliarden steigen. Im derzeit bevölkerungsreichsten Staat China soll sie demnach bei 1,3 Milliarden stagnieren, in Indien hingegen von derzeit 1,2 auf 1,6 Milliarden ansteigen.

Ined rechnet damit, dass in Afrika im Jahr 2050 ein Viertel der Weltbevölkerung leben wird. Die Einwohnerzahl werde sich dort von derzeit 1,1 auf 2,5 Milliarden Menschen mehr als verdoppeln. Als Grund wird eine Geburtenrate von 4,8 Kindern pro Frau angegeben - der weltweite Durchschnitt liegt bei 2,5.

Die Vereinten Nationen hatten im Juni angegeben, dass sie mit einem Anwachsen der Weltbevölkerung auf 9,6 Milliarden Menschen bis zum Jahr 2050 rechnen.

Bis zum Jahr 2050

02.10.2013, 06:50

Die Weltbevölkerung könnte einer aktuellen Studie zufolge bis zum Jahr 2050 von derzeit 7,1 auf 9,7 Milliarden Menschen wachsen. Bis zum Ende des Jahrhunderts könnten sogar bis zu elf Milliarden Menschen auf der Erde leben, hieß es am Mittwoch in einer Untersuchung des französischen Demografieforschungsinstituts Ined.

Demnach werde allein in Asien die Einwohnerzahl bis zum Jahr 2050 von derzeit 4,3 auf 5,2 Milliarden steigen. Im derzeit bevölkerungsreichsten Staat China soll sie demnach bei 1,3 Milliarden stagnieren, in Indien hingegen von derzeit 1,2 auf 1,6 Milliarden ansteigen.

Ined rechnet damit, dass in Afrika im Jahr 2050 ein Viertel der Weltbevölkerung leben wird. Die Einwohnerzahl werde sich dort von derzeit 1,1 auf 2,5 Milliarden Menschen mehr als verdoppeln. Als Grund wird eine Geburtenrate von 4,8 Kindern pro Frau angegeben - der weltweite Durchschnitt liegt bei 2,5.

Die Vereinten Nationen hatten im Juni angegeben, dass sie mit einem Anwachsen der Weltbevölkerung auf 9,6 Milliarden Menschen bis zum Jahr 2050 rechnen.

P.M. Kitco Roundup: Gold Sharply Higher on Short Covering, Bargain Hunting, Safe-Haven Demand

Wednesday October 2, 2013 2:21 PM

(Kitco News) - Comex gold prices ended the U.S. day session sharply higher Wednesday and took back most of Tuesday’s heavy losses. The anxiety regarding the U.S. government shutdown and U.S. lawmakers’ impasse on agreeing to a federal budget ratcheted up a notch Wednesday, as the partial government closure entered its second day. Short covering, bargain hunting and safe-haven demand were featured. Also benefiting all the precious metals Wednesday were key “outside markets” that were in a bullish daily posture: solidly higher crude oil prices and a slump to an eight-month low in the U.S. dollar index.

The gold market was scoring moderate gains overnight after hitting a fresh seven-week low in overseas trading, and then extended those gains just after the Comex futures market opened in New York. December Comex gold was last up $30.60 at $1,316.80 an ounce. Spot gold was last quoted up $29.10 at $1317.00. December Comex silver last traded up $0.605 at $21.79 an ounce.

The marketplace greeted the partial U.S. government shutdown with some increased anxiety Wednesday but certainly not panic. Asian and European stock markets overnight focused on other matters. There are mixed ideas in the market place regarding how long the U.S. lawmakers will let the government remain closed. If the situation drags on for several days, anxiety in the markets will increase. In mid-October the U.S. government will hit its borrowing limit. If that more important matter cannot be agreed upon by U.S. lawmakers in a timely manner, then it could be a much bigger event for the market place than the current budget impasse. Fresh U.S. budget news coming out of Washington Wednesday could be market-sensitive.

U.S. government reports have been postponed due to the government furloughs, including Friday’s monthly employment report. Non-government U.S. economic reports will be issued as scheduled. The ADP national employment report was released at about the time the Comex futures market opened Wednesday morning. It showed a U.S. jobs gain of 166,000 in September, which was slightly less than market expectations.

Here is one school of thought on the U.S. government shutdown: Any extended shutdown will shave points off of U.S. gross domestic product growth. That could, in turn, prompt the Federal Reserve to delay any intended “tapering” of its monthly bond-buying program, also known as quantitative easing. This theory should have been bullish for the raw commodity sector Tuesday. Maybe that scenario will have a delayed bullish price effect on the raw commodity markets. Or, the other side of the coin is that any slower U.S. GDP growth would also be a drag on other world economies’ growth prospects, and also mean less demand for raw commodities.

Wednesday’s European Central Bank meeting resulted in no changes in ECB monetary policy, which supported the Euro currency and added downside pressure to the greenback. The monthly press conference by ECB president Mario Draghi produced no major pronouncements, but Draghi did express concern about the U.S. government shutdown impacting major world economies, if the matter is not resolved soon. There has been some speculation in the market place that the ECB could at some point launch another round of monetary stimulus measures.

The latest German government bond auction Wednesday saw 10-year bund yields drop sharply, as demand for safe-haven German debt increased due to the U.S. government shutdown.

China is observing the Golden Week holiday and market activity in the world’s second-largest economy will be quiet the rest of the week.

The London P.M. gold fix is $1,306.25 versus the previous P.M. fixing of $1,290.75.

Technically, December gold futures prices closed nearer the session high Wednesday after hitting a seven-week low in overnight trading. A five-week-old downtrend is still in place on the daily bar chart. The gold market bears still have the overall near-term technical advantage. The gold bulls’ next upside near-term price breakout objective is to produce a close above solid technical resistance at this week’s high of $1,353.80. Bears' next near-term downside breakout price objective is closing prices below solid technical support at the August low of $1,271.80. First resistance is seen at Wednesday’s high of $1,324.20 and then at $1,337.80. First support is seen at $1,300.00 and then at the September low of $1,291.50. Wyckoff’s Market Rating: 4.0

December silver futures prices closed nearer the session high Wednesday and took back all of Tuesday’s losses. Silver bears still have the overall near-term technical advantage. A five-week-old downtrend is in place on the daily bar chart. Silver bulls’ next upside price breakout objective is closing prices above solid technical resistance at last week’s high of $22.175 an ounce. The next downside price breakout objective for the bears is closing prices below solid technical support at $20.00. First resistance is seen at $22.00 and then at $22.175. Next support is seen at $21.50 and then at $21.225. Wyckoff's Market Rating: 3.5.

December N.Y. copper closed up 430 points at 331.70 cents Wednesday. Prices closed near the session high and took back most of Tuesday’s losses. The key “outside markets” were in a fully bullish posture for the copper market as the U.S. dollar index was solidly lower and crude oil prices were solidly higher. Copper bulls and bears are still on a level near-term technical playing field. Copper bulls' next upside breakout objective is pushing and closing prices above solid technical resistance at the September high of 335.95 cents. The next downside price breakout objective for the bears is closing prices below solid technical support at the September low of 319.05 cents. First resistance is seen at this week’s high of 333.95 cents and then at 335.00 cents. First support is seen at 330.00 cents and then at 327.50 cents. Wyckoff's Market Rating: 5.0.

Wednesday October 2, 2013 2:21 PM

(Kitco News) - Comex gold prices ended the U.S. day session sharply higher Wednesday and took back most of Tuesday’s heavy losses. The anxiety regarding the U.S. government shutdown and U.S. lawmakers’ impasse on agreeing to a federal budget ratcheted up a notch Wednesday, as the partial government closure entered its second day. Short covering, bargain hunting and safe-haven demand were featured. Also benefiting all the precious metals Wednesday were key “outside markets” that were in a bullish daily posture: solidly higher crude oil prices and a slump to an eight-month low in the U.S. dollar index.

The gold market was scoring moderate gains overnight after hitting a fresh seven-week low in overseas trading, and then extended those gains just after the Comex futures market opened in New York. December Comex gold was last up $30.60 at $1,316.80 an ounce. Spot gold was last quoted up $29.10 at $1317.00. December Comex silver last traded up $0.605 at $21.79 an ounce.

The marketplace greeted the partial U.S. government shutdown with some increased anxiety Wednesday but certainly not panic. Asian and European stock markets overnight focused on other matters. There are mixed ideas in the market place regarding how long the U.S. lawmakers will let the government remain closed. If the situation drags on for several days, anxiety in the markets will increase. In mid-October the U.S. government will hit its borrowing limit. If that more important matter cannot be agreed upon by U.S. lawmakers in a timely manner, then it could be a much bigger event for the market place than the current budget impasse. Fresh U.S. budget news coming out of Washington Wednesday could be market-sensitive.

U.S. government reports have been postponed due to the government furloughs, including Friday’s monthly employment report. Non-government U.S. economic reports will be issued as scheduled. The ADP national employment report was released at about the time the Comex futures market opened Wednesday morning. It showed a U.S. jobs gain of 166,000 in September, which was slightly less than market expectations.

Here is one school of thought on the U.S. government shutdown: Any extended shutdown will shave points off of U.S. gross domestic product growth. That could, in turn, prompt the Federal Reserve to delay any intended “tapering” of its monthly bond-buying program, also known as quantitative easing. This theory should have been bullish for the raw commodity sector Tuesday. Maybe that scenario will have a delayed bullish price effect on the raw commodity markets. Or, the other side of the coin is that any slower U.S. GDP growth would also be a drag on other world economies’ growth prospects, and also mean less demand for raw commodities.

Wednesday’s European Central Bank meeting resulted in no changes in ECB monetary policy, which supported the Euro currency and added downside pressure to the greenback. The monthly press conference by ECB president Mario Draghi produced no major pronouncements, but Draghi did express concern about the U.S. government shutdown impacting major world economies, if the matter is not resolved soon. There has been some speculation in the market place that the ECB could at some point launch another round of monetary stimulus measures.

The latest German government bond auction Wednesday saw 10-year bund yields drop sharply, as demand for safe-haven German debt increased due to the U.S. government shutdown.

China is observing the Golden Week holiday and market activity in the world’s second-largest economy will be quiet the rest of the week.

The London P.M. gold fix is $1,306.25 versus the previous P.M. fixing of $1,290.75.

Technically, December gold futures prices closed nearer the session high Wednesday after hitting a seven-week low in overnight trading. A five-week-old downtrend is still in place on the daily bar chart. The gold market bears still have the overall near-term technical advantage. The gold bulls’ next upside near-term price breakout objective is to produce a close above solid technical resistance at this week’s high of $1,353.80. Bears' next near-term downside breakout price objective is closing prices below solid technical support at the August low of $1,271.80. First resistance is seen at Wednesday’s high of $1,324.20 and then at $1,337.80. First support is seen at $1,300.00 and then at the September low of $1,291.50. Wyckoff’s Market Rating: 4.0

December silver futures prices closed nearer the session high Wednesday and took back all of Tuesday’s losses. Silver bears still have the overall near-term technical advantage. A five-week-old downtrend is in place on the daily bar chart. Silver bulls’ next upside price breakout objective is closing prices above solid technical resistance at last week’s high of $22.175 an ounce. The next downside price breakout objective for the bears is closing prices below solid technical support at $20.00. First resistance is seen at $22.00 and then at $22.175. Next support is seen at $21.50 and then at $21.225. Wyckoff's Market Rating: 3.5.

December N.Y. copper closed up 430 points at 331.70 cents Wednesday. Prices closed near the session high and took back most of Tuesday’s losses. The key “outside markets” were in a fully bullish posture for the copper market as the U.S. dollar index was solidly lower and crude oil prices were solidly higher. Copper bulls and bears are still on a level near-term technical playing field. Copper bulls' next upside breakout objective is pushing and closing prices above solid technical resistance at the September high of 335.95 cents. The next downside price breakout objective for the bears is closing prices below solid technical support at the September low of 319.05 cents. First resistance is seen at this week’s high of 333.95 cents and then at 335.00 cents. First support is seen at 330.00 cents and then at 327.50 cents. Wyckoff's Market Rating: 5.0.

Gold Surges On Technicals, View That ADP Data Means Delayed Fed Tapering

By Allen Sykora Kitco News

Wednesday October 02, 2013 12:14 PM

(Kitco News) - A weaker-than-forecast report on U.S. private-sector payrolls at a time of a partial government shutdown has added to doubts that the Federal Open Market Committee will taper quantitative easing this month, helping gold futures rocket higher Wednesday.

Much of the buying is being described as short covering a day after a big sell-off, analysts said. Despite the big move, some added, gold essentially remains directionless within its recent trading range, although volatile.

As of 11:46 a.m. EDT, December gold was $29.80, or 2.3%, higher to $1,315.90 an ounce on the Comex division of the New York Mercantile Exchange. December silver gained 59 cents, or 2.8%, to $21.765.

Technically, the slide in gold futures Tuesday and overnight – accelerated by sell stops that were triggered -- stopped at $1,276.90 an ounce, holding chart support at the early-August low of $1,271.80.

“That was an important support level,” said Frank Lesh, broker and futures analyst with FuturePath Trading. “It held and we got some short covering with bottom picking from people who want to buy gold below the $1,300 area. They feel that’s a value spot down there.”

Gold edged higher, then picked up momentum in early New York trading when a report from Automatic Data Processing Inc. showed that private-sector employment rose by 166,000 in September. Economists had expected a figure closer to 180,000. Furthermore, ADP revised down the August tally to 159,000 new jobs from the originally reported 176,000.

The ADP jobs report – at a time of a partial government shutdown due to a standoff between politicians over a continuing resolution for a budget, and ahead of another looming fight over raising the debt-ceiling limit – is leading traders to conclude there is “too much uncertainty” for the Federal Reserve to start tapering quantitative easing yet, said Phil Flynn, senior market analyst with Price Futures Group.

“With the bad jobs number, that increases the odds that tapering won’t happen,” Flynn said “And that, of course, should be friendly for gold. It should mean a weaker dollar, which we’ve already seen.”

Added Lesh: “You look at the ADP number and that says taper later rather than sooner.”

The December dollar index was down 0.315 point to 79.935. The euro was up to $1.3594 from $1.3523 late Tuesday.

Further, equities are on the defensive, and there likely is at least some rotation out of stocks and into gold and bonds, said Zachary Oxman, portfolio manager with TrendMax Futures. The Dow Jones Industrial Average was down by 95 points.