Barclays: Chinese PGM Imports Strong In October; Copper Tops Expectations

Thursday November 21, 2013 2:49 PM

Chinese imports of platinum group metals were firm in October, copper stronger than expected and silver lagged, says Barclays in an analysis of the monthly data. Palladium imports were the “most notable,” rising by 89% year-on-year and a modest 3% month-on-month to around 64,200 ounces, the highest since April 2012. “Palladium imports have been somewhat subdued in 2013, following the initial elevated inventory picture at the start of the year, but vehicle sales have been strong and we expect that to continue,” Barclays says. Platinum imports rose 61% YOY in October but fell by 27% MOM to some 248,700 ounces. They have been above 200,000 each month since March, Barclays says. Refined copper imports eased month-on-month but were up 27% YOY, Barclays says. Net imports were also the second strongest of the year at some 278,000 tons due to a pick-up in financing demand, described as more attractive than any time since early 2012. “Bonded warehouse stocks of copper have risen as a result and we expect that trend to continue as imports are likely to stay high,” Barclays says. Silver imports fell by 6% YOY in October but remained above 200 tons for the fourth month, Barclays says. “Exports rose by 84% y/y to 125 tons, keeping China a net importer,” the bank adds.

By Allen Sykora of Kitco News; asykora@kitco.com

Barclays: Subtrend Continues On Palladium Flows In Swiss Trade Data

Thursday November 21, 2013 12:12 PM

An important subtrend has continued on Swiss imports of palladium from Russia, says Barclays. Swiss data for October show Russian shipments jumped to around 13,500 ounces from roughly 6,500 in September. “Palladium shipments are measured as a total of powder imports and semi-manufactured imports, the former of which has been quite volatile…,” Barclays says. When “massive” shipments have materialized out of Russia, as in May and March, it was due to powder shipments. “On the other hand, semi-manufactured imports, which began materializing in a consistent form in late 2010, have consistently averaged 6.6koz since January 2011, and in fact have been 6.4-6.5koz for the last five months; such shipments upheld the overall trend we have seen over the last year, while powder shipments have been entirely responsible for the spikes in Russian shipments,” Barclays says. Russia’s shipments for 2013 to date are around 504,000 ounces, more than triple 2012, slightly lower than in 2011 and far below shipments for any year from 1996 to 2010, Barclays says. “We reaffirm our view that shipments from Russian state stocks are likely to be limited both this year and next, but we cannot entirely rule out the possibility of surprise months of elevated shipments,” the bank says. The palladium market closely monitors the Swiss data for clues on what may be happening to state stockpiles of palladium in Russia, although the data is for all imports, not just those from state stocks.

By Allen Sykora of Kitco News; asykora@kitco.com

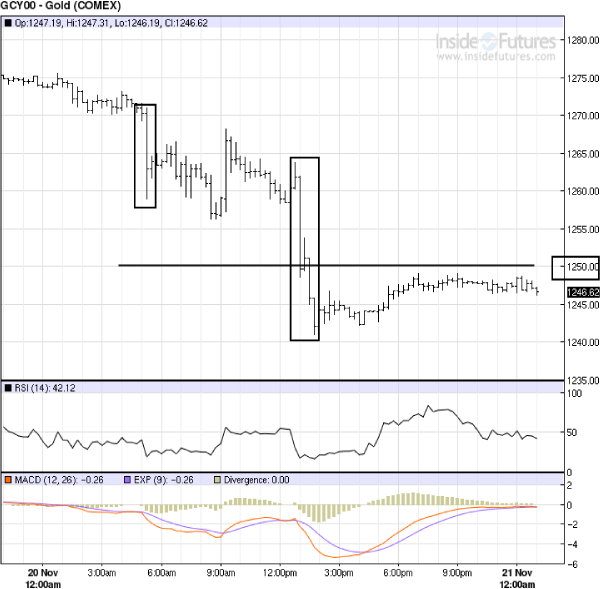

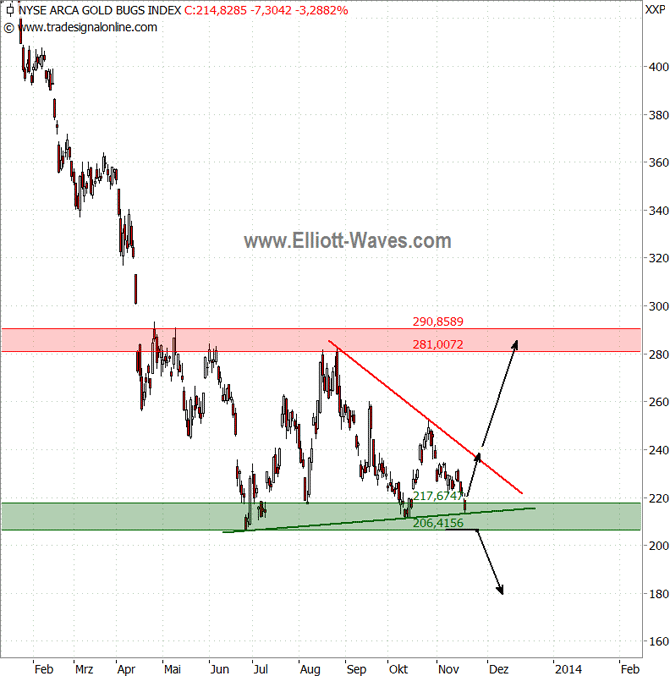

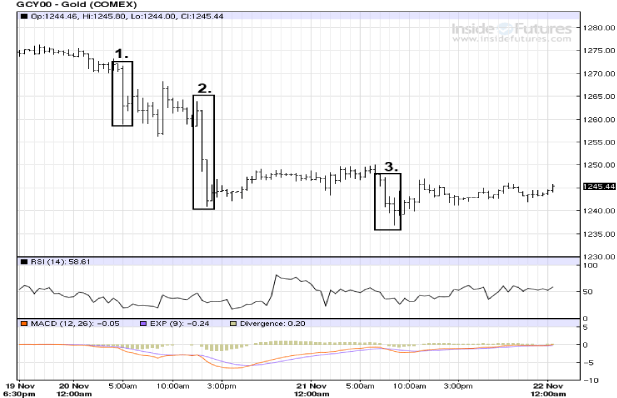

Gold Prices Could Fall To $1,200/Oz – optionsXpress

Thursday November 21, 2013 11:10 AM

Selling in gold to close out long positions is weighing on prices, says optionsXpress, and with the market breaking support at $1,260 an ounce, prices “could approach the $1,200 mark in the near future.” The firm notes that gold was unable to find any support from comments by Federal Reserve Chairman Ben Bernanke that “may be interpreted as favoring expansionary policy…. The reason the dovish comments failed to inspire bulls is that traders were already targeting the March 18-19 FOMC meeting as the beginning of the tapering cycle.” The U.S. dollar also held support at a key technical chart level, also weighing on gold prices. The firm says if prices cannot hold $1,200, gold could test the $1,085 mark.

By Debbie Carlson dcarlson@kitco.com

CIBC: Sharp Drop In Jobless Claims Should Be Taken With A Grain Of Salt

Thursday November 21, 2013 8:55 AM

U.S. weekly jobless claims, for the week ending Nov. 16, declined by 21,000 to 323,000, the lowest level since late September, says the U.S. Labor Department. However, Avery Shenfeld, senior economist at CIBC World Markets, says the number was affected by a holiday. “The somewhat larger than expected drop in jobless claims, to 323K from 344K the prior week, has to be taken with a grain of salt, since it came in the Veterans' Day holiday week, which adds imprecision to the seasonal adjustment process,” he says.

By Neils Christensen of Kitco News; nchristensen@kitco.com

Deutsche Bank: Commodities Could Face More Pressure In 2014

Thursday November 21, 2013 8:41 AM

Many of the forces that have driven commodity index returns lower during 2013 are set to continue into next year, Deutsche Bank says. Eventual tapering of U.S. quantitative easing “will force both long-term U.S. real yields and the U.S. dollar higher, both of which have historically proven problematic for gold returns,” the bank says. “In terms of energy, we believe a more hostile environment is emerging in response to the rapid increase in U.S. crude oil production, rising OPEC spare capacity and the possibility that geopolitical risk in on the retreat.” Deutsche Bank says it has an above-consensus outlook for Chinese economic growth next year. “However, even here strong industrial metal supply growth, for example in copper, threatens to derail price recoveries across this sector.”

By Allen Sykora of Kitco News; asykora@kitco.com

Citi: Chinese Imports Of Raw Materials Strong In October

Thursday November 21, 2013 8:41 AM

Chinese imports of raw materials were strong in October, and this includes many of the base metals, says Citi Research. Wheat and kerosene imports hit the highest levels on record, the bank says. “Zinc imports reached the highest level since 2009,” Citi says. “Imports have been boosted by an attractive import arb, strong underlying demand and increased financing activity. However, we expect imports to decline in 2014.” Meanwhile, bauxite, alumina and nickel ore imports all remained strong, Citi says. “Chinese aluminum production continues to expand, with October up 14% YoY (year-on-year), driving demand for bauxite and alumina. Nickel ore imports from Indonesia were up slightly as NPI (nickel pig iron) production remains strong and producers secure inventories ahead of a possible export ban.”

By Allen Sykora of Kitco News; asykora@kitco.com

BBH: FOMC Minutes ‘Did Not Break New Ground’

Thursday November 21, 2013 8:41 AM

The late-Wednesday release of October Federal Open Market Committee minutes showed what the markets expected – the Fed may taper quantitative easing at upcoming meetings but officials do not view tapering as tightening, says Brown Brothers Harriman. “The market seemed to take to heart the notion that the Fed is still prepared to taper at one of the next few meetings,” BBH says. “This is not news. The minutes did not break new ground. (Fed Chairman Ben) Bernanke has said the same thing earlier this week. Surveys had shown the consensus is for tapering to be announced in March.” Meanwhile, the minutes also confirmed what the market already suspected about the reliance on forward guidance instead of asset purchases, BBH says. “The Fed want(s) to anchor expectations that tapering is not tightening,” BBH says. “And the tapering is likely to be accompanied by stronger forward guidance. It seemed much of the discussion was about how to drive home this message.”

By Allen Sykora of Kitco News; asykora@kitco.com

BMO: Copper Demand May Disappoint; Inventories Low; Costs Rising

Thursday November 21, 2013 8:17 AM

Growth in 2014 copper demand could disappoint, inventories are low and profit margins for producers are down due to rising costs, says BMO Research. Analysts listed these as some of the takeaways from Cesco Asia Copper Week. “Challenges to mine supply growth near term continue to be topical, but are largely priced in, in BMO’s view,” the bank says. “The greater uncertainty is on the demand side, which BMO expects could actually disappoint next year given the very strong performance in consumption growth this year. Longer term, it appears the miners and smelters have come to terms with the fact that profit margins for the sector are unlikely to be as strong as in recent years due to rapid cost escalation. This is (due to) a combination of declining ore grades, rising energy and labor costs, and increasing social and environmental regulations.” BMO notes that despite mixed near-term sentiment, copper remains the metal garnering the most investor interest. “Fundamentals are supported by low relative inventory levels, and the fact that copper end use is diversified across the development cycle,” BMO says.

By Allen Sykora of Kitco News; asykora@kitco.com

Commerzbank: Nickel Hits Nearly Four-Month Low As Surplus Builds

Thursday November 21, 2013 8:17 AM

Nickel prices have fallen to their lowest levels since late July as a global surplus builds, says Commerzbank. The International Nickel Study Group reports a supply surplus of 127,100 metric tons in the first nine months of the year, well up from 57,000 for the same period last year. “The reported September surplus of 18,100 tons was the highest since January,” Commerzbank says. “At the same time, supply continuously outstripped demand in the past 24 months, with the result that LME (London Metal Exchange) nickel stocks have tripled in the last two years to just under 249,000 tons.” Indonesia is playing a major role the surplus, Commerzbank says. In the run-up to a planned ban on ore exports that goes into effect Jan. 1, the country already exported nearly 32 million tons of nickel ore from January to July, up 27% year-on-year, according to data from the World Bureau of Metal Statistics. “Large amounts of nickel are also likely to have been exported in the meantime,” Commerzbank says. “If the export ban were to be softened, as many market participants anticipate, Indonesia will doubtless export large quantities of nickel next year too. This would prevent any significant reduction of the surpluses on the global market.”