Global Gold Hedge Book Continues Decline In 3Q 2013

By Kitco News

Tuesday January 28, 2014 10:43 AM

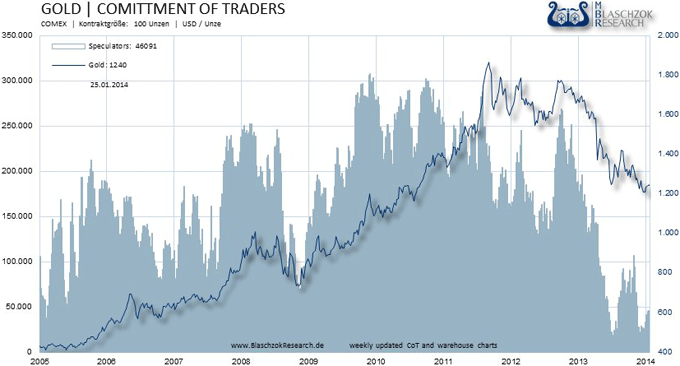

(Kitco News) - Net producers de-hedging of gold continued in the third quarter of 2013, according to a quarterly hedge book report from Thomson Reuters GFMS and Societe Generale released on Tuesday.

The decline was 188,000 ounces, or 6 metric tons, the firms said.

With the fall, the global gold hedge book stood at 2.94 million ounces, or 92 tons, as of the end of the third quarter. This was lowest volume since the quarterly report began in 2002.

Twenty-five companies reduced their delta-adjusted positions by a collective 17 tons, with the majority the result of scheduled deliveries into maturing contracts, the report said. Some of the largest decreases were for Minera Frisco, Petropavlovsk, B2 Gold and Coeur Mining.

New hedging was described as “modest in scale,” with the largest delta- adjusted gains said to be for Evolution Mining, Regis Resources and Dundee Precious Metals, who collectively increased their hedge books by 11 tons, according to the report.

The marked-to-market value of the global producer hedge book was listed at $174 million at the end of September, a reduction of $248 million since the end of the second quarter.

“There is not yet any evidence to suggest that producers are returning to large-scale hedging, with limited reports of new hedge positions since the end of Q3,” the report said. “During 2013, producers have focused on protecting margins through cost-containment initiatives. We therefore expect net de-hedging to have been sustained throughout the duration of 2013.”

By Kitco News

Tuesday January 28, 2014 10:43 AM

(Kitco News) - Net producers de-hedging of gold continued in the third quarter of 2013, according to a quarterly hedge book report from Thomson Reuters GFMS and Societe Generale released on Tuesday.

The decline was 188,000 ounces, or 6 metric tons, the firms said.

With the fall, the global gold hedge book stood at 2.94 million ounces, or 92 tons, as of the end of the third quarter. This was lowest volume since the quarterly report began in 2002.

Twenty-five companies reduced their delta-adjusted positions by a collective 17 tons, with the majority the result of scheduled deliveries into maturing contracts, the report said. Some of the largest decreases were for Minera Frisco, Petropavlovsk, B2 Gold and Coeur Mining.

New hedging was described as “modest in scale,” with the largest delta- adjusted gains said to be for Evolution Mining, Regis Resources and Dundee Precious Metals, who collectively increased their hedge books by 11 tons, according to the report.

The marked-to-market value of the global producer hedge book was listed at $174 million at the end of September, a reduction of $248 million since the end of the second quarter.

“There is not yet any evidence to suggest that producers are returning to large-scale hedging, with limited reports of new hedge positions since the end of Q3,” the report said. “During 2013, producers have focused on protecting margins through cost-containment initiatives. We therefore expect net de-hedging to have been sustained throughout the duration of 2013.”