UPDATE: Comex Gold Gives Up Earlier Gains; Impacted By Outside Markets

By Allen Sykora Kitco News

Friday January 31, 2014 11:21 AM

As of 11:23 a.m. EST, the April gold futures on the Comex division of the New York Mercantile Exchange were down $1.70 to $1,240.80 an ounce. March silver was nearly flat, down 1.1 cents to $19.115.

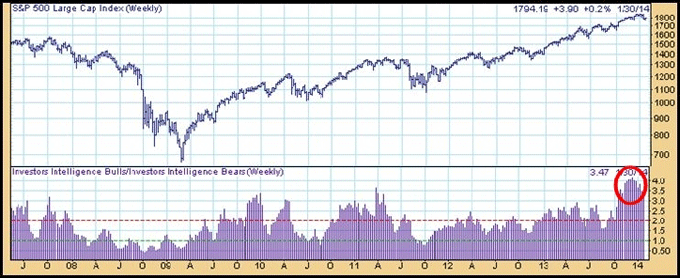

The April gold contract earlier traded as much as $12.30 higher, with observers at the time citing the weaker tone in equities and short covering. Stocks still remain lower, but the March S&P 500 futures have recouped much of their earlier weakness. They were down 3.40 points to 1,777.80, but well up from an early low of $1,762.10. The Dow Jones Industrial Average, however, remains lower by triple digits.

Meanwhile, a softer tone in the euro is pulling gold lower, said Daniel Pavilonis, senior commodity broker with RJO Futures. The single European currency was down to $1.34957 from $1.35520 in late-Thursday North American trade.

“Ultimately, you’re going to see the dollar take off now,” he said. Gold especially could come under pressure if the dollar index were to climb above 82, he added. The March dollar index traded as high as 81.44, its strongest level since Jan. 21, which in turn was a two-month high.

Charles Nedoss, senior market strategist with LaSalle Futures Group, said the $1,250 level appears to be a pivotal technical-chart area for gold futures.

“A close above $1,250 is positive,” he said. Meanwhile, a key downside level is the 50-day moving average, which was $1,236.40 for the front-month February contract and $1,237.10 for most-active April.

So far, gold futures are having an inside session in which the high and low are within the prior day’s range, Nedoss pointed out. Technicians often see this as an indicator of short-term indecision or consolidation in a market.

By Allen Sykora Kitco News

Friday January 31, 2014 11:21 AM

As of 11:23 a.m. EST, the April gold futures on the Comex division of the New York Mercantile Exchange were down $1.70 to $1,240.80 an ounce. March silver was nearly flat, down 1.1 cents to $19.115.

The April gold contract earlier traded as much as $12.30 higher, with observers at the time citing the weaker tone in equities and short covering. Stocks still remain lower, but the March S&P 500 futures have recouped much of their earlier weakness. They were down 3.40 points to 1,777.80, but well up from an early low of $1,762.10. The Dow Jones Industrial Average, however, remains lower by triple digits.

Meanwhile, a softer tone in the euro is pulling gold lower, said Daniel Pavilonis, senior commodity broker with RJO Futures. The single European currency was down to $1.34957 from $1.35520 in late-Thursday North American trade.

“Ultimately, you’re going to see the dollar take off now,” he said. Gold especially could come under pressure if the dollar index were to climb above 82, he added. The March dollar index traded as high as 81.44, its strongest level since Jan. 21, which in turn was a two-month high.

Charles Nedoss, senior market strategist with LaSalle Futures Group, said the $1,250 level appears to be a pivotal technical-chart area for gold futures.

“A close above $1,250 is positive,” he said. Meanwhile, a key downside level is the 50-day moving average, which was $1,236.40 for the front-month February contract and $1,237.10 for most-active April.

So far, gold futures are having an inside session in which the high and low are within the prior day’s range, Nedoss pointed out. Technicians often see this as an indicator of short-term indecision or consolidation in a market.