P.M. Kitco Metals Roundup: Gold Down on More Profit Taking, Consolidation, But No Chart Damage

Tuesday March 18, 2014 1:37 PM

(Kitco News) - Gold prices ended the U.S. day session lower Tuesday, on more profit-taking pressure and chart consolidation from recent gains that saw prices hit a six-month high Monday. This type of “backing and filling” of prices on the daily chart is not surprising and the gold market bulls still possess the near-term technical advantage. The markets so far this week are digesting very well the news Crimea will become part of Russia, which is at present a bearish factor for safe-haven gold. April gold was last down $14.00 at $1,359.00 an ounce. Spot gold was last quoted down $8.30 at $1,359.75. May Comex silver last traded down $0.41 at $20.865 an ounce.

Russian president Vladimir Putin delivered a speech to the Russian parliament Tuesday. He said Russia will not seek to annex other regions of Asia, after it annexed Crimea. Putin’s remarks acted to assuage the market place, as U.S. stock indexes moved higher and the gold market moved lower. Apparently, the market place thought Putin could have been more bombastic in his speech and he did not threaten to annex any other regions of Asia. As many market watchers commented on Putin’s assertions: “We’ll see. Actions speak louder than words.” This situation is still far from stable. Any escalation of tensions in Ukraine would quickly put keen risk-aversion back into the market place. The market place will continue to closely monitor the latest developments in the Ukraine and from Russia.

Focus of the market place turns to the meeting of the U.S. Federal Reserve’s Open Market Committee (FOMC), taking place Tuesday and Wednesday. Fed Chair Janet Yellen will deliver her first press conference after the FOMC meeting’s conclusion Wednesday afternoon. It is expected the FOMC will continue on its “tapering” program, whereby monthly bond purchases are whittled down by $10 billion a month. Recent U.S. economic data has been a mixed bag, which is making it tougher for the market place to read what the Fed’s intentions might be.

U.S. economic data released Tuesday was again a mixed bag and did not have a major impact on the markets. The data included the consumer price index, real earnings, new residential construction and building permits. The housing numbers were a bit stronger than expected and also helped to put some upside pressure on the stock indexes, which in turn put some more downside price pressure on the precious metals.

The London P.M. gold fixing was $1,355.75 versus the previous P.M. fixing of $1,378.50.

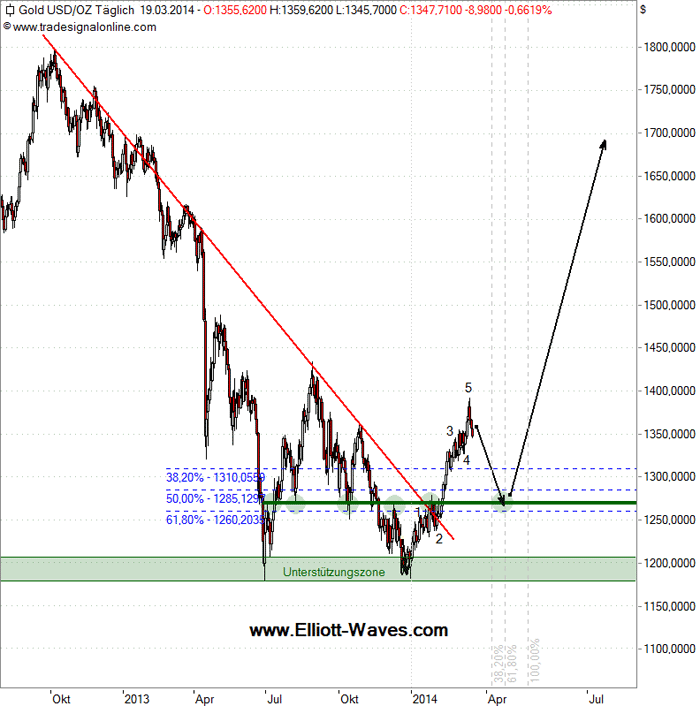

Technically, April gold futures prices closed near mid-range Tuesday. A 2.5-month-old uptrend is still in place on the daily bar chart. Bulls still have the overall near-term technical advantage. The gold bulls’ next upside near-term price breakout objective is to produce a close above solid technical resistance at last week’s high of $1,392.60. Bears' next near-term downside breakout price objective is closing prices below solid technical support at the March low of $1,326.60. First resistance is seen at Tuesday’s high of $1,367.90 and then at $1,375.00. First support is seen at Tuesday’s low of $1,351.10 and then at $1,350.00. Wyckoff’s Market Rating: 6.5

May silver futures prices closed nearer the session low Tuesday. The bears have the near-term technical advantage. Silver bulls’ next upside price breakout objective is closing prices above solid technical resistance at last week’s high of $21.795 an ounce. The next downside price breakout objective for the bears is closing prices below solid technical support at the March low of $20.61. First resistance is seen at $21.00 and then at Tuesday’s high of $21.25. Next support is seen at $20.61 and then at $20.50. Wyckoff's Market Rating: 4.0.

May N.Y. copper closed up 10 points at 295.30 cents Tuesday. Prices closed nearer the session low. Prices last week hit a four-year low. Prices are in an 11-week-old downtrend on the daily bar chart. A bear flag has formed on the daily chart just recently. Bears have the solid near-term technical advantage. Copper bulls' next upside breakout objective is pushing and closing prices above solid technical resistance at last week’s high of 307.75 cents. The next downside price breakout objective for the bears is closing prices below solid technical support at 290.00 cents. First resistance is seen at 300.00 cents and then at 302.50 cents. First support is seen at Tuesday’s low of 293.90 cents and then at the contract low of 290.80 cents. Wyckoff's Market Rating: 1.0.

Tuesday March 18, 2014 1:37 PM

(Kitco News) - Gold prices ended the U.S. day session lower Tuesday, on more profit-taking pressure and chart consolidation from recent gains that saw prices hit a six-month high Monday. This type of “backing and filling” of prices on the daily chart is not surprising and the gold market bulls still possess the near-term technical advantage. The markets so far this week are digesting very well the news Crimea will become part of Russia, which is at present a bearish factor for safe-haven gold. April gold was last down $14.00 at $1,359.00 an ounce. Spot gold was last quoted down $8.30 at $1,359.75. May Comex silver last traded down $0.41 at $20.865 an ounce.

Russian president Vladimir Putin delivered a speech to the Russian parliament Tuesday. He said Russia will not seek to annex other regions of Asia, after it annexed Crimea. Putin’s remarks acted to assuage the market place, as U.S. stock indexes moved higher and the gold market moved lower. Apparently, the market place thought Putin could have been more bombastic in his speech and he did not threaten to annex any other regions of Asia. As many market watchers commented on Putin’s assertions: “We’ll see. Actions speak louder than words.” This situation is still far from stable. Any escalation of tensions in Ukraine would quickly put keen risk-aversion back into the market place. The market place will continue to closely monitor the latest developments in the Ukraine and from Russia.

Focus of the market place turns to the meeting of the U.S. Federal Reserve’s Open Market Committee (FOMC), taking place Tuesday and Wednesday. Fed Chair Janet Yellen will deliver her first press conference after the FOMC meeting’s conclusion Wednesday afternoon. It is expected the FOMC will continue on its “tapering” program, whereby monthly bond purchases are whittled down by $10 billion a month. Recent U.S. economic data has been a mixed bag, which is making it tougher for the market place to read what the Fed’s intentions might be.

U.S. economic data released Tuesday was again a mixed bag and did not have a major impact on the markets. The data included the consumer price index, real earnings, new residential construction and building permits. The housing numbers were a bit stronger than expected and also helped to put some upside pressure on the stock indexes, which in turn put some more downside price pressure on the precious metals.

The London P.M. gold fixing was $1,355.75 versus the previous P.M. fixing of $1,378.50.

Technically, April gold futures prices closed near mid-range Tuesday. A 2.5-month-old uptrend is still in place on the daily bar chart. Bulls still have the overall near-term technical advantage. The gold bulls’ next upside near-term price breakout objective is to produce a close above solid technical resistance at last week’s high of $1,392.60. Bears' next near-term downside breakout price objective is closing prices below solid technical support at the March low of $1,326.60. First resistance is seen at Tuesday’s high of $1,367.90 and then at $1,375.00. First support is seen at Tuesday’s low of $1,351.10 and then at $1,350.00. Wyckoff’s Market Rating: 6.5

May silver futures prices closed nearer the session low Tuesday. The bears have the near-term technical advantage. Silver bulls’ next upside price breakout objective is closing prices above solid technical resistance at last week’s high of $21.795 an ounce. The next downside price breakout objective for the bears is closing prices below solid technical support at the March low of $20.61. First resistance is seen at $21.00 and then at Tuesday’s high of $21.25. Next support is seen at $20.61 and then at $20.50. Wyckoff's Market Rating: 4.0.

May N.Y. copper closed up 10 points at 295.30 cents Tuesday. Prices closed nearer the session low. Prices last week hit a four-year low. Prices are in an 11-week-old downtrend on the daily bar chart. A bear flag has formed on the daily chart just recently. Bears have the solid near-term technical advantage. Copper bulls' next upside breakout objective is pushing and closing prices above solid technical resistance at last week’s high of 307.75 cents. The next downside price breakout objective for the bears is closing prices below solid technical support at 290.00 cents. First resistance is seen at 300.00 cents and then at 302.50 cents. First support is seen at Tuesday’s low of 293.90 cents and then at the contract low of 290.80 cents. Wyckoff's Market Rating: 1.0.